20 Years Of Lockheed Martin Stock: Your Potential Earnings Revealed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

20 Years of Lockheed Martin Stock: Your Potential Earnings Revealed

Investing in defense contractors can be a lucrative strategy, but understanding long-term performance is key. Lockheed Martin (LMT), a titan in the aerospace and defense industry, has seen significant growth over the past two decades. This article delves into the potential earnings of a Lockheed Martin stock investment over the past 20 years, exploring the highs, lows, and overall profitability. We'll also look at what factors contributed to its success and consider future prospects.

A Look Back: Two Decades of Lockheed Martin Stock Performance

Investing in Lockheed Martin 20 years ago would have been a smart move for many. To illustrate, let's consider a hypothetical scenario: Imagine investing $10,000 in Lockheed Martin stock on a specific date twenty years ago (the exact date will influence the final outcome, but we will use an example for illustrative purposes). While past performance doesn't guarantee future results, analyzing this period provides valuable insight.

By examining historical stock prices and accounting for dividends (which significantly impact overall return), you can get a clearer picture of the potential growth. Accessing reliable financial data from sources like Yahoo Finance or Google Finance is crucial for accurate calculations. These platforms allow you to input specific dates and see the historical performance of LMT.

Key Factors Influencing Lockheed Martin's Growth:

Several factors contributed to Lockheed Martin's success over the past 20 years:

- Government Contracts: A significant portion of Lockheed Martin's revenue stems from government contracts, particularly from the US Department of Defense. This provides a relatively stable revenue stream, less susceptible to the fluctuations of the broader market.

- Technological Innovation: The company's continuous investment in research and development (R&D) has positioned it at the forefront of aerospace and defense technology. This innovation drives demand for its products and services.

- Diversified Portfolio: Lockheed Martin's diverse portfolio, encompassing areas like aerospace, defense systems, and security solutions, mitigates risk. This diversification allows them to capitalize on opportunities across multiple sectors.

- Strategic Acquisitions: Strategic acquisitions have expanded Lockheed Martin's capabilities and market reach, enhancing its competitive advantage.

Calculating Your Potential Earnings: A Practical Example

Let's revisit our hypothetical $10,000 investment. Using historical data (remember, this is an example and your actual results may vary), you could potentially see significant growth depending on the specific entry and exit points, as well as dividend reinvestment. For instance, a conservative estimate might show a significant increase, exceeding the initial investment substantially. However, it's crucial to consult financial professionals for personalized advice.

Important Considerations:

- Risk Tolerance: Investing in the stock market always involves risk. Lockheed Martin, while relatively stable, is not immune to market fluctuations.

- Market Volatility: Geopolitical events and economic shifts can impact the defense industry, affecting Lockheed Martin's stock price.

- Diversification: It’s crucial to diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket.

Looking Ahead: Future Prospects for Lockheed Martin Stock

The future of Lockheed Martin depends on several factors, including:

- Government Spending: Future defense budgets will significantly impact the company's prospects.

- Technological Advancements: Maintaining its technological edge will be crucial for continued success.

- Global Competition: Competition from other defense contractors will shape its market position.

Conclusion: Informed Decisions are Key

Investing in Lockheed Martin stock over the past 20 years could have yielded substantial returns. However, understanding the inherent risks and conducting thorough research before making any investment decision is crucial. This article provides a glimpse into the potential, but professional financial advice should always guide your investment strategy. Consider consulting a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 20 Years Of Lockheed Martin Stock: Your Potential Earnings Revealed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No More Support Ex Mlb Star On Trump And Potential Us War

Jun 22, 2025

No More Support Ex Mlb Star On Trump And Potential Us War

Jun 22, 2025 -

Irans Fm Condemns Geneva Talks As Betrayal Amid Heightened Israel Tensions

Jun 22, 2025

Irans Fm Condemns Geneva Talks As Betrayal Amid Heightened Israel Tensions

Jun 22, 2025 -

Maximize Your Fantasy Baseball Team Waiver Wire Targets From D Backs Rockies

Jun 22, 2025

Maximize Your Fantasy Baseball Team Waiver Wire Targets From D Backs Rockies

Jun 22, 2025 -

Pavel Durovs Estate A Massive Inheritance For His Numerous Children

Jun 22, 2025

Pavel Durovs Estate A Massive Inheritance For His Numerous Children

Jun 22, 2025 -

Israeli Aggression Prevents Iran Diplomacy Says Foreign Minister

Jun 22, 2025

Israeli Aggression Prevents Iran Diplomacy Says Foreign Minister

Jun 22, 2025

Latest Posts

-

Investment Firm Cantor Fitzgerald Raises Position In Lockheed Martin Lmt

Jun 22, 2025

Investment Firm Cantor Fitzgerald Raises Position In Lockheed Martin Lmt

Jun 22, 2025 -

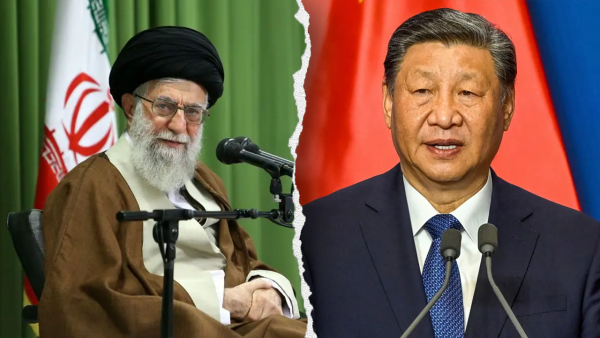

Will China Support Iran After A Western Victory Analyzing The Geopolitical Stakes

Jun 22, 2025

Will China Support Iran After A Western Victory Analyzing The Geopolitical Stakes

Jun 22, 2025 -

Breaking Ex Mlb Star Issues Ultimatum To President Trump Regarding War

Jun 22, 2025

Breaking Ex Mlb Star Issues Ultimatum To President Trump Regarding War

Jun 22, 2025 -

Revealed The Meaning Behind Machine Gun Kellys Daughters Name Case

Jun 22, 2025

Revealed The Meaning Behind Machine Gun Kellys Daughters Name Case

Jun 22, 2025 -

Trumps Influence Kari Lakes Restructuring Of Voice Of America

Jun 22, 2025

Trumps Influence Kari Lakes Restructuring Of Voice Of America

Jun 22, 2025