$5 Billion+ Invested: The Rise Of Bitcoin ETFs And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Invested: The Rise of Bitcoin ETFs and Future Outlook

The world of finance is buzzing. Over $5 billion has poured into Bitcoin exchange-traded funds (ETFs) since the first spot Bitcoin ETF, the ProShares Bitcoin Strategy ETF (BITO), launched in October 2021. This monumental investment signifies a significant shift in how institutional and retail investors are approaching Bitcoin, marking a watershed moment for cryptocurrency adoption and mainstream financial inclusion. But what fuels this explosive growth, and what does the future hold for Bitcoin ETFs?

The Surge in Bitcoin ETF Investment: A Multi-Factor Phenomenon

Several factors contribute to the massive influx of capital into Bitcoin ETFs:

- Increased Regulatory Clarity: The approval of the first spot Bitcoin ETF in the US, after years of regulatory uncertainty, provided a much-needed boost of confidence. This paved the way for more ETFs to enter the market, attracting a broader range of investors seeking regulated exposure to Bitcoin. The SEC's decision to approve several more Bitcoin futures ETFs has further fueled this growth.

- Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin through ETFs. This is driven by Bitcoin's perceived potential as a hedge against inflation and its established role as a digital asset.

- Ease of Access: ETFs offer a simple and convenient way to invest in Bitcoin, unlike directly purchasing and storing the cryptocurrency, which can be complex and risky for many investors. This accessibility is a significant driver of the surge in investment.

- Growing Retail Investor Interest: The increasing mainstream awareness of Bitcoin and its potential, coupled with the ease of access provided by ETFs, has drawn a significant number of retail investors into the market. This broader participation contributes to the overall growth in investment.

The Future of Bitcoin ETFs: Challenges and Opportunities

While the future looks bright, several challenges remain:

- Regulatory Landscape: The regulatory environment for cryptocurrencies remains fluid and subject to change. Future regulatory decisions could impact the growth and stability of the Bitcoin ETF market.

- Market Volatility: Bitcoin's inherent price volatility remains a significant risk factor for investors. While ETFs offer diversification benefits, they are not immune to the price fluctuations of the underlying asset.

- Competition: As more Bitcoin ETFs enter the market, competition will intensify, potentially leading to lower fees and increased innovation in product offerings.

Despite these challenges, the opportunities are substantial:

- Innovation: We can expect to see further innovation in Bitcoin ETF products, including actively managed ETFs and ETFs with specific investment strategies.

- Global Expansion: The success of Bitcoin ETFs in the US is likely to spur similar developments in other major markets globally, further expanding access to Bitcoin for investors worldwide.

- Increased Liquidity: The growing number of Bitcoin ETFs will contribute to increased liquidity in the Bitcoin market, making it easier for investors to buy and sell.

Conclusion: A New Era for Bitcoin Investment?

The $5 billion+ invested in Bitcoin ETFs is a powerful indicator of the growing acceptance of Bitcoin as a legitimate asset class. While challenges remain, the future of Bitcoin ETFs appears bright, promising increased accessibility, innovation, and potentially a more stable and liquid Bitcoin market. Investors should, however, carefully consider their risk tolerance and investment goals before investing in any Bitcoin ETF. Further research and consultation with a financial advisor are recommended. Stay tuned for more updates as this exciting space continues to evolve. What are your thoughts on the future of Bitcoin ETFs? Share your predictions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Invested: The Rise Of Bitcoin ETFs And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Balis Tourism Crisis A Call For International Collaboration On Safety And Responsible Travel

May 20, 2025

Balis Tourism Crisis A Call For International Collaboration On Safety And Responsible Travel

