2034 Social Security Payment Cuts: What Congress Must Do

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2034 Social Security Payment Cuts: What Congress Must Do to Avert a Crisis

The looming threat of Social Security payment cuts in 2034 is no longer a distant possibility; it's a rapidly approaching reality. Unless Congress acts decisively, millions of retirees and disabled Americans face a significant reduction in their benefits, potentially plunging many into financial hardship. Understanding the problem and the potential solutions is crucial for every American, regardless of age.

The Ticking Clock: Why Social Security Faces a Funding Gap

The Social Security Trust Fund, which pays out benefits, is projected to be depleted by 2034. This doesn't mean Social Security will vanish entirely; however, it means the program will only be able to pay approximately 80% of scheduled benefits without legislative action. This projected shortfall stems from several factors, including:

- An aging population: The ratio of workers contributing to the system versus retirees receiving benefits is shifting dramatically. As the Baby Boomer generation enters retirement, the number of beneficiaries is increasing while the workforce contributing to the system is relatively stagnant.

- Increased life expectancy: People are living longer, meaning they draw benefits for a longer period, increasing the overall financial burden on the system.

- Declining birth rates: Lower birth rates contribute to a smaller workforce to support a growing retired population.

The Potential Impact of 2034 Cuts: A Looming Crisis for Millions

A 20% reduction in Social Security benefits would be devastating for many seniors. Many rely on these payments as their primary source of income, and such a cut could lead to:

- Increased poverty rates among seniors: Many older Americans live on a tight budget, and a benefit reduction would push many below the poverty line.

- Reduced access to healthcare: Healthcare costs are already a significant burden for many seniors. Benefit cuts could severely limit access to vital medical care.

- Increased homelessness and housing insecurity: For those living on the margins, a reduction in Social Security could lead to homelessness or the inability to afford adequate housing.

What Can Congress Do? Exploring Potential Solutions

The looming crisis demands immediate action from Congress. Several potential solutions are being debated, including:

- Raising the full retirement age: Gradually increasing the age at which individuals can receive full Social Security benefits could help alleviate the financial strain on the system. However, this measure disproportionately affects lower-income individuals who often have shorter life expectancies and may not live long enough to receive full benefits.

- Increasing the Social Security tax: Raising the Social Security tax rate for both employers and employees could generate additional revenue for the system. However, increasing taxes could negatively impact economic growth and individual finances.

- Increasing the taxable earnings base: Currently, Social Security taxes only apply to earnings up to a certain limit. Raising this limit would include more high-income earners in the Social Security tax base, generating additional revenue.

- Reducing benefits for high earners: This option involves adjusting the benefit formula to reduce payments for higher-income retirees. This approach has the potential to raise significant revenue without dramatically affecting the majority of beneficiaries.

A Call to Action: Engaging with Your Representatives

The future of Social Security is in the hands of Congress. It’s crucial for citizens to contact their representatives and senators, urging them to take swift and decisive action. Understanding the different proposed solutions and their potential impacts is vital in making informed choices and advocating for a sustainable future for Social Security. Visit the official Social Security Administration website () for more detailed information and resources. Your voice matters; make it heard.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2034 Social Security Payment Cuts: What Congress Must Do. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Check Now Your Bay Area City On Pg And Es Power Shutoff List

Jun 20, 2025

Check Now Your Bay Area City On Pg And Es Power Shutoff List

Jun 20, 2025 -

Mlb News Verlander And Bailey Activated From Injured List For Giants

Jun 20, 2025

Mlb News Verlander And Bailey Activated From Injured List For Giants

Jun 20, 2025 -

A Night Of Terror In Kyiv Counting The Cost And The Search For The Deceased

Jun 20, 2025

A Night Of Terror In Kyiv Counting The Cost And The Search For The Deceased

Jun 20, 2025 -

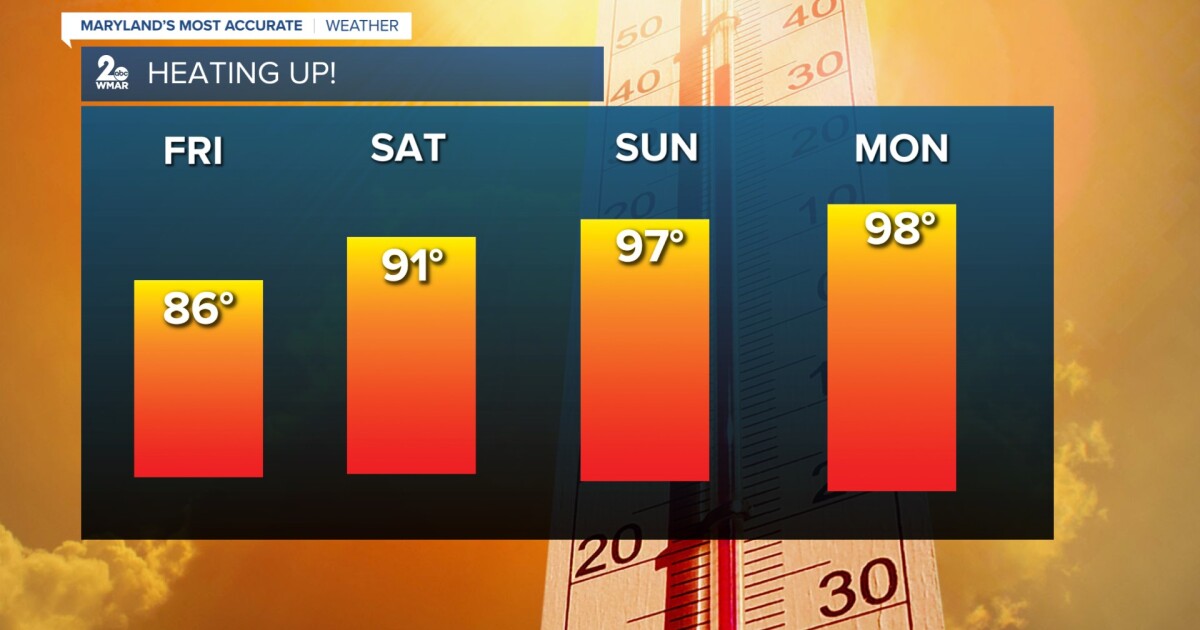

Urgent Weather Update Widespread Strong Severe Thunderstorms Impacting Region Name

Jun 20, 2025

Urgent Weather Update Widespread Strong Severe Thunderstorms Impacting Region Name

Jun 20, 2025 -

Why Indiana Fever Coach Stephanie White Wont Coach Thursdays Game

Jun 20, 2025

Why Indiana Fever Coach Stephanie White Wont Coach Thursdays Game

Jun 20, 2025

Latest Posts

-

Decoding Lion Links The Significance Of The 6 20 25 Pattern

Jun 21, 2025

Decoding Lion Links The Significance Of The 6 20 25 Pattern

Jun 21, 2025 -

University Students Warned Prepare For Shock And Offense

Jun 21, 2025

University Students Warned Prepare For Shock And Offense

Jun 21, 2025 -

Patrick Mahomes On The Chiefs Offseason A Conversation With Andy Reid

Jun 21, 2025

Patrick Mahomes On The Chiefs Offseason A Conversation With Andy Reid

Jun 21, 2025 -

Camden Rolex Murder 66 Year Old Woman Taken Into Custody

Jun 21, 2025

Camden Rolex Murder 66 Year Old Woman Taken Into Custody

Jun 21, 2025 -

Analyzing Lion Links 6 20 25 And Its Implications

Jun 21, 2025

Analyzing Lion Links 6 20 25 And Its Implications

Jun 21, 2025