2025 Tourism Slump: 4 Steps To Safeguard Your Retirement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2025 Tourism Slump: 4 Steps to Safeguard Your Retirement

The travel industry, a significant contributor to global economies and a beloved pastime for millions, faces potential headwinds. Predictions suggest a possible tourism slump in 2025, a prospect that could significantly impact retirees heavily reliant on travel-related income streams, like rental properties or tourism-based businesses. This isn't a prediction of doom and gloom, but a call to action. Proactive planning now can safeguard your retirement against unforeseen economic downturns. Let's explore four crucial steps to secure your financial future.

H2: Understanding the Potential 2025 Tourism Slump

Several factors contribute to the projected downturn. Inflation, rising interest rates, and geopolitical instability are all casting shadows over the industry. [Link to reputable source discussing economic forecasts]. For retirees who depend on tourism revenue, this uncertainty demands careful consideration and strategic adaptation. A dip in travel could mean reduced rental income from vacation properties, lower profits from tour guiding businesses, or even diminished returns from investments tied to the sector.

H2: Step 1: Diversify Your Income Streams

The golden rule of financial security is diversification. Don't put all your eggs in one basket. If a significant portion of your retirement income relies on tourism, it's crucial to explore alternative revenue streams. This could involve:

- Investing in diverse asset classes: Consider a mix of stocks, bonds, and real estate outside the tourism sector. [Link to article on retirement investment diversification]

- Developing a passive income source: Explore online businesses, freelance work, or dividend-paying stocks to supplement your income.

- Part-time employment: Consider a flexible part-time job to add a safety net to your retirement funds.

H2: Step 2: Review and Adjust Your Budget

Facing potential financial challenges requires a thorough review of your budget. Identify areas where you can cut back without significantly impacting your quality of life. This might involve:

- Reducing discretionary spending: Analyze your non-essential expenses and identify areas for reduction.

- Negotiating lower bills: Contact service providers to explore options for lower rates.

- Exploring cheaper alternatives: Look for cost-effective options for groceries, entertainment, and healthcare.

H2: Step 3: Build an Emergency Fund

A robust emergency fund is your financial safety net. Aim for at least three to six months' worth of living expenses in easily accessible accounts. This buffer will provide financial stability during unexpected economic downturns, preventing you from having to dip into your retirement savings.

H2: Step 4: Consider Downsizing or Relocation

For retirees with significant assets tied to the tourism sector, downsizing your home or relocating to a lower cost-of-living area could significantly reduce expenses and improve your financial resilience. This strategy can free up capital and reduce your reliance on tourism-related income.

H2: Conclusion: Proactive Planning is Key

While the possibility of a 2025 tourism slump is a concern, it's not an insurmountable obstacle. By implementing these four steps – diversifying income, adjusting your budget, building an emergency fund, and considering downsizing – you can significantly safeguard your retirement and navigate potential economic challenges with greater confidence and financial security. Don't wait until the downturn hits; start planning today. Your future self will thank you.

Call to Action: Consult with a qualified financial advisor to create a personalized retirement plan tailored to your specific circumstances and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2025 Tourism Slump: 4 Steps To Safeguard Your Retirement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Johan Rojas Eighth Inning Robbery A Game Changing Catch

