$121k-$120k & $114.5k-$113.6k: Crucial Bitcoin Liquidation Levels Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$121k-$120k & $114.5k-$113.6k: Crucial Bitcoin Liquidation Levels Analyzed

Bitcoin's price continues its volatile dance, leaving traders on edge. Recent market movements have highlighted specific price points acting as significant resistance and support levels, potentially triggering large-scale liquidations. Understanding these crucial zones is key for navigating the current market uncertainty. This analysis focuses on two key ranges: $121k-$120k and $114.5k-$113.6k.

Why are Liquidation Levels So Important?

Liquidation levels represent price points where leveraged positions are automatically closed by exchanges due to insufficient collateral. When a significant number of traders are liquidated at the same price, it can exacerbate market volatility, creating a cascading effect. This is particularly true in the volatile world of cryptocurrencies like Bitcoin. Identifying these levels allows traders to anticipate potential price swings and adjust their strategies accordingly.

The $121k-$120k Resistance Zone: A Strong Hurdle

The $121k-$120k range has proven to be a significant resistance zone for Bitcoin in recent weeks. Multiple attempts to break through this level have been met with selling pressure, resulting in price corrections. Several factors contribute to the strength of this resistance:

- Psychological Barrier: The $120,000 mark represents a psychological barrier for many investors, triggering profit-taking.

- High Concentration of Long Positions: Analysis suggests a high concentration of leveraged long positions (bets on price increases) around this level. A price drop would trigger widespread liquidations.

- Technical Indicators: Technical indicators such as the Relative Strength Index (RSI) and Moving Averages often suggest overbought conditions near this price range, indicating a potential reversal.

The $114.5k-$113.6k Support Zone: A Potential Lifeline (or Trap)?

Conversely, the $114.5k-$113.6k range is currently acting as a key support zone. If Bitcoin's price falls below this level, it could trigger further liquidations, potentially accelerating the downward trend. However, this zone could also provide a temporary respite, allowing for a potential rebound.

- Accumulation Zone: Some analysts believe this range may represent an accumulation zone where larger investors are buying Bitcoin at lower prices.

- Previous Support: This price range has served as support in previous market corrections.

- Potential for a Bounce: A strong bounce off this support level could signal a temporary reprieve before another attempt to break through the $120k resistance.

Navigating the Volatility: Key Considerations for Traders

The volatility surrounding these key price points highlights the importance of risk management. Traders should:

- Use Stop-Loss Orders: Employ stop-loss orders to limit potential losses if the market moves against their positions.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification can help mitigate risk.

- Stay Informed: Keep abreast of market news and analysis to make informed trading decisions. Consult reputable sources like [link to reputable crypto news site] and [link to another reputable source].

Conclusion: A Waiting Game?

Bitcoin's price action in the coming days will likely be pivotal. A decisive break above $121k could signal a bullish trend, while a break below $113.6k could lead to further declines. Traders should carefully monitor these crucial liquidation levels and adjust their strategies accordingly. The current market conditions demand caution and a thorough understanding of the risks involved. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions.

Keywords: Bitcoin, Bitcoin price, Bitcoin liquidation, cryptocurrency, crypto trading, Bitcoin analysis, Bitcoin support, Bitcoin resistance, $120k Bitcoin, $114k Bitcoin, market analysis, technical analysis, trading strategy, cryptocurrency market, volatility, leveraged trading, risk management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $121k-$120k & $114.5k-$113.6k: Crucial Bitcoin Liquidation Levels Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Severe Turbulence Forces Delta Flight To Land Passengers Injured Hospitalized

Aug 02, 2025

Severe Turbulence Forces Delta Flight To Land Passengers Injured Hospitalized

Aug 02, 2025 -

Colorado Dentists Fatal Poisoning Of Wife Results In Life In Prison

Aug 02, 2025

Colorado Dentists Fatal Poisoning Of Wife Results In Life In Prison

Aug 02, 2025 -

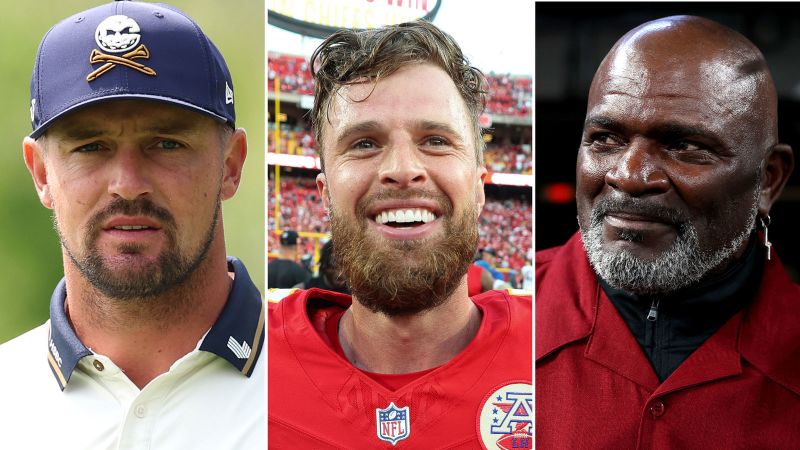

Details Emerge Trumps Restructured Presidential Sports Council And Its Athlete Members

Aug 02, 2025

Details Emerge Trumps Restructured Presidential Sports Council And Its Athlete Members

Aug 02, 2025 -

Forgotten Cold War Relic Inside Lithuanias Secret Missile Base

Aug 02, 2025

Forgotten Cold War Relic Inside Lithuanias Secret Missile Base

Aug 02, 2025 -

Delta Flight Diverted Passengers Injured In Mid Air Turbulence

Aug 02, 2025

Delta Flight Diverted Passengers Injured In Mid Air Turbulence

Aug 02, 2025

Latest Posts

-

Pattinsons Batman And Corenswets Superman A Gunn Sequel

Aug 02, 2025

Pattinsons Batman And Corenswets Superman A Gunn Sequel

Aug 02, 2025 -

Mega Millions Jackpot 8 1 25 Winning Numbers And Results

Aug 02, 2025

Mega Millions Jackpot 8 1 25 Winning Numbers And Results

Aug 02, 2025 -

Mr Beasts Team Trees Successor 40 Million Clean Water Initiative

Aug 02, 2025

Mr Beasts Team Trees Successor 40 Million Clean Water Initiative

Aug 02, 2025 -

No Pattinson As Batman James Gunn Clarifies Dcu Casting Rumors

Aug 02, 2025

No Pattinson As Batman James Gunn Clarifies Dcu Casting Rumors

Aug 02, 2025 -

Quentin Tarantino Breaks Silence On Michael Madsens Passing

Aug 02, 2025

Quentin Tarantino Breaks Silence On Michael Madsens Passing

Aug 02, 2025