20 Years Of Lockheed Martin Stock Ownership: A Return On Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

20 Years of Lockheed Martin Stock Ownership: A Return on Investment Analysis

Investing in defense contractors can be a lucrative strategy, but it's crucial to understand the long-term implications. For those who invested in Lockheed Martin (LMT) two decades ago, the journey has been one of significant growth, albeit with periods of volatility. This in-depth analysis examines the return on investment (ROI) for Lockheed Martin stock over the past 20 years, considering factors beyond simple price appreciation.

Lockheed Martin: A Giant in the Aerospace and Defense Industry

Lockheed Martin Corporation is a global security and aerospace company, a leader in the design, development, manufacturing, integration, and sustainment of advanced technology systems, products, and services. Their portfolio encompasses a wide range of offerings, from fighter jets like the F-35 to space exploration technologies and advanced missile defense systems. This diversification has played a significant role in the company's long-term stability and growth.

Analyzing the 20-Year ROI: More Than Just the Stock Price

Simply looking at the closing price of Lockheed Martin stock 20 years ago and comparing it to today's price only tells part of the story. A thorough ROI analysis must consider:

-

Dividends: Lockheed Martin has a history of paying consistent dividends to its shareholders. Reinvested dividends significantly compound returns over time, boosting the overall ROI. Calculating the total return including dividends paints a more accurate picture of long-term performance. (For detailed dividend history, refer to reputable financial sources like or ).

-

Stock Splits: Stock splits, while not directly impacting the overall value of your investment, can affect the number of shares owned and the perceived price. Accounting for any stock splits that occurred over the past two decades is essential for accurate ROI calculation.

-

Economic Context: The past 20 years have seen significant economic shifts, including periods of recession and periods of robust growth. Understanding how Lockheed Martin performed during these different economic cycles provides valuable context for assessing the investment’s resilience.

-

Geopolitical Factors: The defense industry is heavily influenced by geopolitical events. Increased global instability often translates into higher defense spending, benefiting companies like Lockheed Martin. Analyzing the impact of specific geopolitical events on LMT's stock performance can offer valuable insights.

Methodology for ROI Calculation

To calculate the accurate ROI, one would need to use a financial calculator or spreadsheet software to account for all factors mentioned above. The formula would typically involve:

- Initial Investment: The cost of purchasing the Lockheed Martin shares 20 years ago.

- Dividends Received: The total value of dividends received and reinvested over the 20-year period.

- Current Value: The current market value of the shares.

- ROI Formula: ((Current Value + Total Dividends Received - Initial Investment) / Initial Investment) * 100

Potential Challenges and Considerations

While the long-term outlook for Lockheed Martin appears positive, investors should always acknowledge potential risks:

- Government Spending: Fluctuations in government defense budgets can directly impact Lockheed Martin's revenue and profitability.

- Competition: The aerospace and defense industry is competitive. New technologies and competitors can impact Lockheed Martin's market share.

- Economic Downturns: Even a company as large as Lockheed Martin is not immune to the effects of a major economic recession.

Conclusion: A Long-Term Perspective is Key

Investing in Lockheed Martin stock over the past 20 years would likely have yielded a substantial ROI, especially when considering dividend reinvestment. However, the true return varies greatly depending on the specific timing of the investment and the investor's strategy. A thorough analysis, including dividends, stock splits, and an understanding of the broader economic and geopolitical landscape, is crucial for a complete understanding of the investment's performance. Remember, past performance is not indicative of future results. Always conduct thorough research and consult a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 20 Years Of Lockheed Martin Stock Ownership: A Return On Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fantasy Baseball Waiver Wire Dont Miss These Diamondbacks And Rockies Players

Jun 22, 2025

Fantasy Baseball Waiver Wire Dont Miss These Diamondbacks And Rockies Players

Jun 22, 2025 -

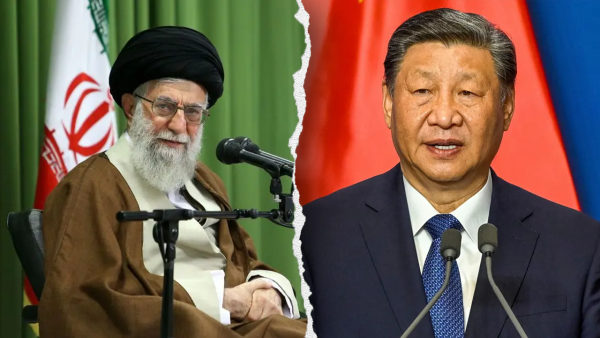

Wests Loss In Iran Conflict Heightened China Concerns

Jun 22, 2025

Wests Loss In Iran Conflict Heightened China Concerns

Jun 22, 2025 -

Oklahoma City Thunder Seek Nba Championship In Decisive Game 6

Jun 22, 2025

Oklahoma City Thunder Seek Nba Championship In Decisive Game 6

Jun 22, 2025 -

China And Iran Assessing Beijings Strategic Choices Amidst Western Involvement

Jun 22, 2025

China And Iran Assessing Beijings Strategic Choices Amidst Western Involvement

Jun 22, 2025 -

Ice Extends Detention Center Deal Despite Failing To Meet Standards

Jun 22, 2025

Ice Extends Detention Center Deal Despite Failing To Meet Standards

Jun 22, 2025

Latest Posts

-

Sparks Star Ben Felters New Achievement A Look At His Relationship With Cameron Brink

Jun 22, 2025

Sparks Star Ben Felters New Achievement A Look At His Relationship With Cameron Brink

Jun 22, 2025 -

Trump Faces Backlash Ex Mlb Star Rejects President Over War Threat

Jun 22, 2025

Trump Faces Backlash Ex Mlb Star Rejects President Over War Threat

Jun 22, 2025 -

Analysis How Kelsey Plums Injury Impacted The Sparks Loss To The Storm

Jun 22, 2025

Analysis How Kelsey Plums Injury Impacted The Sparks Loss To The Storm

Jun 22, 2025 -

Iran Conflict Will A Western Defeat Embolden China

Jun 22, 2025

Iran Conflict Will A Western Defeat Embolden China

Jun 22, 2025 -

Ghost Particle Experiment In Antarctica Uncovers Puzzling Signals

Jun 22, 2025

Ghost Particle Experiment In Antarctica Uncovers Puzzling Signals

Jun 22, 2025