$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Investor Confidence

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: A Surge in Investor Confidence?

The cryptocurrency market has witnessed a significant influx of capital recently, with over $5 billion poured into Bitcoin exchange-traded funds (ETFs) in a remarkably short period. This massive investment signals a potential shift in investor sentiment, raising questions about the growing confidence in Bitcoin's long-term viability as a legitimate asset class. But what's driving this surge, and what does it mean for the future of Bitcoin and the broader crypto market?

This unprecedented investment in Bitcoin ETFs represents a major milestone. For years, institutional investors have been hesitant to directly invest in Bitcoin due to regulatory uncertainty and concerns about volatility. However, the approval of several Bitcoin ETFs in major markets has opened the floodgates, allowing a wider range of investors to gain exposure to the cryptocurrency through a more regulated and accessible vehicle.

What's fueling this investor confidence?

Several factors contribute to this recent surge in Bitcoin ETF investments:

-

Regulatory Clarity: The approval of Bitcoin ETFs by regulatory bodies like the SEC in the US signifies a growing acceptance of cryptocurrencies within the traditional financial system. This reduced regulatory uncertainty makes Bitcoin a more attractive investment for institutional players.

-

Institutional Adoption: Large financial institutions, previously hesitant, are increasingly incorporating Bitcoin into their investment strategies. This institutional adoption lends credibility and legitimacy to Bitcoin, further boosting investor confidence. BlackRock's recent application for a Bitcoin ETF is a prime example of this trend.

-

Inflation Hedge: With persistent inflation globally, investors are seeking alternative assets to protect their purchasing power. Bitcoin, often touted as a "digital gold," is viewed by many as a potential hedge against inflation.

-

Technological Advancements: The ongoing development and improvement of Bitcoin's underlying technology, including the Lightning Network for faster and cheaper transactions, enhance its functionality and appeal.

The Risks Remain:

Despite the significant investment, it's crucial to acknowledge that Bitcoin remains a volatile asset. Price fluctuations are common, and investors should be prepared for potential market downturns. Furthermore, the regulatory landscape for cryptocurrencies is still evolving, and future changes could impact the market.

Looking Ahead:

The massive investment in Bitcoin ETFs represents a significant turning point for the cryptocurrency. While the future remains uncertain, this surge in investor confidence suggests a growing acceptance of Bitcoin as a viable asset class within the broader financial market. The continued development of the crypto infrastructure and regulatory clarity will play a crucial role in shaping Bitcoin's future trajectory.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you should conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Investor Confidence. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Olympic Gold Medalist Reveals Coachs Cruel Training And Body Shaming

