20 Years Of Lockheed Martin Stock: Returns And Growth Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

20 Years of Lockheed Martin Stock: Returns and Growth Potential

Lockheed Martin Corporation (LMT), a name synonymous with defense technology and aerospace innovation, has enjoyed a remarkable two-decade run. But how has investing in Lockheed Martin stock fared over the past 20 years? And what's the potential for future growth? This in-depth analysis explores the company's performance, considering both its historical returns and future prospects.

For investors, understanding the long-term performance of a stock is crucial. Looking back two decades provides valuable context for assessing the risk and reward associated with LMT. While past performance doesn't guarantee future results, it offers a solid foundation for informed decision-making.

Lockheed Martin Stock: A Two-Decade Retrospective

Over the past 20 years, Lockheed Martin stock has delivered significant returns for long-term investors. While market fluctuations have naturally occurred, the overall trajectory has been positive, driven by factors such as:

-

Consistent Government Contracts: Lockheed Martin's core business relies heavily on government contracts for defense systems, aerospace technology, and other crucial projects. This stable revenue stream provides a level of predictability that many other sectors lack.

-

Technological Innovation: The company's continuous investment in research and development (R&D) has positioned it at the forefront of technological advancements in areas like fighter jets (F-35 program), missiles, and space exploration. This innovative edge is a key driver of long-term growth.

-

Strategic Acquisitions: Strategic acquisitions have broadened Lockheed Martin's capabilities and market reach, adding to its overall value and contributing to shareholder returns.

Analyzing the Returns: While precise figures will vary depending on the exact timeframe and the inclusion of dividends, LMT stock has generally outperformed many market benchmarks over the past two decades. Detailed performance data can be found on financial websites like and . Consider factoring in dividend reinvestment for a more complete picture of total returns.

Growth Potential: Looking Ahead

While Lockheed Martin's past performance is impressive, investors are naturally interested in its future potential. Several factors suggest continued growth:

-

Increased Defense Spending: Global geopolitical instability often translates into increased defense spending by governments worldwide. This creates a favorable environment for defense contractors like Lockheed Martin.

-

Technological Advancements: The ongoing demand for cutting-edge technology in defense and aerospace will continue to drive innovation and generate new revenue streams for LMT.

-

Space Exploration Initiatives: The renewed focus on space exploration, both governmental and private, presents significant opportunities for Lockheed Martin's space-related businesses.

Risks to Consider

It's crucial to acknowledge potential risks associated with investing in Lockheed Martin:

-

Government Budget Constraints: Changes in government spending priorities could negatively impact Lockheed Martin's revenue streams.

-

Competition: The defense industry is competitive, and Lockheed Martin faces strong competition from other major players.

-

Geopolitical Uncertainty: Unpredictable geopolitical events can significantly affect defense spending and, consequently, Lockheed Martin's performance.

Conclusion: A Solid, but Not Risk-Free, Investment

Lockheed Martin stock has demonstrated strong performance over the past 20 years. Its consistent revenue stream, commitment to R&D, and strategic acquisitions have contributed to this success. However, investors should carefully consider the inherent risks before investing in LMT. As with any investment, conducting thorough due diligence and diversifying your portfolio are crucial steps. This analysis serves as an overview, and consulting with a qualified financial advisor is recommended before making any investment decisions. Remember, past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 20 Years Of Lockheed Martin Stock: Returns And Growth Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Qatars Tightrope Walk Navigating The Israel Iran Conflict

Jun 22, 2025

Qatars Tightrope Walk Navigating The Israel Iran Conflict

Jun 22, 2025 -

Baby Girls Name Megan Fox And Machine Gun Kelly Make Announcement

Jun 22, 2025

Baby Girls Name Megan Fox And Machine Gun Kelly Make Announcement

Jun 22, 2025 -

Cameron Brinks Boyfriend Ben Felter Achieves New Milestone

Jun 22, 2025

Cameron Brinks Boyfriend Ben Felter Achieves New Milestone

Jun 22, 2025 -

Ian Watkins Of Steps A British Lgbt Award Recipient

Jun 22, 2025

Ian Watkins Of Steps A British Lgbt Award Recipient

Jun 22, 2025 -

Estados Unidos Ataca Iran Ultima Hora Y Desarrollo Del Conflicto En Oriente Medio

Jun 22, 2025

Estados Unidos Ataca Iran Ultima Hora Y Desarrollo Del Conflicto En Oriente Medio

Jun 22, 2025

Latest Posts

-

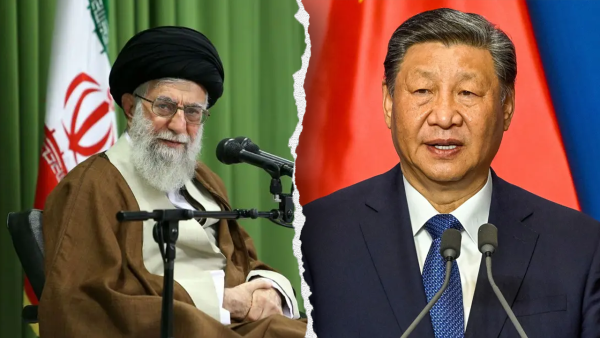

Will A Western Loss In Iran Embolden China Analyzing Potential Responses

Jun 22, 2025

Will A Western Loss In Iran Embolden China Analyzing Potential Responses

Jun 22, 2025 -

Former Mlb Player Zack Cozart No Trump Support If War Begins

Jun 22, 2025

Former Mlb Player Zack Cozart No Trump Support If War Begins

Jun 22, 2025 -

Storm Vs Sparks June 17 2025 Full Game Recap And Highlights

Jun 22, 2025

Storm Vs Sparks June 17 2025 Full Game Recap And Highlights

Jun 22, 2025 -

Sparks Suffer Crushing Defeat Against Storm Kelsey Plum Injury A Factor

Jun 22, 2025

Sparks Suffer Crushing Defeat Against Storm Kelsey Plum Injury A Factor

Jun 22, 2025 -

The Legacy Of Jaws Exploring The Films Impact On Shark Conservation And Public Fear

Jun 22, 2025

The Legacy Of Jaws Exploring The Films Impact On Shark Conservation And Public Fear

Jun 22, 2025