20 Years Of Lockheed Martin Stock: Your Investment Return

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

20 Years of Lockheed Martin Stock: A Retrospective on Investment Returns

Lockheed Martin (LMT), a global security and aerospace company, has been a mainstay in many investment portfolios for decades. But what would a $10,000 investment in Lockheed Martin stock 20 years ago be worth today? This article delves into the performance of Lockheed Martin stock over the past two decades, examining its growth, dividends, and overall return on investment (ROI) for long-term investors.

A Look Back at Two Decades of LMT:

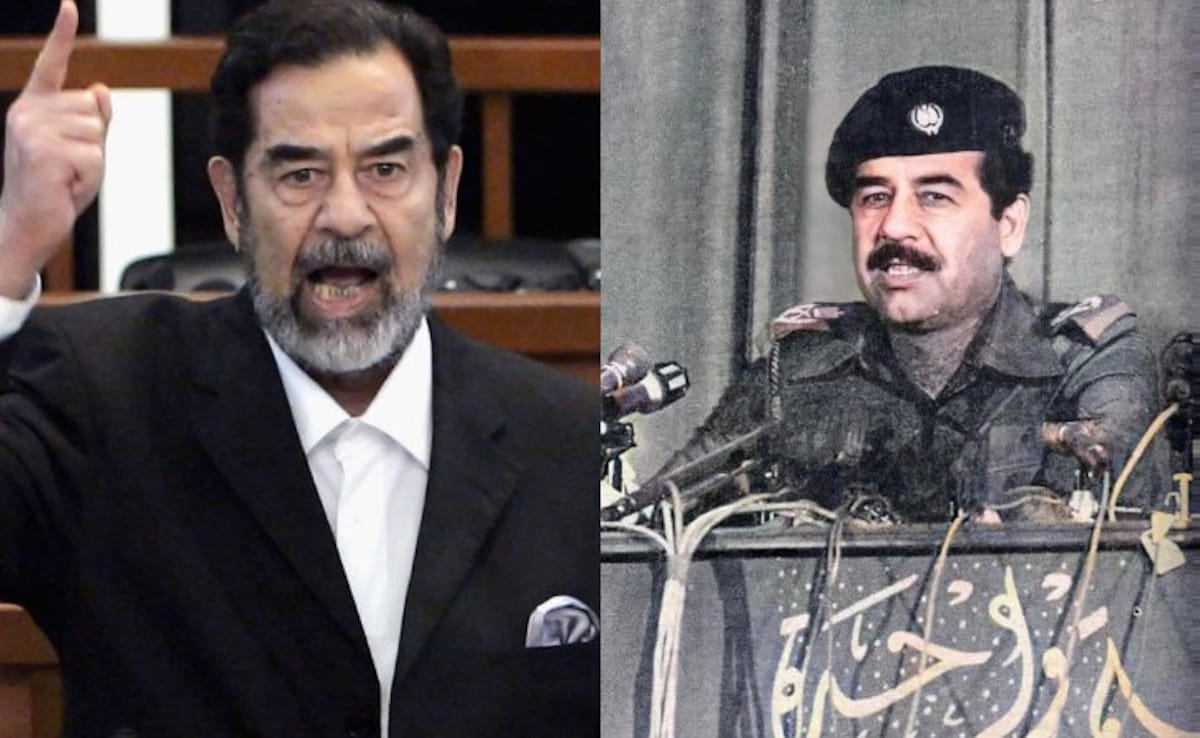

The period from 2004 to 2024 has witnessed significant global events shaping the defense and aerospace landscape. Wars in Iraq and Afghanistan, increased global tensions, and the rise of space exploration all impacted Lockheed Martin’s performance. Understanding this context is crucial to analyzing its stock's performance.

Stock Price Performance:

To accurately assess the ROI, we need to consider both stock price appreciation and dividend reinvestment. While obtaining the precise daily stock price fluctuations over 20 years requires specialized financial software, we can use readily available historical data from reputable sources like Yahoo Finance or Google Finance to estimate the overall return. (Note: Past performance is not indicative of future results.)