May 20, 2025

Olympic Gold Medalist Reveals Coachs Cruel Training And Body Shaming

May 20, 2025 -

The Last Of Us Proves Heartbreak Not Action Is Its Strength

May 20, 2025

The Last Of Us Proves Heartbreak Not Action Is Its Strength

May 20, 2025 -

Assessing The Damage St Louis Rebuilds After Unprecedented Tornado

May 20, 2025

Assessing The Damage St Louis Rebuilds After Unprecedented Tornado

May 20, 2025 -

One Factorys Struggle Unmasking The Inconsistencies In Trumps Trade Policy

May 20, 2025

One Factorys Struggle Unmasking The Inconsistencies In Trumps Trade Policy

May 20, 2025 -

Match Of The Day Host Gary Linekers Potential Bbc Exit Latest Updates

May 20, 2025

Match Of The Day Host Gary Linekers Potential Bbc Exit Latest Updates

May 20, 2025

Latest Posts

-

New Peaky Blinders Series Officially Confirmed Expect The Unexpected

May 21, 2025

New Peaky Blinders Series Officially Confirmed Expect The Unexpected

May 21, 2025 -

2027 The Year For Driverless Cars In The Uk Ubers Perspective

May 21, 2025

2027 The Year For Driverless Cars In The Uk Ubers Perspective

May 21, 2025 -

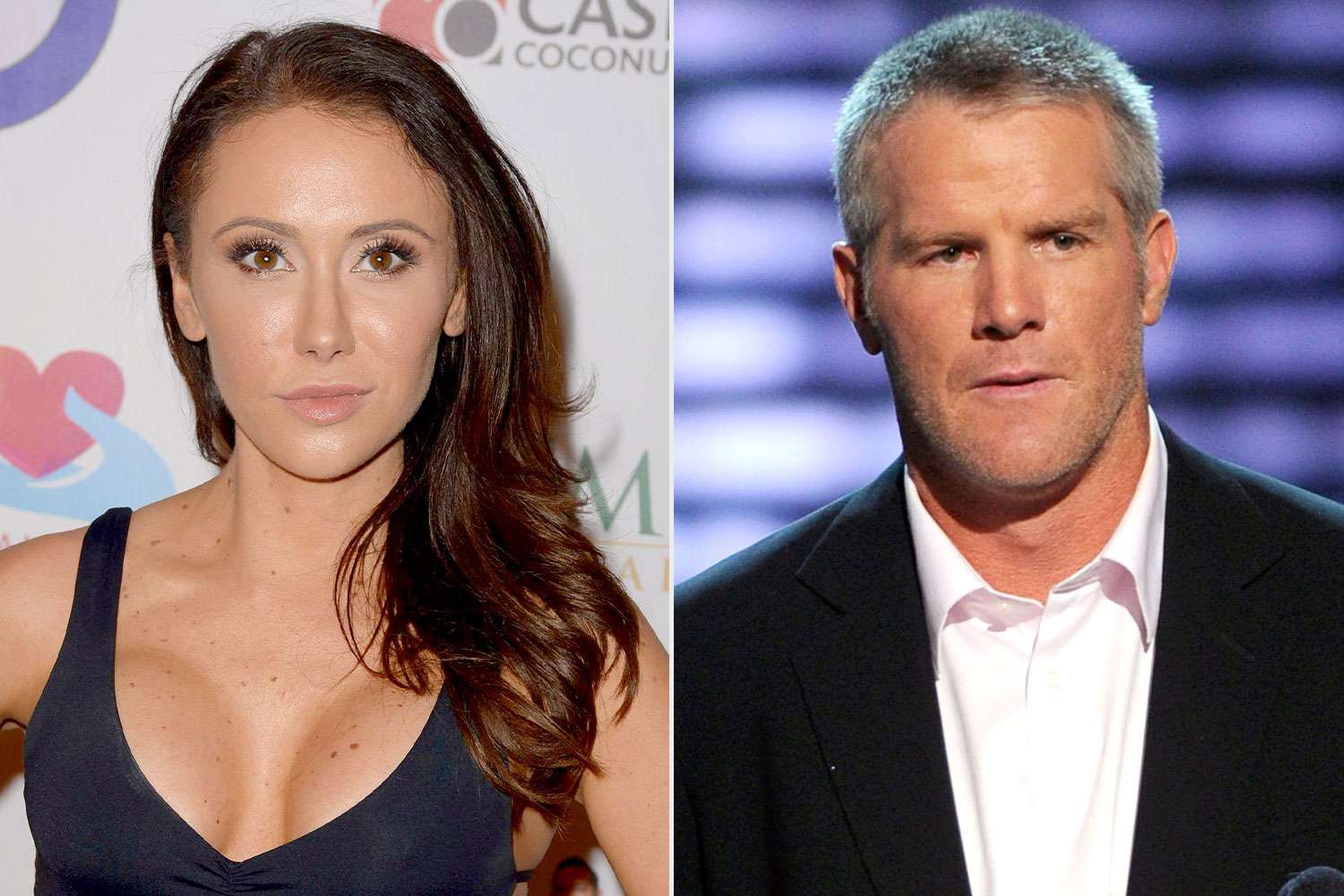

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 21, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 21, 2025 -

Femicide In The Spotlight Recent Deaths Of A Colombian Model And Mexican Influencer Ignite Public Anger

May 21, 2025

Femicide In The Spotlight Recent Deaths Of A Colombian Model And Mexican Influencer Ignite Public Anger

May 21, 2025 -

Putin Demonstrates Unnecessary Reliance On Trump

May 21, 2025

Putin Demonstrates Unnecessary Reliance On Trump

May 21, 2025