31-Year Mortgages Become The Norm For First-Time Buyers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

31-Year Mortgages Become the Norm for First-Time Buyers: A Shifting Landscape in the Housing Market

The dream of homeownership is often intertwined with the idea of a 30-year mortgage. But a subtle shift is occurring in the housing market: 31-year mortgages are rapidly becoming the new standard, especially for first-time homebuyers. This change, driven by a combination of factors including persistent inflation and rising interest rates, presents both opportunities and challenges for aspiring homeowners.

This isn't just a minor adjustment; the extra year significantly impacts affordability and long-term financial planning. Let's delve into the reasons behind this trend and explore what it means for you.

Why the Shift to 31-Year Mortgages?

Several key factors are contributing to the rise of 31-year mortgages:

-

Affordability Crisis: Soaring home prices and interest rates have made it incredibly difficult for many to afford a home, even with a 30-year mortgage. A 31-year term lowers monthly payments, making homeownership more accessible, albeit at the cost of paying more interest overall. This is a crucial factor driving first-time buyers towards longer-term loans.

-

Increased Competition: The competitive housing market forces buyers to explore every avenue to secure a mortgage. Lenders, recognizing this, are offering 31-year mortgages as a competitive advantage to attract more clients.

-

Lender Strategies: Some lenders view 31-year mortgages as a way to increase their profits through longer-term interest payments. While ethically sound lenders prioritize responsible lending, it's important for buyers to carefully compare rates and terms across multiple institutions.

-

Inflationary Pressures: High inflation erodes the purchasing power of savings, making it harder for prospective homebuyers to save for a down payment. A longer mortgage term reduces the initial financial burden.

The Implications for First-Time Homebuyers

While the lower monthly payment of a 31-year mortgage might seem attractive, it's crucial to consider the long-term implications:

-

Increased Total Interest Paid: Extending the loan term means paying significantly more interest over the life of the loan. This can amount to tens of thousands of dollars extra compared to a 30-year mortgage.

-

Longer-Term Financial Commitment: Being locked into a mortgage for an extra year can impact other financial goals, such as saving for retirement or investing.

-

Potential for Increased Risk: Economic fluctuations and unforeseen circumstances during the longer repayment period could create financial hardship.

Before committing to a 31-year mortgage, it is crucial to:

- Shop around for the best rates: Compare offers from multiple lenders to secure the most competitive terms.

- Consult with a financial advisor: A financial professional can help you assess your financial situation and determine if a 31-year mortgage aligns with your long-term goals.

- Understand the total cost: Carefully calculate the total interest paid over the life of the loan to make an informed decision.

The Future of Mortgage Terms

The prevalence of 31-year mortgages signals a significant change in the housing market, reflecting the challenges faced by first-time buyers. Whether this trend will continue or if it's a temporary adaptation to current economic conditions remains to be seen. However, understanding the implications and making informed decisions is critical for navigating the complexities of homeownership in this evolving landscape. This underscores the need for greater financial literacy and responsible lending practices in the years to come. Staying informed about and is crucial for every potential homeowner.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified professional before making any financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 31-Year Mortgages Become The Norm For First-Time Buyers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Critics And Viewers Agree Netflixs New Series Is Utterly Addictive

