31-Year Mortgage Trend: The Reality For First-Time Buyers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

31-Year Mortgage Trend: The Reality for First-Time Buyers

The dream of homeownership often hinges on the 30-year mortgage, a cornerstone of the American Dream for generations. But is this long-term commitment still the best option for today's first-time homebuyers, particularly in light of rising interest rates and shifting market conditions? Let's delve into the reality of the 31-year mortgage trend (a slight variation often seen in practice) and its implications for those entering the housing market.

The Allure of the 30-Year Mortgage (and its 31-Year Cousin): Lower Monthly Payments

The primary attraction of a 30-year mortgage, and its near-equivalent, the 31-year option, is undoubtedly the lower monthly payment. This makes homeownership more accessible to those with limited budgets, allowing them to spread their payments over a longer period. For first-time buyers often facing competing financial priorities, this can be a crucial factor. However, this lower monthly payment comes with a significant caveat: you'll pay substantially more in interest over the life of the loan.

The Hidden Cost: Total Interest Paid

While the lower monthly payment is enticing, the total interest paid over 30 or 31 years can significantly outweigh the initial affordability. This means you'll end up paying considerably more for your home than its initial purchase price. Before signing on the dotted line, first-time buyers need to carefully analyze the amortization schedule, which details the principal and interest payments over the loan's lifetime. Several online mortgage calculators can help you visualize this crucial aspect. [Link to reputable mortgage calculator].

Rising Interest Rates: A Game Changer for Long-Term Mortgages

The current interest rate environment significantly impacts the feasibility of a 30 or 31-year mortgage. Higher rates lead to larger monthly payments and an even greater total interest burden. First-time homebuyers need to carefully consider the long-term implications of these increased costs and factor them into their overall financial planning. Understanding the difference between fixed-rate and adjustable-rate mortgages (ARMs) is also critical in navigating this fluctuating market. [Link to article explaining fixed vs. adjustable rate mortgages].

Alternatives to Consider: Shorter-Term Mortgages

While the 30-year mortgage holds appeal, alternatives like 15-year mortgages offer considerable advantages, particularly in a high-interest-rate environment. Although monthly payments are higher, you'll pay significantly less interest overall and own your home outright much sooner. This faster equity building can be a powerful long-term financial strategy.

What First-Time Buyers Should Do:

- Shop around for the best rates: Don't settle for the first offer you receive. Compare rates from multiple lenders.

- Get pre-approved for a mortgage: This gives you a clear understanding of your borrowing power.

- Understand your budget: Carefully assess your income, expenses, and debt-to-income ratio.

- Consider all your options: Don't limit your search to 30-year mortgages. Explore 15-year and other loan options.

- Seek professional advice: Consult with a financial advisor and a real estate agent to make informed decisions.

Conclusion:

The 31-year mortgage trend, a slight variation on the traditional 30-year loan, presents a mixed bag for first-time homebuyers. While the lower monthly payments offer immediate affordability, the long-term cost in interest can be substantial, particularly in a climate of rising interest rates. Thorough research, careful planning, and a realistic assessment of your financial situation are crucial to navigating the complexities of homeownership and making the right choice for your future. Don't hesitate to seek expert advice before committing to such a significant financial undertaking.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 31-Year Mortgage Trend: The Reality For First-Time Buyers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Doctor Whos Ncuti Gatwa Regeneration Details And Fan Reaction

Jun 03, 2025

Doctor Whos Ncuti Gatwa Regeneration Details And Fan Reaction

Jun 03, 2025 -

Solve Nyt Spelling Bee Strands Puzzle June 3rd Answers And Clues

Jun 03, 2025

Solve Nyt Spelling Bee Strands Puzzle June 3rd Answers And Clues

Jun 03, 2025 -

Encouraging Developments In Colorectal Cancer Research Unveils New Treatment And Prevention Options

Jun 03, 2025

Encouraging Developments In Colorectal Cancer Research Unveils New Treatment And Prevention Options

Jun 03, 2025 -

Mets Ronny Mauricio Gets The Call Minor League Success Earns Mlb Promotion

Jun 03, 2025

Mets Ronny Mauricio Gets The Call Minor League Success Earns Mlb Promotion

Jun 03, 2025 -

Ronny Mauricio Called Up Mets Roster Move Signals Shift

Jun 03, 2025

Ronny Mauricio Called Up Mets Roster Move Signals Shift

Jun 03, 2025

Latest Posts

-

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025 -

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025 -

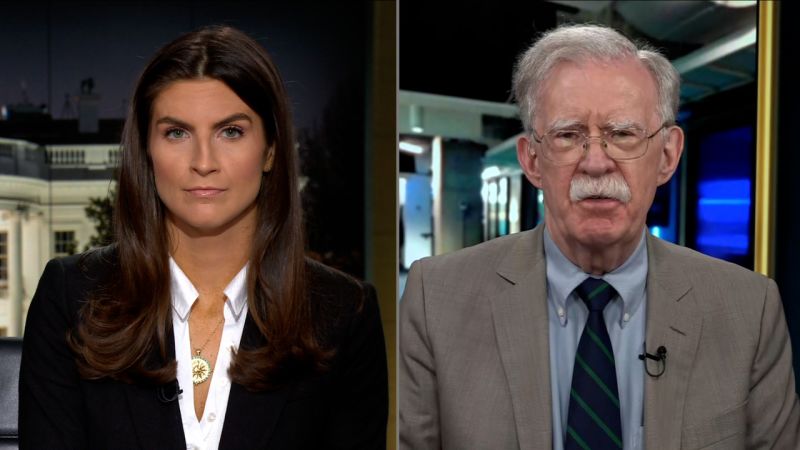

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025 -

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025 -

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025