10-Year Outlook: Top 2 Tech Stocks To Hold

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

10-Year Outlook: Top 2 Tech Stocks to Hold for Long-Term Growth

The tech sector is a dynamic landscape, constantly evolving with groundbreaking innovations. While short-term market fluctuations are inevitable, identifying companies poised for sustained growth over the next decade requires a keen eye and careful analysis. For investors with a long-term horizon, selecting the right tech stocks can be the key to building significant wealth. This article explores two tech giants we believe are prime candidates for inclusion in your portfolio over the next 10 years.

Why a 10-Year Outlook Matters

Investing for the long term allows you to weather short-term market volatility. Instead of focusing on daily price swings, you can concentrate on the fundamental strength and future potential of a company. This strategy is particularly relevant in the tech sector, where disruptive innovations can dramatically reshape the market landscape.

Top Tech Stock #1: Microsoft (MSFT)

Microsoft’s enduring success isn't just about its legacy software. The company has strategically positioned itself as a leader in cloud computing (Azure), gaming (Xbox), and artificial intelligence (AI). This diversification mitigates risk and provides multiple avenues for growth.

- Cloud Computing Dominance: Azure continues to gain market share against Amazon Web Services (AWS), representing a significant and consistently growing revenue stream. The expansion of cloud services into various sectors ensures ongoing demand.

- AI Leadership: Microsoft's significant investment in AI, including its partnership with OpenAI, places it at the forefront of this transformative technology. The integration of AI across its product portfolio will drive innovation and attract new customers.

- Gaming Powerhouse: Xbox remains a major player in the gaming industry, generating substantial revenue and engaging a vast user base. The growth of cloud gaming further expands Microsoft's reach and potential.

Long-Term Outlook: Microsoft’s strong fundamentals, diversified revenue streams, and strategic investments in emerging technologies suggest a promising decade ahead. Its consistent innovation and adaptability make it a compelling long-term investment. [Link to Microsoft Investor Relations]

Top Tech Stock #2: Alphabet (GOOGL)

Alphabet, the parent company of Google, dominates the search engine market and boasts a diverse portfolio of products and services. From search and advertising to YouTube and Waymo (self-driving cars), Alphabet’s reach is unparalleled.

- Advertising Powerhouse: Google's search dominance translates into a massive advertising revenue stream, a foundation for continued growth. While advertising trends fluctuate, Google's market share provides a strong buffer.

- YouTube's Global Reach: YouTube's immense popularity provides a significant and diversified revenue stream through advertising, subscriptions, and other avenues. Its global reach ensures ongoing growth potential.

- Innovation Across Multiple Sectors: Alphabet’s investment in innovative technologies like AI, autonomous vehicles, and healthcare positions it for future growth in diverse sectors. This diversification lessens reliance on any single product or service.

Long-Term Outlook: Alphabet’s strong market position, massive user base, and consistent innovation across multiple sectors make it a compelling choice for long-term investors. The company's focus on future technologies ensures its relevance and growth potential in the coming years. [Link to Alphabet Investor Relations]

Important Considerations:

- Risk Assessment: While these stocks offer significant potential, no investment is without risk. Market fluctuations, competition, and unforeseen events can impact performance.

- Diversification: It's crucial to diversify your portfolio beyond these two stocks to manage risk effectively. Consider other sectors and investment vehicles to create a balanced investment strategy.

- Professional Advice: Consult with a qualified financial advisor before making any investment decisions. They can help you assess your risk tolerance and create a personalized investment plan.

Conclusion:

Microsoft and Alphabet offer compelling long-term investment opportunities within the dynamic tech sector. Their strong fundamentals, strategic positioning, and focus on innovation suggest a promising future. However, remember to conduct thorough research and seek professional advice before investing. This analysis is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 10-Year Outlook: Top 2 Tech Stocks To Hold. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Subban Praises Nhls Resurgence A League At Its Highest Point

May 15, 2025

Subban Praises Nhls Resurgence A League At Its Highest Point

May 15, 2025 -

Lingering Tariffs Impact Of Trumps China Trade War On Consumer Goods

May 15, 2025

Lingering Tariffs Impact Of Trumps China Trade War On Consumer Goods

May 15, 2025 -

Did Andor Save Star Wars Exploring The Shows Critical Acclaim And Cultural Impact

