1000% Increase In SBET Stock: A Deep Dive Into The Market Drivers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

1000% Increase in SBET Stock: A Deep Dive into the Market Drivers

The stock market witnessed a dramatic surge recently with SBET stock experiencing a phenomenal 1000% increase. This unprecedented growth has left many investors wondering: what fueled this incredible rally? This in-depth analysis explores the key market drivers behind SBET's astonishing performance, examining both the internal factors within the company and the broader macroeconomic trends that contributed to this exceptional rise.

Understanding SBET's Business Model: Before diving into the reasons behind the surge, it's crucial to understand SBET's core business. (Insert a concise, factual description of SBET's business model here. Include information about their products, services, target market, and competitive landscape. This section should be informative and avoid biased language.) This understanding provides the context necessary to analyze the factors that have propelled its stock price to such extraordinary heights.

Key Drivers Behind the 1000% Surge:

Several interconnected factors contributed to SBET's remarkable performance. Let's examine them closely:

1. Innovative Product Launch & Market Disruption: (Discuss a recent successful product launch or strategic move that significantly impacted SBET's market position and revenue streams. Provide specific examples and quantify the impact whenever possible. Use data to support your claims.) This disruptive innovation captured significant market share and significantly boosted investor confidence.

2. Strategic Partnerships and Acquisitions: (If applicable, detail any strategic partnerships or acquisitions that contributed to the stock's growth. Highlight the synergistic effects and the positive impact on SBET's overall financial performance.) These strategic moves expanded SBET's market reach and diversified its revenue streams.

3. Strong Financial Performance and Positive Earnings Reports: (Analyze SBET's recent financial reports, focusing on key metrics such as revenue growth, profit margins, and earnings per share (EPS). Highlight any positive trends and compare them to previous periods or industry benchmarks.) Consistent positive financial results reassured investors and fueled the upward trajectory of the stock price.

4. Positive Industry Trends and Macroeconomic Factors: (Discuss relevant industry trends and macroeconomic factors that positively impacted SBET's performance. For example, are there positive regulatory changes, increased consumer demand, or favorable economic conditions that contributed to the growth?) These broader market forces created a favorable environment for SBET's expansion.

5. Increased Investor Sentiment and Speculative Trading: (Acknowledge the role of investor sentiment and speculative trading in the stock's price surge. Be cautious and avoid promoting speculative investing. Mention the risks involved in such volatile market movements.) While investor enthusiasm undoubtedly played a significant role, it's crucial to remember that such rapid growth often involves increased risk.

Risks and Considerations:

While the 1000% increase is impressive, it's important to acknowledge the inherent risks associated with such volatile growth. (Discuss potential risks such as market corrections, competition, regulatory changes, and the sustainability of the current growth rate. Encourage readers to conduct their own thorough research before making investment decisions.)

Conclusion:

The 1000% increase in SBET stock is a testament to a confluence of factors, ranging from innovative product launches and strategic partnerships to favorable market conditions and increased investor sentiment. However, investors should approach such significant gains with caution, carefully considering the inherent risks before making any investment decisions. Further research and a comprehensive understanding of SBET's business model and the broader market landscape are essential for informed investment choices. Remember to consult with a financial advisor before making any investment decisions.

(Optional) Call to Action: Stay informed about market trends by subscribing to our newsletter for regular updates and analysis. (link to newsletter signup)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 1000% Increase In SBET Stock: A Deep Dive Into The Market Drivers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Decaying Properties The Aftermath Of The A1 Northumberland Road Project

