4 Crucial Actions To Take Now To Protect Retirement Savings From The Potential 2025 Tourism Slump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

4 Crucial Actions to Take Now to Protect Retirement Savings from the Potential 2025 Tourism Slump

The global tourism industry, a significant driver of economic growth worldwide, faces headwinds. Experts predict a potential slump in 2025, impacting various sectors, including investments tied to travel and hospitality. For retirees relying on these investments, this presents a serious concern. Don't wait until it's too late; proactive steps are crucial to safeguard your retirement savings. This article outlines four crucial actions you can take now to mitigate the potential impact of a 2025 tourism slump on your retirement nest egg.

1. Diversify Your Investment Portfolio: The Foundation of Stability

Over-reliance on any single sector, especially one as volatile as tourism, exposes your retirement savings to significant risk. A 2025 tourism slump could severely impact your returns if a large portion of your portfolio is invested in travel-related stocks, bonds, or real estate investment trusts (REITs). Diversification is key. Spread your investments across different asset classes, including:

- Stocks: Consider a mix of large-cap, mid-cap, and small-cap stocks across various sectors (technology, healthcare, consumer staples, etc.).

- Bonds: Government and corporate bonds offer a degree of stability, counterbalancing the riskier elements of your portfolio.

- Real Estate: While tourism-related real estate might be vulnerable, diversifying into residential or commercial properties in stable markets can help cushion the blow.

- Alternative Investments: Explore options like precious metals, commodities, or even ethically-sourced investments.

Remember: Consult with a qualified financial advisor to create a personalized diversification strategy that aligns with your risk tolerance and retirement goals. A well-diversified portfolio can significantly reduce your vulnerability to sector-specific downturns.

2. Reassess Your Retirement Spending Plan: Adjusting to Uncertainty

A potential tourism slump could mean lower-than-expected returns on your investments. Proactive planning is vital. Re-evaluate your retirement spending plan, considering potential scenarios:

- Conservative Budgeting: Adopt a more conservative spending approach, prioritizing essential expenses and delaying non-essential purchases.

- Emergency Fund: Ensure you have a robust emergency fund (ideally 3-6 months of living expenses) to weather unexpected financial storms.

- Contingency Planning: Develop a plan for potential income shortfalls, exploring options like part-time work or downsizing your living arrangements.

3. Explore Inflation-Protected Investments: Hedging Against Rising Prices

Inflation erodes the purchasing power of your savings. With potential economic uncertainty linked to a tourism slump, inflation could further impact your retirement income. Consider incorporating inflation-protected investments into your portfolio:

- Treasury Inflation-Protected Securities (TIPS): These government bonds adjust their principal value based on inflation, helping preserve your savings' real value.

- Inflation-Linked Annuities: These annuities offer a guaranteed income stream that adjusts for inflation.

4. Stay Informed and Adapt: The Importance of Continuous Monitoring

The economic landscape is constantly evolving. Staying informed about potential market shifts is crucial. Regularly monitor your investments and adjust your strategy as needed:

- Financial News: Keep abreast of economic news and industry trends affecting your investments.

- Professional Advice: Maintain regular communication with your financial advisor to discuss potential adjustments to your portfolio.

- Flexibility: Be prepared to adapt your retirement plan based on changing economic conditions.

Conclusion: While the potential 2025 tourism slump presents a challenge, proactive steps can significantly reduce its impact on your retirement savings. Diversification, careful spending planning, inflation-protected investments, and continuous monitoring are crucial strategies to safeguard your financial future. Don't delay; take action now to protect your retirement security. Consult with a financial professional to develop a comprehensive strategy tailored to your individual needs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 4 Crucial Actions To Take Now To Protect Retirement Savings From The Potential 2025 Tourism Slump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