Jun 04, 2025

Critics And Viewers Agree Netflixs New Series Is Utterly Addictive

Jun 04, 2025 -

Roland Garros 2025 Complete Day 8 Coverage Key Matches And Results

Jun 04, 2025

Roland Garros 2025 Complete Day 8 Coverage Key Matches And Results

Jun 04, 2025 -

Beat Rising College Costs 529 Plan Hacks For Ohio Parents

Jun 04, 2025

Beat Rising College Costs 529 Plan Hacks For Ohio Parents

Jun 04, 2025 -

Netflix Comedy Series Has Viewers In A Chokehold Demand For Season 2 Soars

Jun 04, 2025

Netflix Comedy Series Has Viewers In A Chokehold Demand For Season 2 Soars

Jun 04, 2025 -

Blake Lively Drops Lawsuit Against Justin Baldoni Details Emerge

Jun 04, 2025

Blake Lively Drops Lawsuit Against Justin Baldoni Details Emerge

Jun 04, 2025

Latest Posts

-

Joe Sacco Departs Bruins New Nhl Coaching Staff Destination Revealed

Jun 05, 2025

Joe Sacco Departs Bruins New Nhl Coaching Staff Destination Revealed

Jun 05, 2025 -

Broadcom Earnings Impact Analyst And Trader Outlook For Avgo Stock

Jun 05, 2025

Broadcom Earnings Impact Analyst And Trader Outlook For Avgo Stock

Jun 05, 2025 -

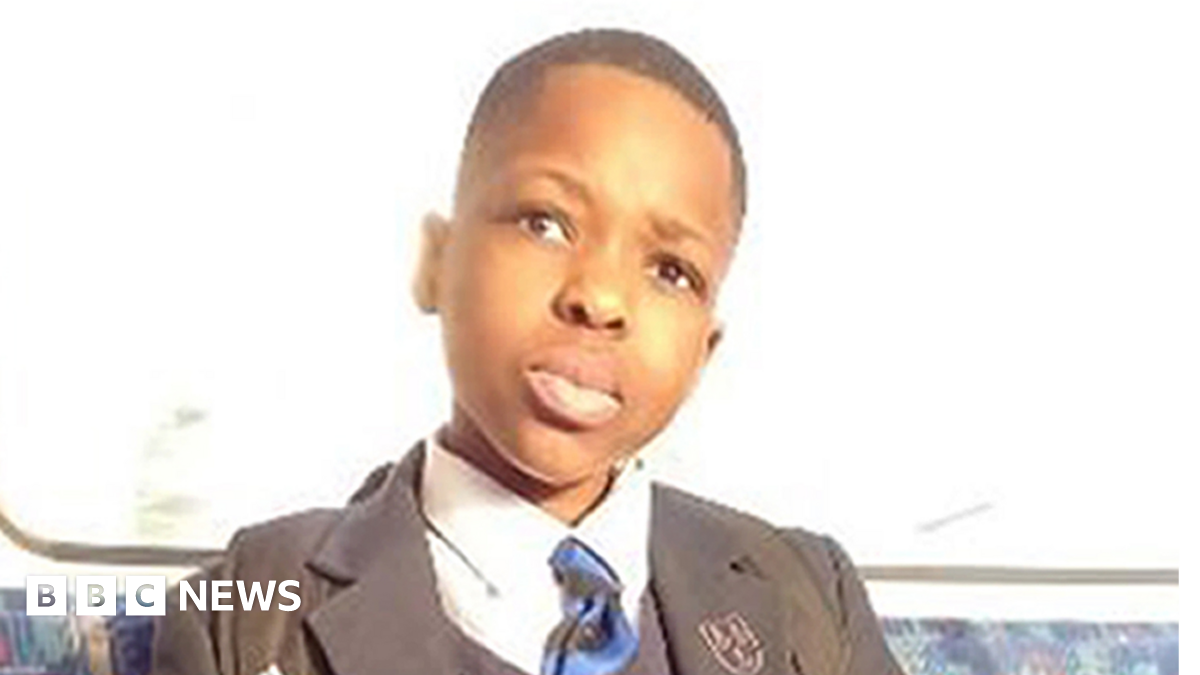

Daniel Anjorin Death Prosecution Presents Evidence Of Marcus Monzos Intent To Kill

Jun 05, 2025

Daniel Anjorin Death Prosecution Presents Evidence Of Marcus Monzos Intent To Kill

Jun 05, 2025 -

Rangers Coaching Staff Bolstered By Quinn And Sacco Appointments

Jun 05, 2025

Rangers Coaching Staff Bolstered By Quinn And Sacco Appointments

Jun 05, 2025 -

Caa Football After Villanova Conference Restructuring And Future Plans

Jun 05, 2025

Caa Football After Villanova Conference Restructuring And Future Plans

Jun 05, 2025