2025 Tourism Downturn: 4 Steps To Safeguard Your Retirement Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2025 Tourism Downturn: 4 Steps to Safeguard Your Retirement Investments

The global tourism industry, a behemoth impacting countless economies and retirement portfolios, faces potential headwinds in 2025. Experts predict a downturn, driven by factors ranging from inflation and economic uncertainty to geopolitical instability and evolving travel preferences. For retirees heavily invested in tourism-related stocks or real estate, this presents a significant risk. But don't panic! Proactive steps can help safeguard your retirement investments and navigate this potential storm.

Understanding the Predicted Downturn:

Several factors point towards a possible tourism slump in 2025. Increased inflation is squeezing consumer spending, making discretionary travel less affordable. Geopolitical tensions and potential conflicts continue to disrupt travel plans. Furthermore, the rise of sustainable and responsible travel is forcing industry players to adapt, leading to uncertainty and potential consolidation. These factors, combined, create a challenging environment for tourism-related investments.

H2: 4 Crucial Steps to Protect Your Retirement:

Retirees with significant exposure to the tourism sector need a robust strategy to mitigate potential losses. Here are four crucial steps to safeguard your retirement investments:

1. Diversify Your Portfolio: This is the golden rule of investing, regardless of the sector. Over-reliance on any single industry, especially one as volatile as tourism, exposes you to significant risk. Diversification means spreading your investments across different asset classes, such as stocks, bonds, real estate (outside of tourism), and perhaps even precious metals. Consider consulting a financial advisor to create a diversified portfolio aligned with your risk tolerance and retirement goals. [Link to a reputable financial planning resource]

2. Re-evaluate Your Tourism Holdings: It’s time for a thorough review of your current tourism-related investments. This includes analyzing the financial health of individual companies in your portfolio, considering their resilience to economic downturns, and assessing their long-term growth potential in a changing market. Companies prioritizing sustainability and adapting to evolving travel trends might fare better than those lagging behind. Consider reducing your exposure to companies with high debt or those heavily reliant on specific, volatile tourism segments.

3. Explore Defensive Investments: During economic downturns, "defensive" investments tend to perform better. These are assets that are less sensitive to market fluctuations. Examples include government bonds, high-quality dividend-paying stocks, and utility companies. Shifting a portion of your portfolio towards these defensive options can help cushion the impact of a tourism downturn. [Link to an article discussing defensive investing strategies]

4. Develop a Contingency Plan: Unexpected events can impact retirement plans. Having a contingency plan in place is crucial. This might include adjusting your spending habits, delaying certain purchases, or exploring part-time employment options. A realistic budget and emergency fund can significantly reduce the stress associated with market volatility. Consult with a financial planner to determine the best course of action based on your specific circumstances.

H2: Staying Informed is Key:

Keeping abreast of industry trends and economic indicators is crucial for navigating the potential 2025 tourism downturn. Follow reputable financial news sources, and consider subscribing to newsletters focused on the tourism and investment sectors. Regularly reviewing your portfolio and adjusting your strategy as needed will be vital in protecting your retirement savings.

H2: Conclusion:

While the possibility of a tourism downturn in 2025 warrants attention, it doesn't necessitate panic. By implementing these four steps – diversification, re-evaluation, exploring defensive investments, and developing a contingency plan – you can significantly strengthen your retirement portfolio's resilience and navigate this potential challenge effectively. Remember, seeking professional financial advice tailored to your individual circumstances is always recommended.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2025 Tourism Downturn: 4 Steps To Safeguard Your Retirement Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Black Lives Matter Plaza A Legacy Of Controversy And Change