May 30, 2025

Decaying Properties The Aftermath Of The A1 Northumberland Road Project

May 30, 2025 -

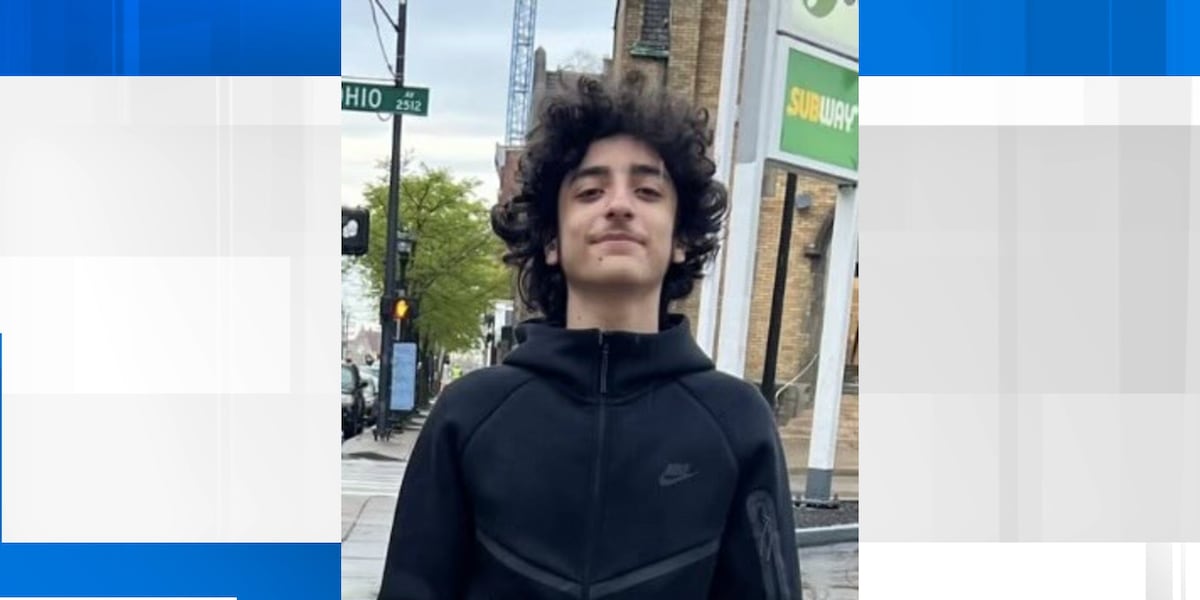

Endangered Missing Person Lexington Police Investigate Teens Disappearance

May 30, 2025

Endangered Missing Person Lexington Police Investigate Teens Disappearance

May 30, 2025 -

Planning Your Trip The 2025 Detroit Grand Prix Guide

May 30, 2025

Planning Your Trip The 2025 Detroit Grand Prix Guide

May 30, 2025 -

Bank Fraud And Tax Crimes Trumps Pardon Of Reality Show Couple Sparks Debate

May 30, 2025

Bank Fraud And Tax Crimes Trumps Pardon Of Reality Show Couple Sparks Debate

May 30, 2025 -

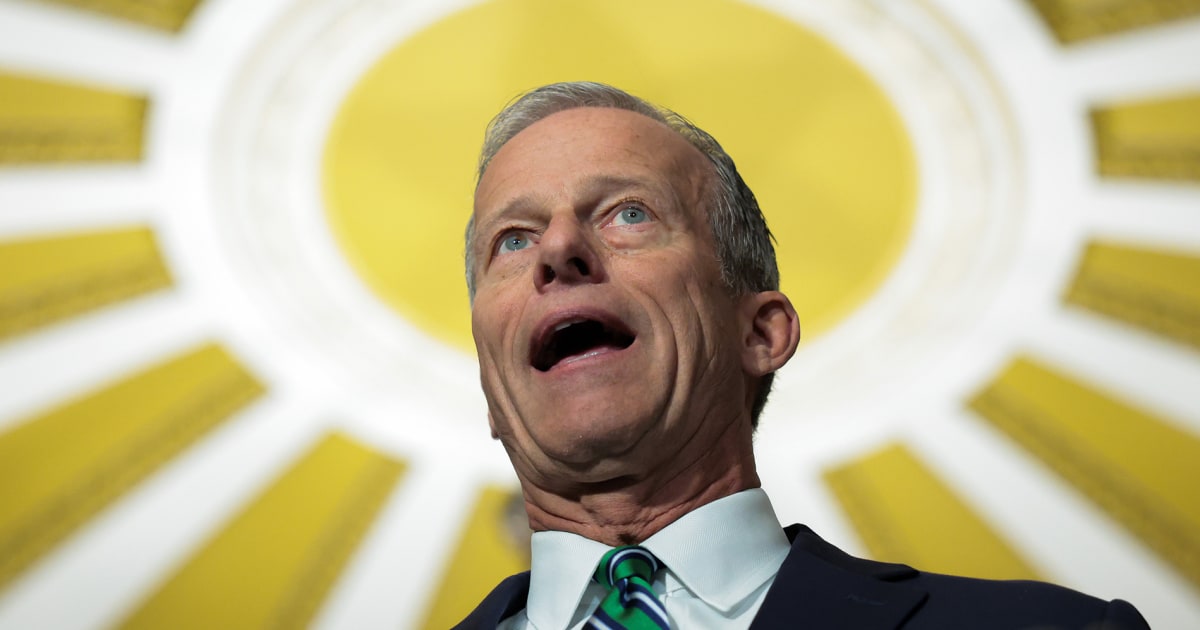

Inside The Gop Strategy Navigating The Path For Trumps Large Scale Bill

May 30, 2025

Inside The Gop Strategy Navigating The Path For Trumps Large Scale Bill

May 30, 2025

Latest Posts

-

Yellowstone Star Shares Exciting News About Season 5

Jun 01, 2025

Yellowstone Star Shares Exciting News About Season 5

Jun 01, 2025 -

Billy Bob Thornton On Landman Season 2 His Vision For The Future

Jun 01, 2025

Billy Bob Thornton On Landman Season 2 His Vision For The Future

Jun 01, 2025 -

The Spanish Grand Prix Aramcos Post Race Analysis

Jun 01, 2025

The Spanish Grand Prix Aramcos Post Race Analysis

Jun 01, 2025 -

Never Bring These Two Things To A Party Ina Gartens Guide

Jun 01, 2025

Never Bring These Two Things To A Party Ina Gartens Guide

Jun 01, 2025 -

The Unexpected Dinner Party Tip From Ina Garten According To Willie Geist

Jun 01, 2025

The Unexpected Dinner Party Tip From Ina Garten According To Willie Geist

Jun 01, 2025