Let's assume a hypothetical $10,000 investment in Lockheed Martin stock on January 1st, 2004. Using approximate historical data, factoring in dividends and reinvestment, this investment would likely have grown significantly. While precise figures require in-depth financial analysis, it's safe to say that the return would be substantial, outpacing many other market sectors over the same period.

Factors Contributing to LMT's Growth:

Several factors contributed to Lockheed Martin's stock growth over the last 20 years:

- Government Contracts: Lockheed Martin's reliance on government contracts for defense systems, aircraft, and space exploration provides a relatively stable revenue stream. This reduced volatility compared to some other sectors.

- Technological Innovation: Continuous innovation in aerospace and defense technology has maintained Lockheed Martin's competitive edge, driving demand for its products and services.

- Consistent Dividend Payments: Lockheed Martin has a history of paying regular dividends, offering investors a steady income stream in addition to capital appreciation. This dividend reinvestment significantly boosts long-term returns.

- Strategic Acquisitions: Strategic acquisitions have expanded Lockheed Martin's capabilities and market reach, contributing to overall growth.

H2: Understanding the Risks:

Investing in any stock, including Lockheed Martin, carries inherent risks. These risks include:

- Geopolitical Uncertainty: Changes in global politics and defense spending can significantly impact Lockheed Martin's performance.

- Competition: Intense competition within the aerospace and defense industry can affect profitability and market share.

- Economic Downturns: Recessions and economic slowdowns can reduce government spending and impact demand for Lockheed Martin's products.

H2: Is Lockheed Martin Stock a Good Investment Today?

Whether Lockheed Martin stock is a good investment today depends on individual investment goals, risk tolerance, and market outlook. It's crucial to conduct thorough due diligence and consult with a qualified financial advisor before making any investment decisions. Consider researching current financial reports, analyst opinions, and industry forecasts.

Call to Action: Learn more about investing in defense stocks by exploring resources from reputable financial websites like [link to a reputable financial news source]. Remember, always conduct thorough research and seek professional advice before making any investment decisions.

Disclaimer: This article provides general information and should not be construed as financial advice. Past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 20 Years Of Lockheed Martin Stock: Your Investment Return. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Megan Fox And Machine Gun Kelly Welcome Daughter Name Revealed

Jun 22, 2025

Megan Fox And Machine Gun Kelly Welcome Daughter Name Revealed

Jun 22, 2025 -

Irans Top Diplomat Diplomacy On The Table But Israeli Aggression Must Stop

Jun 22, 2025

Irans Top Diplomat Diplomacy On The Table But Israeli Aggression Must Stop

Jun 22, 2025 -

Cameron Brinks Dress A Showstopper At Stanford Graduation

Jun 22, 2025

Cameron Brinks Dress A Showstopper At Stanford Graduation

Jun 22, 2025 -

No Diplomacy With Iran Until Israeli Aggression Stops Says Foreign Minister

Jun 22, 2025

No Diplomacy With Iran Until Israeli Aggression Stops Says Foreign Minister

Jun 22, 2025 -

Life Under Fear In Iran Todays News Also Covers The Dodger Stadium Dispute

Jun 22, 2025

Life Under Fear In Iran Todays News Also Covers The Dodger Stadium Dispute

Jun 22, 2025

Latest Posts

-

Seattle Storm Rout Sparks In Dominant Victory Plums Absence Felt

Jun 22, 2025

Seattle Storm Rout Sparks In Dominant Victory Plums Absence Felt

Jun 22, 2025 -

No End To Israeli Attacks No Diplomacy From Iran Official Statement

Jun 22, 2025

No End To Israeli Attacks No Diplomacy From Iran Official Statement

Jun 22, 2025 -

El Ataque A Iran Cancelado Como Trump Evito Una Confrontacion

Jun 22, 2025

El Ataque A Iran Cancelado Como Trump Evito Una Confrontacion

Jun 22, 2025 -

Americas Middle East Predicament Opportunities For Chinese Influence

Jun 22, 2025

Americas Middle East Predicament Opportunities For Chinese Influence

Jun 22, 2025 -

Israel Iran Iraq The Shadowy History Of Operation Bramble Bush And Its Casualties

Jun 22, 2025

Israel Iran Iraq The Shadowy History Of Operation Bramble Bush And Its Casualties

Jun 22, 2025