May 15, 2025

Did Andor Save Star Wars Exploring The Shows Critical Acclaim And Cultural Impact

May 15, 2025 -

Nba Playoffs 2024 Predicting Early Exits In The Second Round

May 15, 2025

Nba Playoffs 2024 Predicting Early Exits In The Second Round

May 15, 2025 -

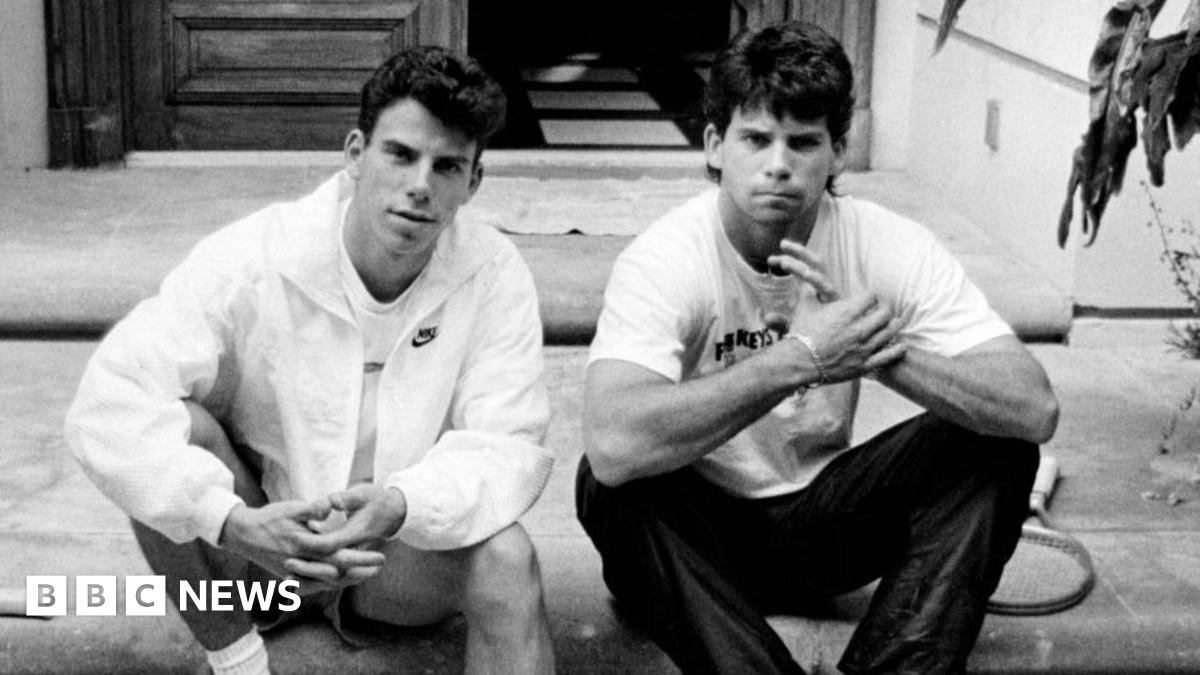

1989 Murders Menendez Brothers Receive Amended Sentences

May 15, 2025

1989 Murders Menendez Brothers Receive Amended Sentences

May 15, 2025

Latest Posts

-

Ripples Xrp Soars Factors Contributing To Todays Price Increase

Jul 17, 2025

Ripples Xrp Soars Factors Contributing To Todays Price Increase

Jul 17, 2025 -

De Chambeau Calls Your Local Course Sneaky Hard Heres Why

Jul 17, 2025

De Chambeau Calls Your Local Course Sneaky Hard Heres Why

Jul 17, 2025 -

Us Restrictions Reversed Nvidia To Restart China Sales Of Crucial Ai Chip

Jul 17, 2025

Us Restrictions Reversed Nvidia To Restart China Sales Of Crucial Ai Chip

Jul 17, 2025 -

Los Cabos Open Basavareddy Wins Alvarez Advances In Home Crowd

Jul 17, 2025

Los Cabos Open Basavareddy Wins Alvarez Advances In Home Crowd

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Relationship Update And Plans For The Future

Jul 17, 2025

Love Island Usas Amaya And Bryan Relationship Update And Plans For The Future

Jul 17, 2025