$5B+ Poured Into Bitcoin ETFs: Understanding The Bold Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Decoding the Bold Investment Strategy

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) in a recent surge, signifying a significant shift in institutional and individual investor sentiment. This unprecedented influx begs the question: what's driving this bold investment strategy, and what does it mean for the future of Bitcoin and the broader crypto market?

This massive investment isn't just a fleeting trend; it represents a growing confidence in Bitcoin's long-term viability as a store of value and a potential hedge against inflation. Let's delve into the key factors fueling this dramatic increase in Bitcoin ETF investment.

Why the Rush into Bitcoin ETFs?

Several factors contribute to this surge in Bitcoin ETF investment:

-

Regulatory Approvals: The recent approval of several Bitcoin ETFs in major markets, such as the United States, has dramatically increased accessibility for investors. This regulatory green light has legitimized Bitcoin in the eyes of many, reducing perceived risk and attracting institutional capital. The SEC's approval, in particular, marked a significant turning point.

-

Institutional Adoption: Large financial institutions are increasingly incorporating Bitcoin into their portfolios. This institutional adoption provides a crucial stamp of approval, boosting confidence and driving further investment. The diversification benefits and potential for high returns are key drivers for these large players.

-

Inflation Hedge: With persistent inflation in many global economies, investors are seeking alternative assets to protect their wealth. Bitcoin, with its limited supply and decentralized nature, is viewed by many as a potential hedge against inflation, driving demand for exposure through ETFs.

-

Ease of Access: Bitcoin ETFs provide a relatively straightforward and regulated way for investors to gain exposure to Bitcoin without the complexities of directly holding and managing the cryptocurrency. This ease of access is particularly attractive to less tech-savvy investors.

-

Growing Market Maturity: The cryptocurrency market, while still volatile, is maturing. Improved infrastructure, increased regulatory clarity, and a growing understanding of blockchain technology are all contributing to a more stable and attractive investment landscape.

What Does This Mean for the Future?

The influx of billions into Bitcoin ETFs points towards a potentially significant upward trend in Bitcoin's price. However, it's crucial to remember that the cryptocurrency market remains inherently volatile. While this investment signifies growing acceptance, it doesn't guarantee sustained growth.

Risks Associated with Bitcoin ETF Investments:

While the potential returns are significant, investors should be aware of the inherent risks:

- Market Volatility: Bitcoin's price is notoriously volatile, subject to sudden and significant fluctuations.

- Regulatory Uncertainty: While regulatory approval has increased, the regulatory landscape remains fluid and subject to change.

- Security Risks: While ETFs mitigate some risks associated with directly holding Bitcoin, security risks associated with the underlying technology still exist.

Conclusion:

The over $5 billion poured into Bitcoin ETFs marks a pivotal moment in the evolution of the cryptocurrency market. This surge highlights growing institutional confidence, increased regulatory acceptance, and a broader recognition of Bitcoin's potential as a valuable asset. However, investors should approach this market with caution, understanding the associated risks and conducting thorough research before investing. For further information on investment strategies, consult a qualified financial advisor. Staying informed about the latest developments in the crypto space is crucial for making informed decisions. Are you considering adding Bitcoin ETFs to your portfolio? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: Understanding The Bold Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Data Breach At M And S And Co Op What The Bbc Learned From Hackers

