$420,000 Retirement Loss: Understanding The New GOP Plan's Effects On Young Adults

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$420,000 Retirement Loss: How the GOP Plan Could Devastate Young Adults' Financial Futures

The proposed GOP retirement plan has sent shockwaves through the financial community, particularly amongst young adults. Early projections suggest that the average young worker could lose a staggering $420,000 in retirement savings under this plan. This isn't just a statistic; it's a potential life-altering blow to financial security for millions. Let's delve into the specifics and understand the potential ramifications.

Understanding the Proposed Changes

The core of the concern lies in the proposed changes to [mention specific aspects of the GOP plan, e.g., 401(k) contribution limits, tax deductions for retirement savings, etc.]. These alterations, while potentially beneficial for certain demographics, are predicted to disproportionately impact younger workers who are just beginning to build their retirement nest eggs.

The $420,000 Figure: How Did We Get Here?

This significant figure – the potential $420,000 loss – is not plucked from thin air. Independent analyses [cite sources here, linking to reputable financial news outlets or research papers] have modeled the impact of the proposed changes on various age groups and income brackets. These models take into account factors like:

- Reduced contribution limits: Lower contribution caps directly limit the amount individuals can save annually.

- Tax implications: Changes in tax deductions or credits associated with retirement savings can significantly reduce the overall return on investment.

- Impact of compound interest: The power of compound interest is crucial for long-term retirement planning. Even small reductions in contributions early in a career can have a massive impact over decades.

Who is Most Affected?

The projected $420,000 loss most acutely affects:

- Millennials and Gen Z: These generations are already facing significant financial headwinds, including student loan debt and a competitive housing market. A reduction in retirement savings only exacerbates these challenges.

- Lower-income earners: Those with lower incomes may find it harder to adjust to the proposed changes, potentially widening the wealth gap.

- Self-employed individuals: Individuals who rely on self-directed retirement plans may be particularly vulnerable to the proposed alterations.

What Can Young Adults Do?

While the proposed plan presents significant challenges, young adults are not powerless. Here are some steps they can take:

- Maximize current contributions: Contribute the maximum allowable amount to retirement accounts, even with the potential limitations.

- Diversify investments: Spread investments across different asset classes to mitigate risk.

- Seek professional financial advice: A financial advisor can help navigate the complexities of retirement planning in this evolving landscape.

- Advocate for change: Contact your elected officials and voice your concerns about the potential impact of this plan on young adults. [Link to a relevant advocacy group or website here.]

Looking Ahead: Uncertainty and the Need for Transparency

The long-term consequences of this proposed plan remain uncertain. Transparency and open discussion are crucial to ensure that the voices of young adults – the generation who will bear the brunt of these changes – are heard. The potential $420,000 retirement loss highlights the urgent need for a retirement plan that is equitable and supports the financial security of all Americans, regardless of age or income. This is not just about numbers; it's about the future security and well-being of millions.

Call to Action: Stay informed about the ongoing debates surrounding retirement plans and advocate for policies that benefit all generations. Learn more about financial planning strategies and resources available to young adults at [link to a relevant resource, e.g., government website or reputable financial planning site].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $420,000 Retirement Loss: Understanding The New GOP Plan's Effects On Young Adults. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Glastonbury 2025 Lineup Complete Stage Times And Unannounced Acts

Jun 05, 2025

Glastonbury 2025 Lineup Complete Stage Times And Unannounced Acts

Jun 05, 2025 -

2026 Patriot League Football Villanova Wildcats Officially Join As Associate Member

Jun 05, 2025

2026 Patriot League Football Villanova Wildcats Officially Join As Associate Member

Jun 05, 2025 -

Paige De Sorbos Summer House Era Ends Official Statement

Jun 05, 2025

Paige De Sorbos Summer House Era Ends Official Statement

Jun 05, 2025 -

Sinner Vs Alcaraz A Tennis Legends Prediction On Their Long Term Success

Jun 05, 2025

Sinner Vs Alcaraz A Tennis Legends Prediction On Their Long Term Success

Jun 05, 2025 -

Are Tariffs Hurting American Consumers Dollar Generals Unexpected Rise

Jun 05, 2025

Are Tariffs Hurting American Consumers Dollar Generals Unexpected Rise

Jun 05, 2025

Latest Posts

-

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025 -

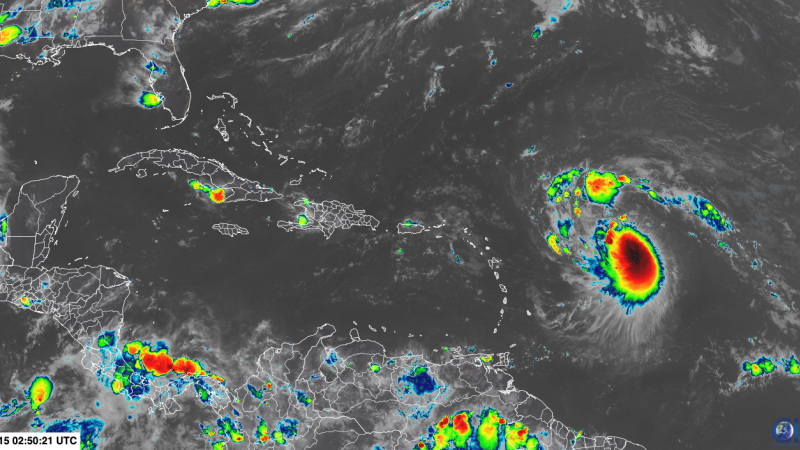

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025 -

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025 -

And Just Like That Highs Lows And Lasting Impressions

Aug 17, 2025

And Just Like That Highs Lows And Lasting Impressions

Aug 17, 2025 -

Nba And Nbpa Consider Regulations For Player Prop Betting Markets

Aug 17, 2025

Nba And Nbpa Consider Regulations For Player Prop Betting Markets

Aug 17, 2025