May 26, 2025

The Black Lives Matter Plaza A Legacy Of Controversy And Change

May 26, 2025 -

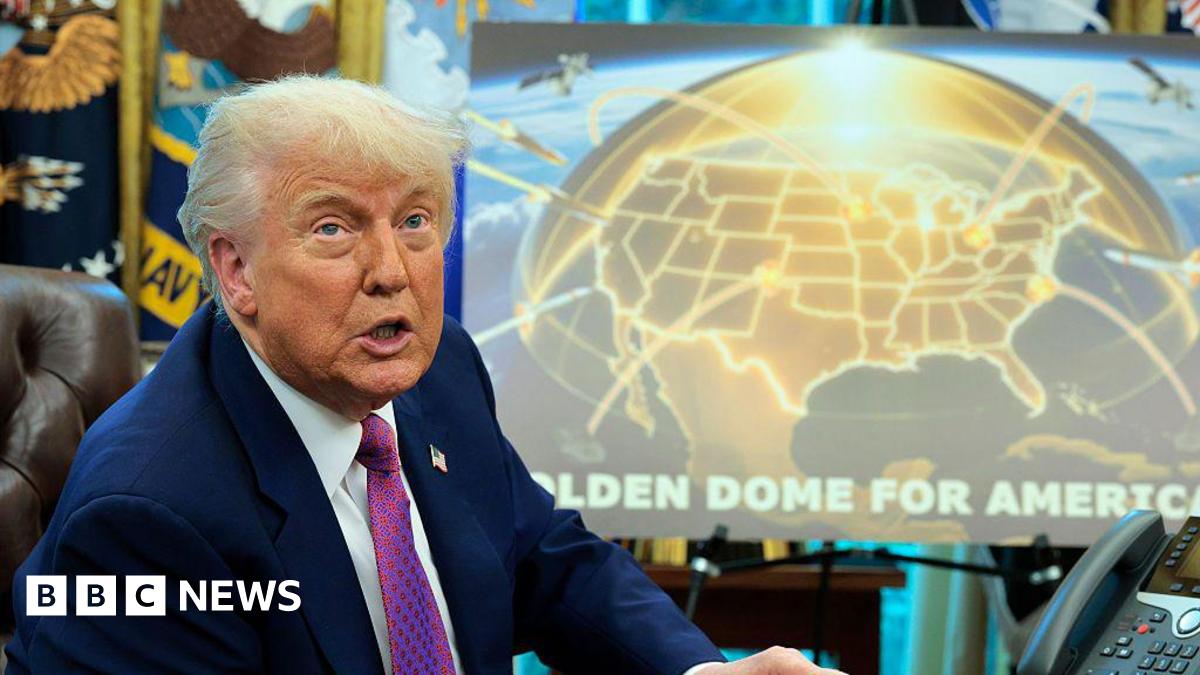

Can The Us Afford And Build Trumps Proposed Golden Dome Missile Defense

May 26, 2025

Can The Us Afford And Build Trumps Proposed Golden Dome Missile Defense

May 26, 2025 -

L Elysee S Explique Sur La Video Montrant Un Echange Tendu Entre Le President Et Son Epouse

May 26, 2025

L Elysee S Explique Sur La Video Montrant Un Echange Tendu Entre Le President Et Son Epouse

May 26, 2025 -

Eu Us Trade Relations Respect The Foundation For A New Trade Agreement

May 26, 2025

Eu Us Trade Relations Respect The Foundation For A New Trade Agreement

May 26, 2025 -

Benefit Cap Future Uncertain Rayners Response On Abolition

May 26, 2025

Benefit Cap Future Uncertain Rayners Response On Abolition

May 26, 2025

Latest Posts

-

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025 -

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025 -

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025 -

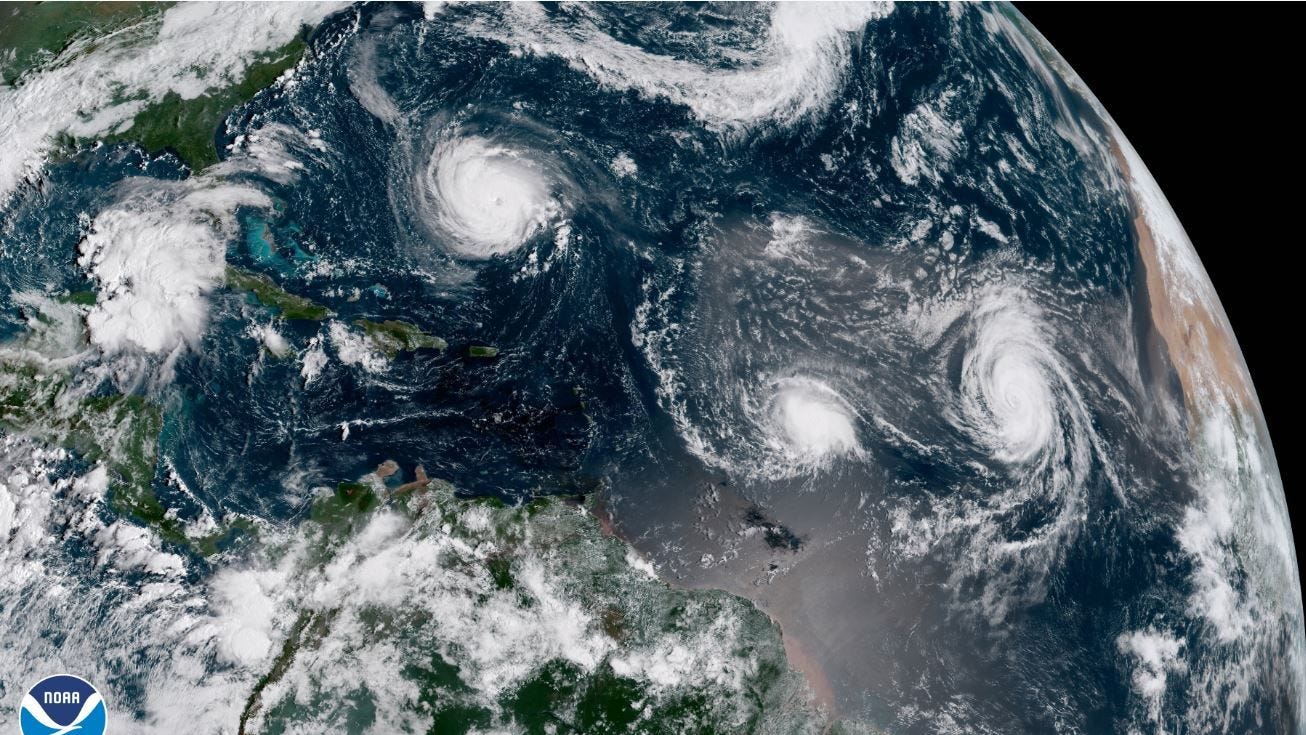

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025