$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Directional Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Pooled into Bitcoin ETFs: Decoding the Market's Directional Bets

The cryptocurrency market is buzzing. Over $5 billion has flowed into Bitcoin exchange-traded funds (ETFs) in recent months, signaling a significant shift in institutional investor sentiment and potentially foreshadowing further price action. This massive influx of capital raises crucial questions: What's driving this surge? What are the implications for Bitcoin's future price? And what are the risks involved? Let's delve into the details and analyze these directional bets.

The Institutional Embrace of Bitcoin ETFs

The approval of the first Bitcoin futures ETF in the US marked a watershed moment. Previously, institutional investors faced significant hurdles in directly accessing Bitcoin. ETFs, however, offer a regulated and accessible pathway, mitigating some of the risks associated with direct cryptocurrency ownership. This accessibility is a key driver behind the recent surge in investment.

- Reduced Risk and Regulatory Compliance: ETFs offer a degree of security and transparency unavailable through direct Bitcoin purchases. This is especially attractive to institutional investors who are bound by strict regulatory guidelines.

- Diversification Strategy: For many, Bitcoin ETFs are a component of a broader diversification strategy within a portfolio. They offer exposure to the cryptocurrency market without the complexities of setting up and managing a cryptocurrency wallet.

- Increased Liquidity: ETFs trade on major exchanges, offering higher liquidity compared to directly trading Bitcoin. This means investors can buy and sell their holdings more easily and efficiently.

Understanding the Directional Bets

The massive investment in Bitcoin ETFs indicates a bullish sentiment among institutional investors. They are essentially betting that the price of Bitcoin will continue to rise or at least remain stable. Several factors contribute to this bullish outlook:

- Adoption by Major Companies: The growing adoption of Bitcoin by major corporations and financial institutions lends credibility to the asset and signals increasing mainstream acceptance.

- Halving Events: Bitcoin's periodic halving events, which reduce the rate of new Bitcoin creation, are often associated with price increases due to decreased supply. The next halving is anticipated to further impact the market.

- Inflation Hedge: In times of economic uncertainty and inflation, Bitcoin is often viewed as a potential hedge against devaluation of traditional fiat currencies.

Potential Risks and Considerations

While the influx of capital into Bitcoin ETFs is largely positive, it's crucial to acknowledge the inherent risks:

- Volatility: Bitcoin is notoriously volatile, and its price can fluctuate dramatically in short periods. ETF investments are not immune to this volatility.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and future changes could impact the value of Bitcoin ETFs.

- Security Risks: While ETFs mitigate some risks, there's still the potential for security breaches affecting the underlying Bitcoin holdings.

Looking Ahead: The Future of Bitcoin ETFs

The massive investment in Bitcoin ETFs represents a significant milestone for the cryptocurrency market. It signals a growing acceptance of Bitcoin as a legitimate asset class and underscores the potential for continued growth. However, investors should proceed with caution, understanding the inherent risks associated with this asset class. Further regulatory clarity and increased adoption will be key factors shaping the future of Bitcoin ETFs and their impact on the cryptocurrency market. Stay informed and continue researching before making any investment decisions. For more in-depth analysis of the cryptocurrency market, consider exploring resources like [link to a reputable financial news source].

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency ETF, Bitcoin Investment, Institutional Investors, Bitcoin Price, Cryptocurrency Investment, Bitcoin Volatility, Crypto Regulation, Bitcoin Halving, Inflation Hedge

Call to Action (subtle): Stay tuned for further updates and analysis on the evolving cryptocurrency market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Directional Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Multiple Casualties After Train Hits Family On Bridge