May 25, 2025

Johan Rojas Eighth Inning Robbery A Game Changing Catch

May 25, 2025 -

Urgent Flash Flood Warning Issued For Parts Of Western Pennsylvania

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of Western Pennsylvania

May 25, 2025 -

San Diego Neighborhood Devastated By Plane Crash A Timeline Of Events

May 25, 2025

San Diego Neighborhood Devastated By Plane Crash A Timeline Of Events

May 25, 2025 -

Migrant Smuggling The Role Of Luxury Yachts According To A Former Smuggler

May 25, 2025

Migrant Smuggling The Role Of Luxury Yachts According To A Former Smuggler

May 25, 2025 -

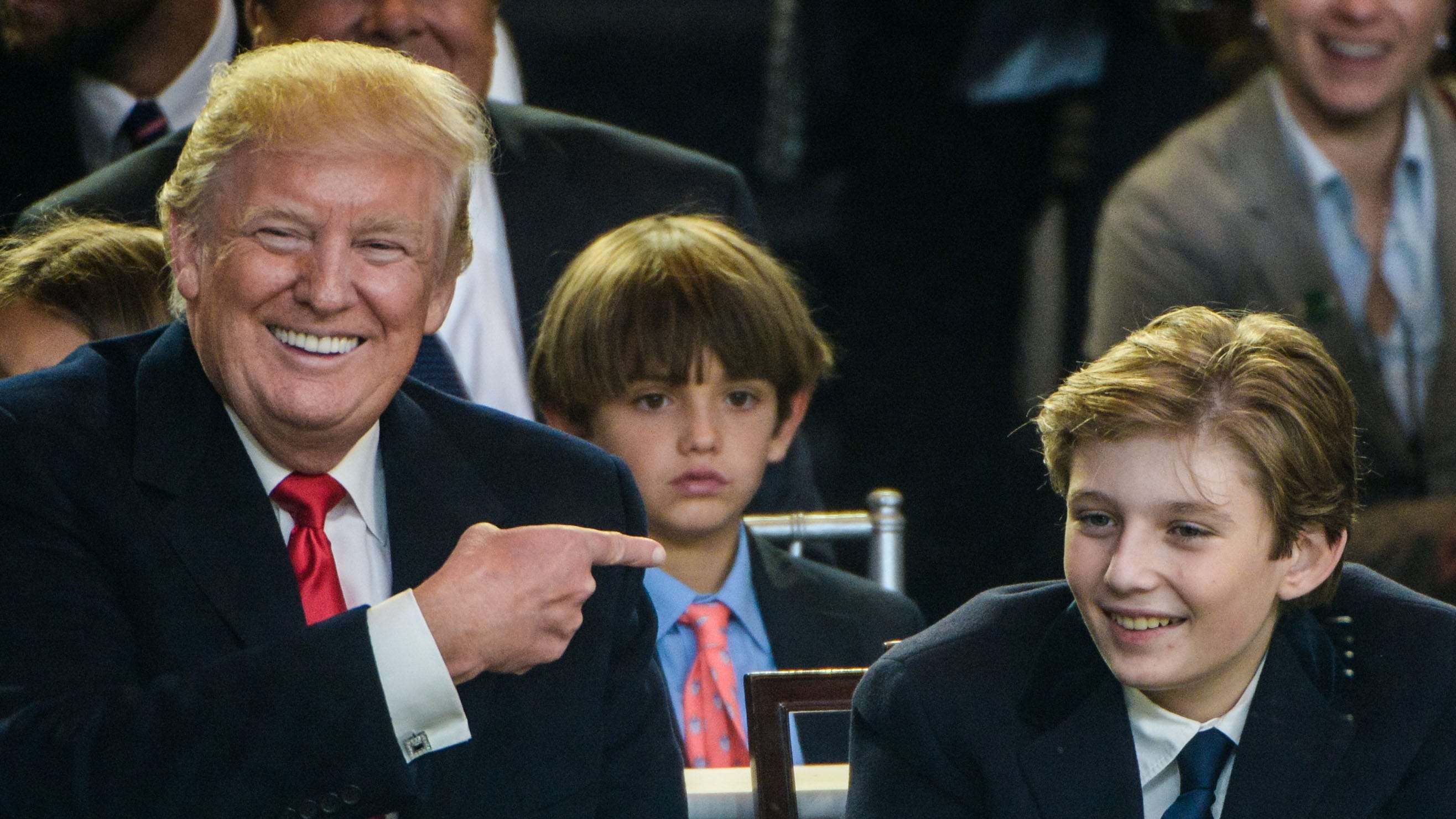

Barron Trump And Harvard Examining The College Applications Of The Trump Children

May 25, 2025

Barron Trump And Harvard Examining The College Applications Of The Trump Children

May 25, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025