$5B+ Poured Into Bitcoin ETFs: Understanding The Investor Confidence

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: A Surge in Investor Confidence?

The cryptocurrency market is buzzing. Over $5 billion has flowed into Bitcoin exchange-traded funds (ETFs) in recent months, marking a significant surge in investor confidence and signaling a potential shift in the broader financial landscape. This influx of capital represents a monumental leap for Bitcoin's mainstream adoption and begs the question: what's driving this unprecedented investment?

This article delves into the factors fueling this massive investment in Bitcoin ETFs, examining the evolving regulatory landscape, the growing institutional interest, and the potential implications for the future of cryptocurrency.

The Regulatory Landscape: A Key Catalyst

The approval of the first Bitcoin futures ETF in the US in 2021 paved the way for increased institutional participation. This initial step, though limited to futures contracts rather than direct Bitcoin holdings, demonstrated a willingness from regulators to embrace cryptocurrencies within the traditional financial system. The ongoing consideration of spot Bitcoin ETFs by regulatory bodies like the Securities and Exchange Commission (SEC) further fuels investor optimism. A potential approval could unlock even greater inflows, potentially leading to a significant price increase for Bitcoin. [Link to SEC website regarding ETF applications]

Institutional Investors Embrace Bitcoin

Beyond regulatory developments, the surge in Bitcoin ETF investment reflects a growing acceptance of Bitcoin among institutional investors. Hedge funds, asset management firms, and even pension funds are increasingly allocating a portion of their portfolios to Bitcoin, recognizing its potential as a store of value and a hedge against inflation. This institutional interest lends credibility and stability to the asset class, attracting a wider range of investors.

Diversification and Inflation Hedge

Many investors view Bitcoin as a diversifier within a broader investment portfolio. Its performance often shows a low correlation with traditional assets like stocks and bonds, meaning it can help mitigate portfolio risk during market downturns. Furthermore, Bitcoin's limited supply and decentralized nature position it as a potential hedge against inflation, a factor driving significant investment in recent years, particularly amidst global economic uncertainty.

Understanding the Risks:

While the influx of capital into Bitcoin ETFs is undeniably significant, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments. Bitcoin's price is notoriously volatile, subject to rapid and unpredictable swings. Investors should conduct thorough research and only invest what they can afford to lose. [Link to resource on cryptocurrency risk management]

The Future of Bitcoin ETFs:

The sustained inflow of capital into Bitcoin ETFs suggests a growing belief in Bitcoin's long-term potential. The ongoing regulatory discussions and the increasing institutional interest are pivotal factors driving this trend. However, the cryptocurrency market remains inherently volatile, and future price movements will depend on numerous factors, including regulatory developments, broader market sentiment, and technological advancements within the Bitcoin ecosystem.

Call to Action: Stay informed about the evolving regulatory landscape and market trends to make informed investment decisions. Consider consulting with a financial advisor before investing in any cryptocurrency.

This continued investment into Bitcoin ETFs demonstrates a powerful shift in investor sentiment. As the regulatory environment evolves and institutional adoption grows, the future of Bitcoin – and its ETFs – remains a compelling story to follow.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: Understanding The Investor Confidence. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Market Rally Continues S And P 500 Six Day Win Streak Positive Momentum For Dow And Nasdaq

May 20, 2025

Market Rally Continues S And P 500 Six Day Win Streak Positive Momentum For Dow And Nasdaq

May 20, 2025 -

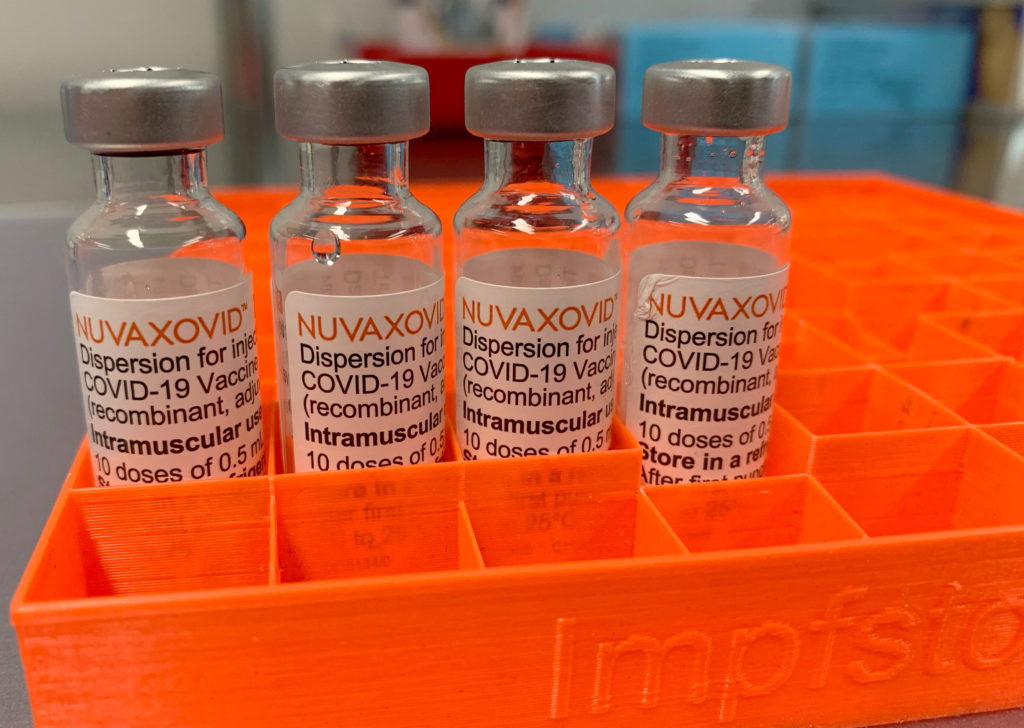

Conditional Fda Approval Novavax Covid 19 Vaccines Restricted Use Explained

May 20, 2025

Conditional Fda Approval Novavax Covid 19 Vaccines Restricted Use Explained

May 20, 2025 -

Lufthansa Plane Flies Without Pilot For 10 Minutes Following Co Pilots Collapse

May 20, 2025

Lufthansa Plane Flies Without Pilot For 10 Minutes Following Co Pilots Collapse

May 20, 2025 -

Two Adults Dead Children Injured After Train Hits Family On Bridge

May 20, 2025

Two Adults Dead Children Injured After Train Hits Family On Bridge

May 20, 2025 -

Family Hit By Train On Bridge Two Fatalities Childrens Condition Critical

May 20, 2025

Family Hit By Train On Bridge Two Fatalities Childrens Condition Critical

May 20, 2025

Latest Posts

-

Extinction Crisis Could Glitter Help Save Wales Water Vole Population

May 21, 2025

Extinction Crisis Could Glitter Help Save Wales Water Vole Population

May 21, 2025 -

Ufc News Jon Jones Aspinall Comments Ignite Fan Fury Strip The Duck Explained

May 21, 2025

Ufc News Jon Jones Aspinall Comments Ignite Fan Fury Strip The Duck Explained

May 21, 2025 -

Jamie Lee Curtis Discusses Her Connection With Lindsay Lohan A Candid Interview

May 21, 2025

Jamie Lee Curtis Discusses Her Connection With Lindsay Lohan A Candid Interview

May 21, 2025 -

Bbc And Gary Lineker Part Ways Analyzing The Fallout

May 21, 2025

Bbc And Gary Lineker Part Ways Analyzing The Fallout

May 21, 2025 -

St Louis Tornado Aftermath Community Resilience Shines

May 21, 2025

St Louis Tornado Aftermath Community Resilience Shines

May 21, 2025