May 20, 2025 -

Longshot Favorite Journalism Claims 2025 Preakness Stakes

May 20, 2025

Longshot Favorite Journalism Claims 2025 Preakness Stakes

May 20, 2025 -

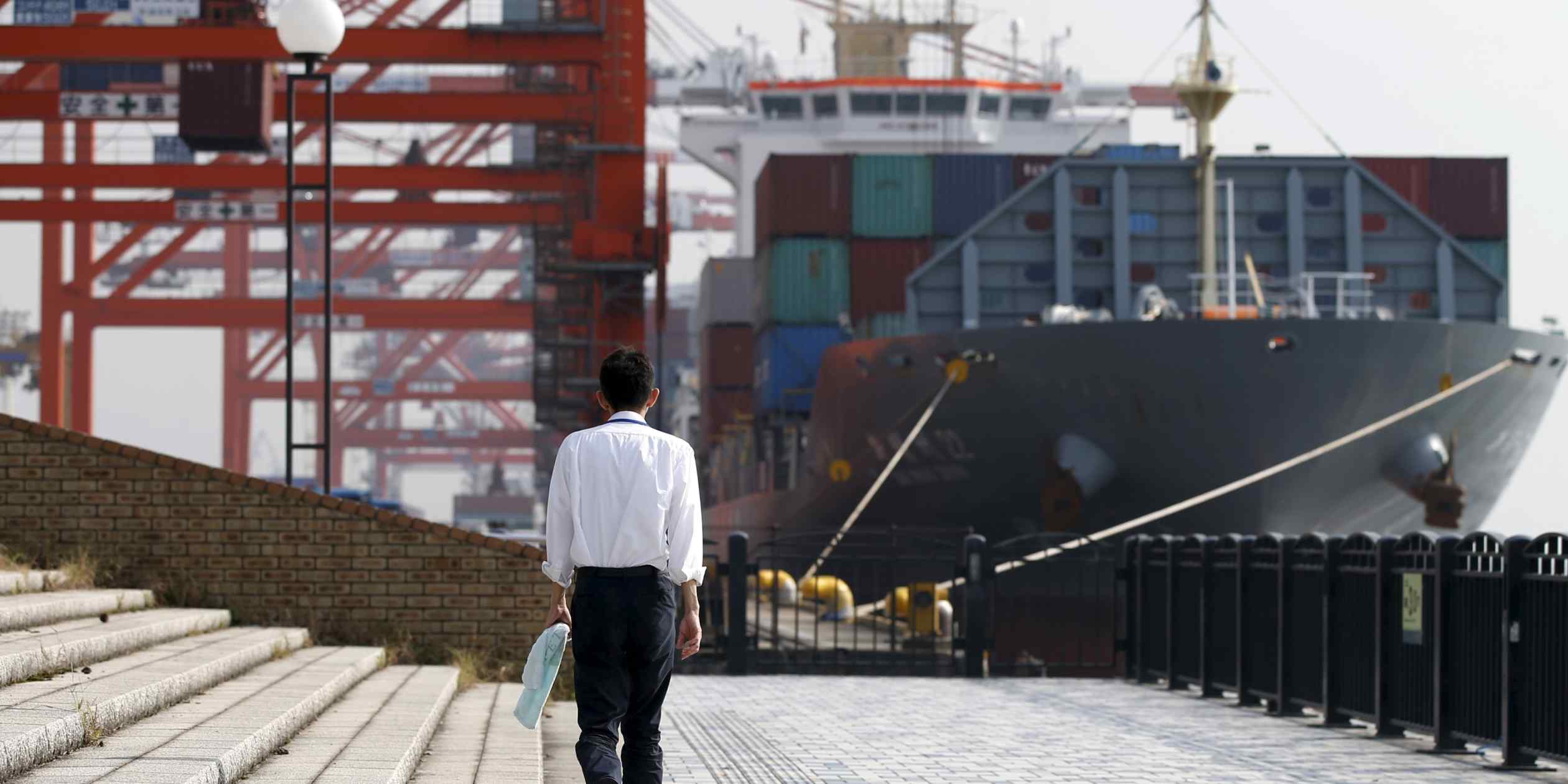

Lower Us Tariffs A Compromise Reached In Japan Us Trade Negotiations

May 20, 2025

Lower Us Tariffs A Compromise Reached In Japan Us Trade Negotiations

May 20, 2025 -

Cnn Business Exclusive A Billionaires Unique Idea Development Process

May 20, 2025

Cnn Business Exclusive A Billionaires Unique Idea Development Process

May 20, 2025 -

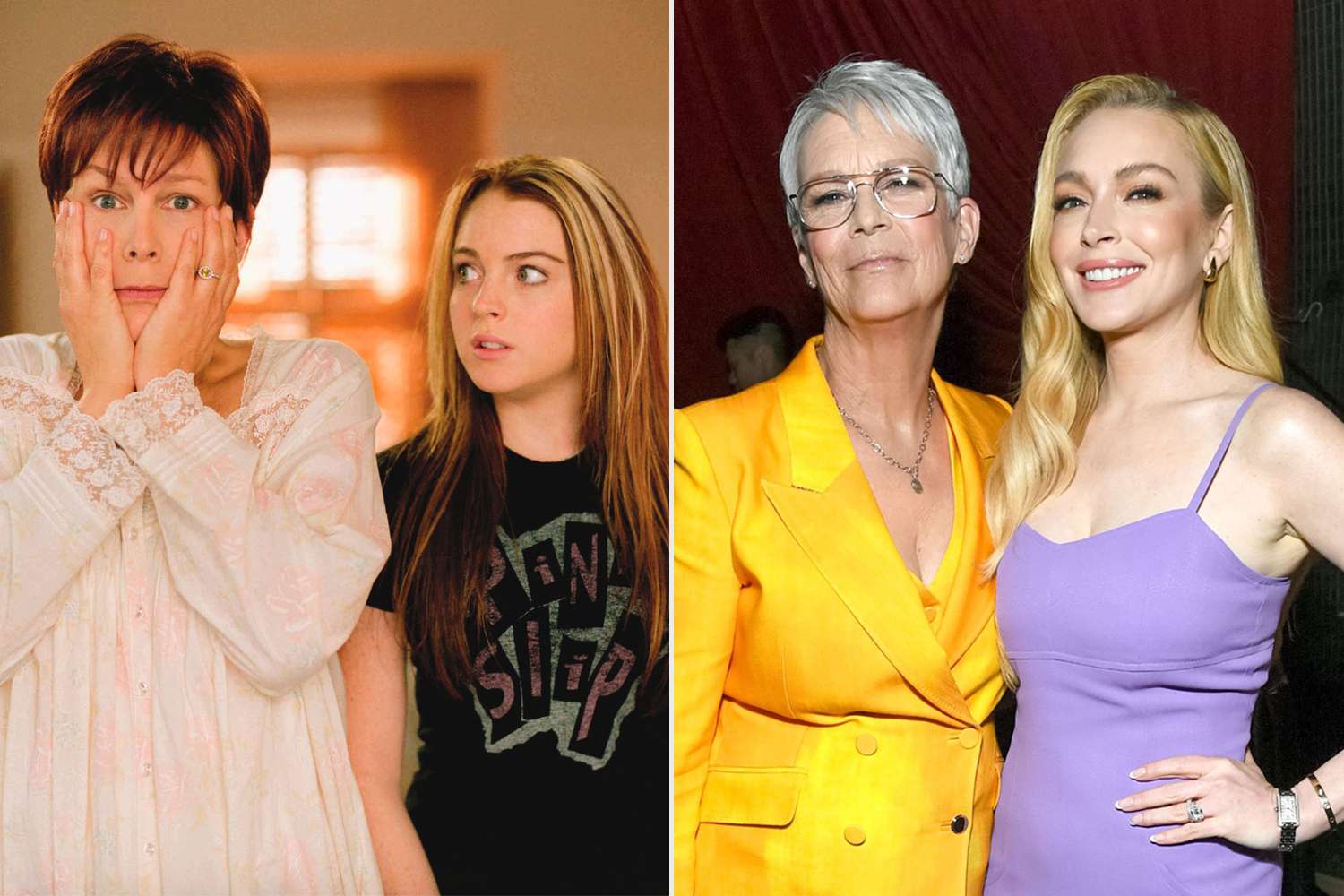

Jamie Lee Curtis And Lindsay Lohan Their Post Freaky Friday Friendship

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan Their Post Freaky Friday Friendship

May 20, 2025

Latest Posts

-

Brexit Endgame Tense Eu Negotiations Reach Critical Juncture

May 20, 2025

Brexit Endgame Tense Eu Negotiations Reach Critical Juncture

May 20, 2025 -

Joe Bidens Prostate Cancer Diagnosis Impact On Presidency And 2024 Election

May 20, 2025

Joe Bidens Prostate Cancer Diagnosis Impact On Presidency And 2024 Election

May 20, 2025 -

Watch Now Powerful Ww 1 Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch Now Powerful Ww 1 Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

Peaky Blinders Creator Reveals Plans For New Series Featuring Key Departure

May 20, 2025

Peaky Blinders Creator Reveals Plans For New Series Featuring Key Departure

May 20, 2025 -

Strip The Duck Jon Jones Controversial Aspinall Comments Ignite Fan Debate

May 20, 2025

Strip The Duck Jon Jones Controversial Aspinall Comments Ignite Fan Debate

May 20, 2025