May 20, 2025

Urgent Multiple Casualties After Train Hits Family On Bridge

May 20, 2025 -

Railroad Bridge Accident Two Fatalities Childrens Injuries Reported

May 20, 2025

Railroad Bridge Accident Two Fatalities Childrens Injuries Reported

May 20, 2025 -

Balancing Act The Director Of Netflixs Fall Of Favre On The Films Challenges

May 20, 2025

Balancing Act The Director Of Netflixs Fall Of Favre On The Films Challenges

May 20, 2025 -

Harsh Coaching And Body Shaming The Price An Olympic Swimmer Paid For Gold

May 20, 2025

Harsh Coaching And Body Shaming The Price An Olympic Swimmer Paid For Gold

May 20, 2025 -

Cnn On The Scene Walking Through The Destruction After The Deadly Tornado

May 20, 2025

Cnn On The Scene Walking Through The Destruction After The Deadly Tornado

May 20, 2025

Latest Posts

-

Gary Lineker Exit Fallout And Potential Replacements For Match Of The Day

May 20, 2025

Gary Lineker Exit Fallout And Potential Replacements For Match Of The Day

May 20, 2025 -

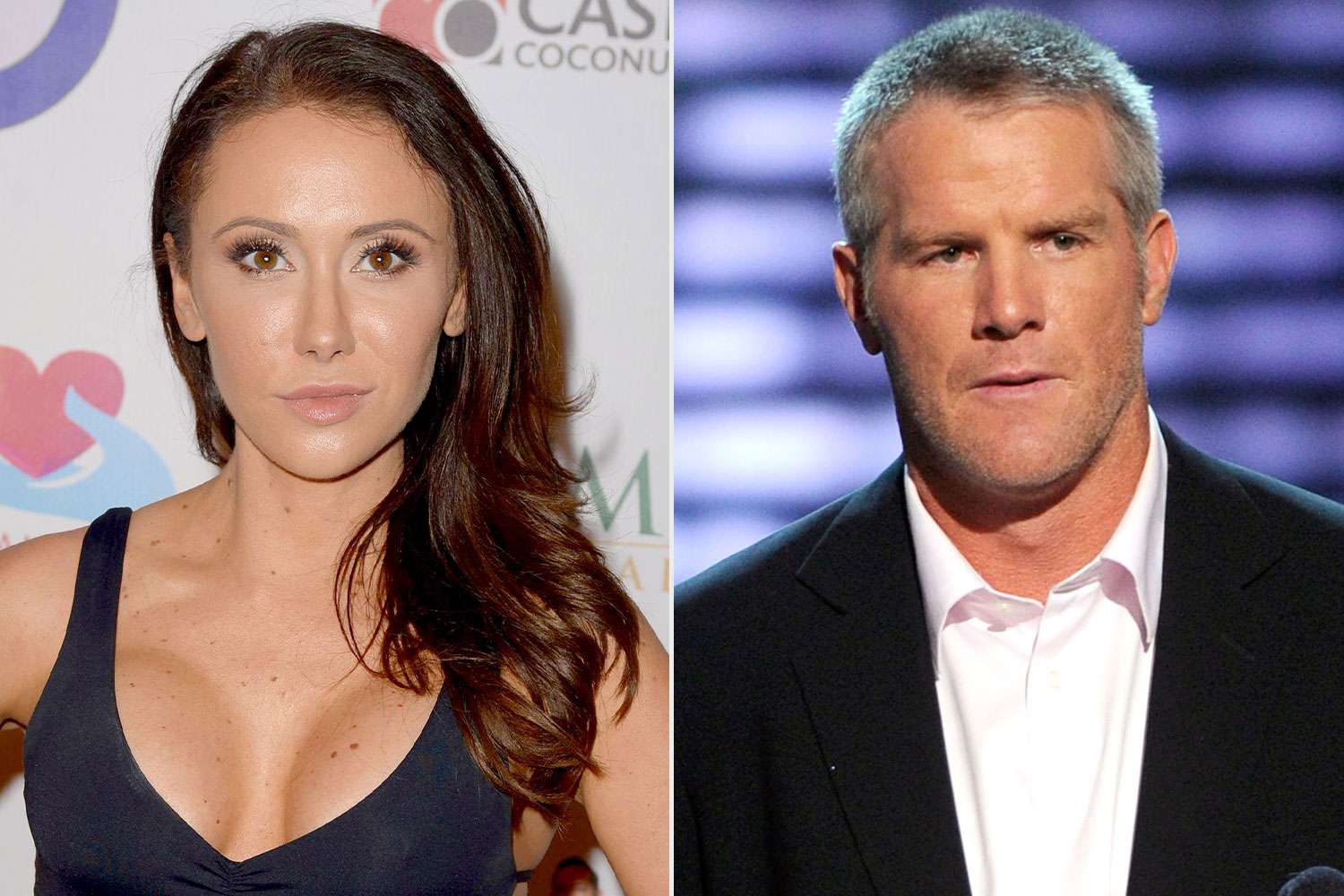

Dehumanized Jenn Sterger Details The Emotional Toll Of The Brett Favre Scandal

May 20, 2025

Dehumanized Jenn Sterger Details The Emotional Toll Of The Brett Favre Scandal

May 20, 2025 -

200 M Ethereum Fund Investment Boom Follows Successful Pectra Upgrade

May 20, 2025

200 M Ethereum Fund Investment Boom Follows Successful Pectra Upgrade

May 20, 2025 -

From Olympic Glory To Heartache A Swimmers Account Of Abuse And Body Image Issues

May 20, 2025

From Olympic Glory To Heartache A Swimmers Account Of Abuse And Body Image Issues

May 20, 2025 -

Russia Ukraine Peace Talks Trumps Immediate Action Announcement

May 20, 2025

Russia Ukraine Peace Talks Trumps Immediate Action Announcement

May 20, 2025