$420,000 Retirement Hit: The Republican Plan's Effect On Gen X And Millennials

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$420,000 Retirement Hit: How the Republican Plan Could Devastate Gen X and Millennial Savings

The Republican Party's proposed changes to retirement savings plans are sparking outrage, with analysts predicting a potential $420,000 loss for the average Gen X and Millennial retiree. This isn't just a number; it's a potential lifetime of financial insecurity for millions. This article delves into the specifics of the proposed plan and its devastating impact on the future retirement security of two entire generations.

Understanding the Proposed Changes:

The Republican plan, while still undergoing revisions and subject to change, proposes significant alterations to several key aspects of retirement savings. These include potential cuts to:

-

Social Security Benefits: Reductions in Social Security payouts are frequently mentioned in various Republican proposals, drastically impacting those relying on this crucial income stream during retirement. This alone could represent a substantial loss for many Gen X and Millennial retirees.

-

Tax Advantages for Retirement Accounts: Changes to tax deductions or contributions limits for 401(k)s and IRAs could severely limit the amount individuals can save for retirement, further compounding the financial burden.

-

Government Matching Contributions: Many retirement plans rely on government matching contributions to incentivize savings. Reductions or eliminations of these programs would disproportionately affect younger generations who haven't yet had the time to amass significant savings.

The $420,000 Figure: A Realistic Projection?

The alarming $420,000 figure isn't plucked from thin air. Financial analysts at [cite reputable financial institution or analysis] have modeled the potential impact of these proposed changes, considering factors like reduced savings, lower investment returns, and decreased Social Security benefits. Their projections indicate a significant shortfall for those currently in their 30s, 40s, and 50s – the core of Gen X and Millennial generations.

Why Gen X and Millennials are Particularly Vulnerable:

Several factors contribute to the disproportionate impact on Gen X and Millennials:

-

Student Loan Debt: Higher education costs have saddled many with crippling student loan debt, leaving less disposable income for retirement savings.

-

Stagnant Wages: Wage growth has not kept pace with inflation for many years, making it harder to save effectively.

-

Housing Costs: Soaring housing costs in many areas consume a significant portion of income, leaving little left for retirement planning.

What Can Gen X and Millennials Do?

The situation is serious, but not hopeless. Here are some steps individuals can take to mitigate the potential impact:

-

Maximize Retirement Contributions: Contribute the maximum allowable amount to your 401(k) and IRA accounts, taking advantage of any employer matching programs.

-

Diversify Investments: Spread your investments across various asset classes to reduce risk.

-

Seek Financial Advice: Consult with a financial advisor to develop a personalized retirement plan.

-

Advocate for Change: Contact your elected officials and voice your concerns about the proposed changes to retirement plans.

Conclusion:

The potential $420,000 retirement hit is a wake-up call. The Republican plan's proposed changes pose a grave threat to the financial security of Gen X and Millennials. Understanding the potential consequences and taking proactive steps to protect your future is crucial. The time to act is now. Learn more about the specifics of the plan and how to advocate for your financial future by visiting [link to a relevant government website or advocacy group].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $420,000 Retirement Hit: The Republican Plan's Effect On Gen X And Millennials. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sean Combs Trial Crucial Forensic Video Evidence Unveiled

Jun 05, 2025

Sean Combs Trial Crucial Forensic Video Evidence Unveiled

Jun 05, 2025 -

Broadcom Avgo Stock Post Earnings Price Predictions From Traders

Jun 05, 2025

Broadcom Avgo Stock Post Earnings Price Predictions From Traders

Jun 05, 2025 -

Confirmed Paige De Sorbo Leaving Summer House After 7 Seasons

Jun 05, 2025

Confirmed Paige De Sorbo Leaving Summer House After 7 Seasons

Jun 05, 2025 -

African Dust And Canadian Wildfire Smoke To Converge Over Southern States

Jun 05, 2025

African Dust And Canadian Wildfire Smoke To Converge Over Southern States

Jun 05, 2025 -

Ohio Woman Wins Supreme Court Case A Victory Against Workplace Discrimination

Jun 05, 2025

Ohio Woman Wins Supreme Court Case A Victory Against Workplace Discrimination

Jun 05, 2025

Latest Posts

-

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025 -

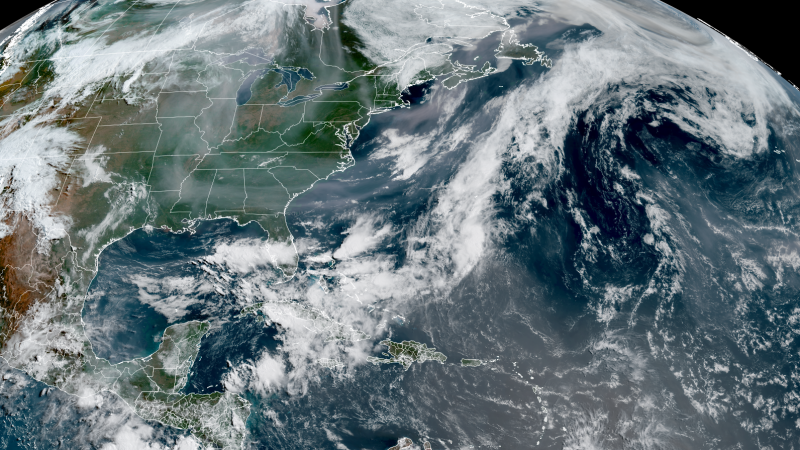

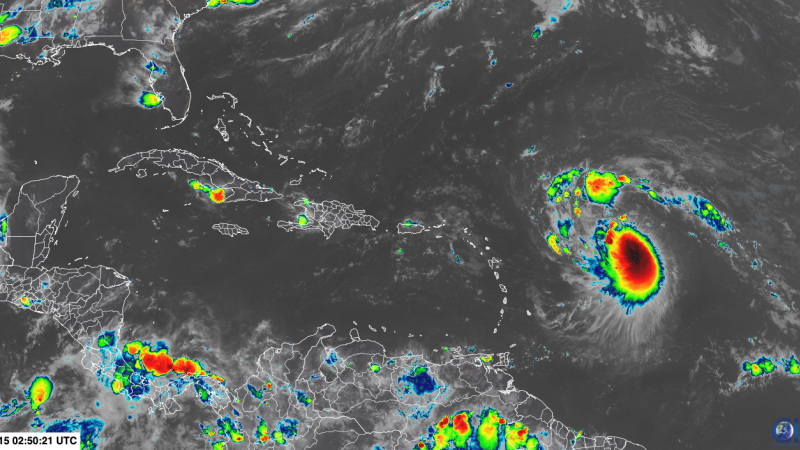

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025 -

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025 -

And Just Like That Highs Lows And Lasting Impressions

Aug 17, 2025

And Just Like That Highs Lows And Lasting Impressions

Aug 17, 2025 -

Nba And Nbpa Consider Regulations For Player Prop Betting Markets

Aug 17, 2025

Nba And Nbpa Consider Regulations For Player Prop Betting Markets

Aug 17, 2025