May 20, 2025

Data Breach At M And S And Co Op What The Bbc Learned From Hackers

May 20, 2025 -

Jon Jones Retirement Speculation Intensifies After Cryptic I M Done Tweet

May 20, 2025

Jon Jones Retirement Speculation Intensifies After Cryptic I M Done Tweet

May 20, 2025 -

New Rules Target Buy Now Pay Later Risks Increased Consumer Safeguards

May 20, 2025

New Rules Target Buy Now Pay Later Risks Increased Consumer Safeguards

May 20, 2025 -

Dallas Fort Worth Tornado Watch Expiry Latest Weather Reports

May 20, 2025

Dallas Fort Worth Tornado Watch Expiry Latest Weather Reports

May 20, 2025 -

Russia Ukraine Conflict Trump Intervenes Peace Talks To Begin

May 20, 2025

Russia Ukraine Conflict Trump Intervenes Peace Talks To Begin

May 20, 2025

Latest Posts

-

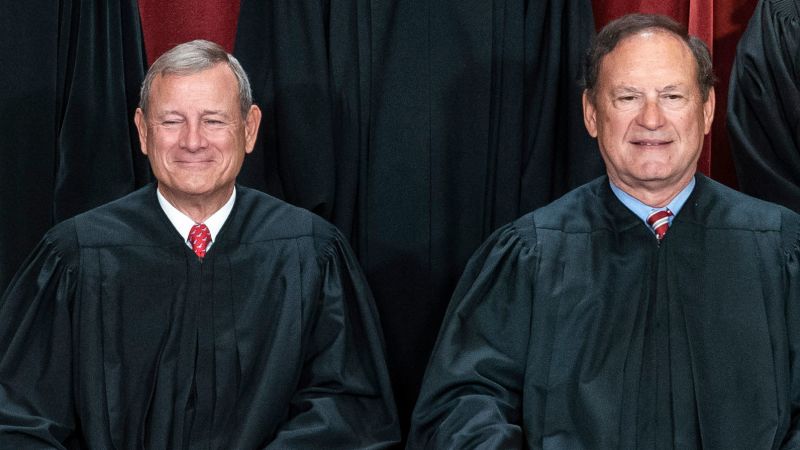

Supreme Court Justices Alito And Roberts A Look Back At Their Tenures

May 21, 2025

Supreme Court Justices Alito And Roberts A Look Back At Their Tenures

May 21, 2025 -

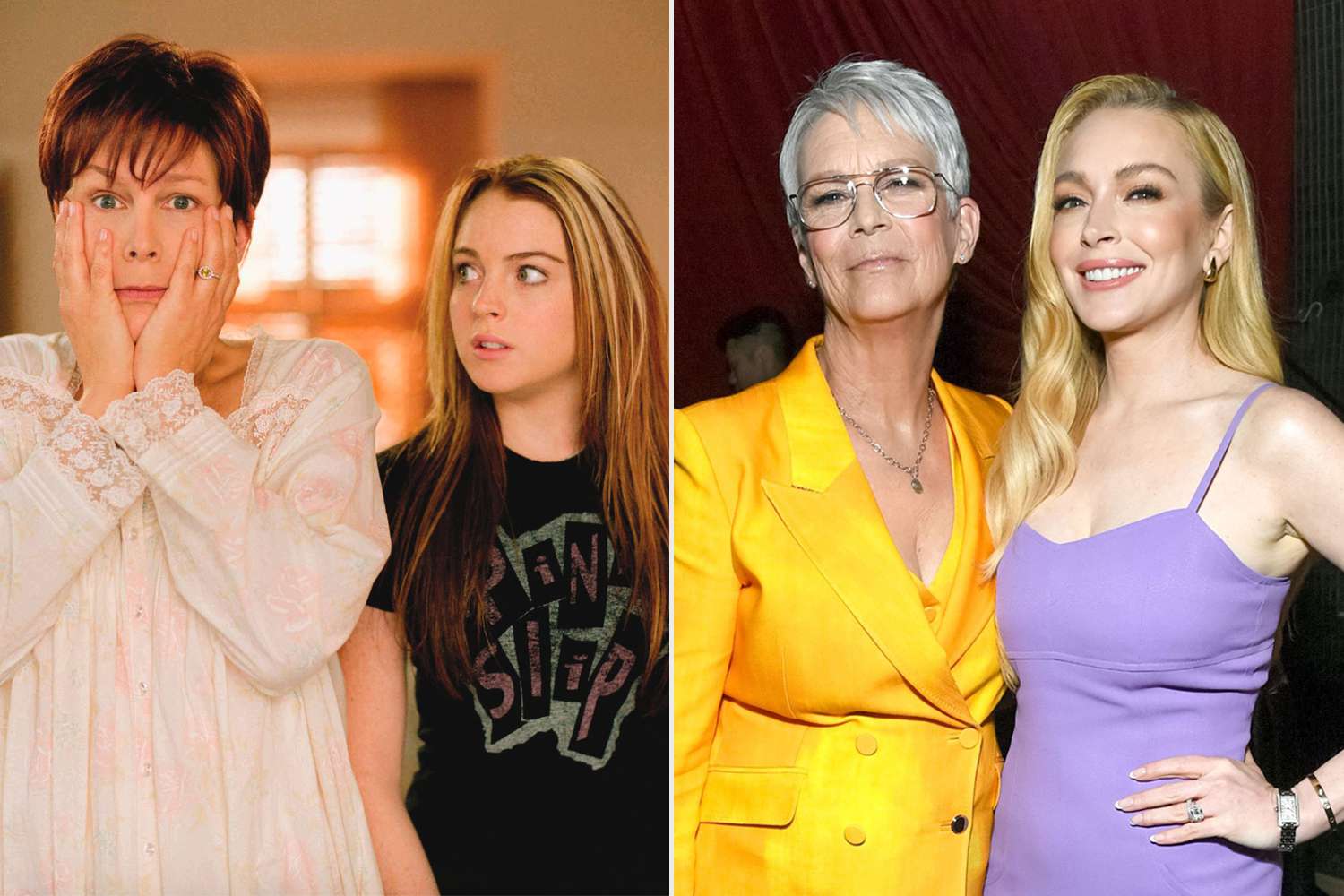

Exclusive Jamie Lee Curtis On Maintaining Her Relationship With Lindsay Lohan

May 21, 2025

Exclusive Jamie Lee Curtis On Maintaining Her Relationship With Lindsay Lohan

May 21, 2025 -

New Discoveries Understanding The Pachyrhinosaurus Mass Grave In Canada

May 21, 2025

New Discoveries Understanding The Pachyrhinosaurus Mass Grave In Canada

May 21, 2025 -

World War I Epic Starring Daniel Craig Cillian Murphy And Tom Hardy Now Streaming

May 21, 2025

World War I Epic Starring Daniel Craig Cillian Murphy And Tom Hardy Now Streaming

May 21, 2025