U S Tourism A 23 Billion Gdp Risk And 230 000 Jobs On The Line

May 25, 2025

U S Tourism A 23 Billion Gdp Risk And 230 000 Jobs On The Line

May 25, 2025 -

My Immediate Actions After I Os 18 5 Installation A Practical Guide

May 25, 2025

My Immediate Actions After I Os 18 5 Installation A Practical Guide

May 25, 2025 -

Examining The Creation And Removal Of Black Lives Matter Plaza

May 25, 2025

Examining The Creation And Removal Of Black Lives Matter Plaza

May 25, 2025 -

Unbelievable Phillies Comeback Three Inning Rally Secures Win

May 25, 2025

Unbelievable Phillies Comeback Three Inning Rally Secures Win

May 25, 2025 -

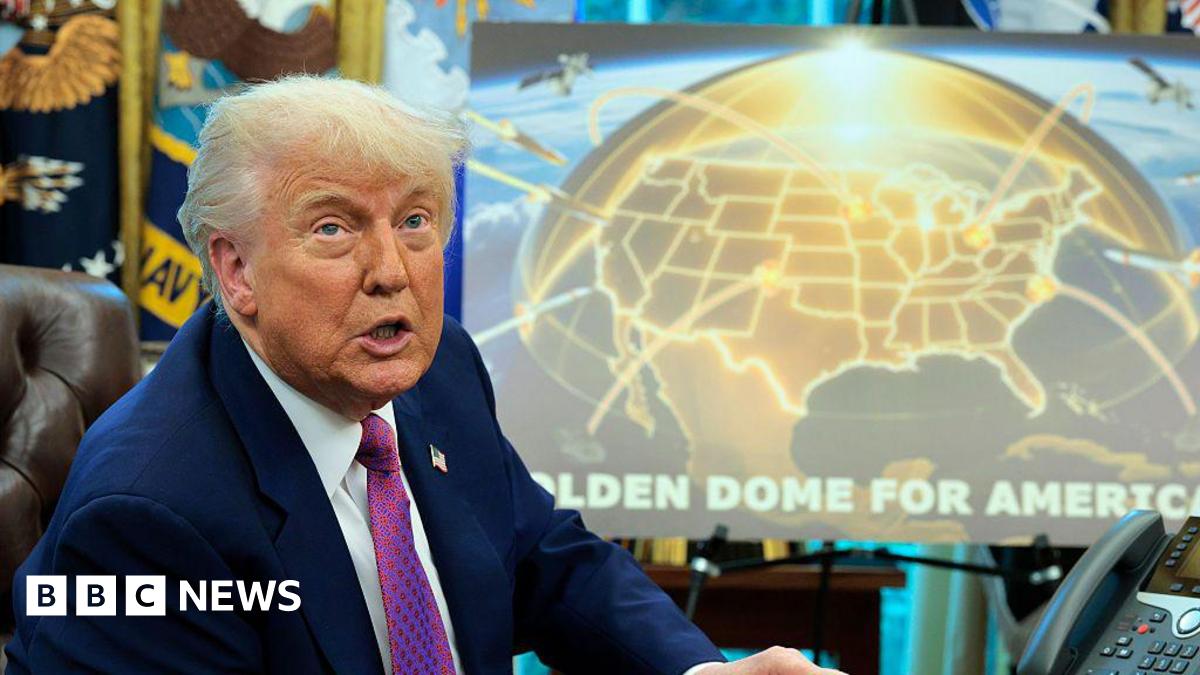

Evaluating The Viability Of Trumps Pricy Golden Dome Missile Defense

May 25, 2025

Evaluating The Viability Of Trumps Pricy Golden Dome Missile Defense

May 25, 2025

Latest Posts

-

Alcaraz Gauff And Beyond Ranking The Top Seeds For The 2025 French Open

May 25, 2025

Alcaraz Gauff And Beyond Ranking The Top Seeds For The 2025 French Open

May 25, 2025 -

Easy Passage Ex Smuggler Exposes Yacht Smuggling Route To Uk

May 25, 2025

Easy Passage Ex Smuggler Exposes Yacht Smuggling Route To Uk

May 25, 2025 -

Ocean Gate Titan Sub Implosion Sound Recorded In Released Footage

May 25, 2025

Ocean Gate Titan Sub Implosion Sound Recorded In Released Footage

May 25, 2025 -

What Happened To Black Lives Matter Plaza The Story Behind Its Demise

May 25, 2025

What Happened To Black Lives Matter Plaza The Story Behind Its Demise

May 25, 2025 -

Post Trump Tensions King Charless Crucial Canadian Moment

May 25, 2025

Post Trump Tensions King Charless Crucial Canadian Moment

May 25, 2025