$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Recent Investment Boom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Understanding the Recent Investment Boom

The cryptocurrency market has witnessed a significant surge in investment, with over $5 billion flowing into Bitcoin exchange-traded funds (ETFs) in recent months. This unprecedented influx of capital signifies a growing institutional confidence in Bitcoin and the maturation of the cryptocurrency asset class. But what's driving this boom, and what does it mean for the future of Bitcoin?

Institutional Adoption Fuels Bitcoin ETF Growth

The recent surge in Bitcoin ETF investments is largely attributed to the increasing acceptance of Bitcoin as a legitimate asset class by institutional investors. Major financial firms are increasingly recognizing Bitcoin's potential as a hedge against inflation and a diversification tool within their portfolios. The approval of several Bitcoin ETFs by regulatory bodies, such as the SEC in the US, has played a crucial role in unlocking this institutional investment. This regulatory clarity has significantly reduced the perceived risk associated with Bitcoin investments, making it more palatable for large-scale investors.

Key Factors Driving the Investment Boom:

- Regulatory Approvals: The approval of Bitcoin ETFs by key regulatory bodies legitimizes Bitcoin as an investment asset, encouraging institutional participation.

- Inflation Hedge: With persistent inflation in many global economies, Bitcoin's limited supply and decentralized nature are seen as a potential hedge against currency devaluation.

- Diversification: Investors are increasingly seeking alternative assets to diversify their portfolios and reduce reliance on traditional markets. Bitcoin offers a unique diversification opportunity.

- Technological Advancements: Continued development of the Bitcoin network and related technologies enhance its security and efficiency, boosting investor confidence.

- Increased Institutional Interest: Major financial institutions are actively exploring and investing in Bitcoin, signaling a shift towards wider acceptance.

What Does This Mean for the Future of Bitcoin?

The massive investment in Bitcoin ETFs suggests a positive outlook for the cryptocurrency's long-term prospects. The increasing institutional adoption could lead to greater price stability and wider mainstream acceptance. However, it's crucial to remember that the cryptocurrency market remains volatile, and investors should always conduct thorough research and manage risk appropriately.

Potential Implications:

- Increased Price Volatility (Short Term): While long-term prospects are positive, short-term price fluctuations are still expected.

- Greater Mainstream Adoption: The influx of institutional capital is likely to drive greater awareness and adoption of Bitcoin among retail investors.

- Further Regulatory Scrutiny: The growing popularity of Bitcoin ETFs may lead to increased regulatory oversight and potentially stricter regulations in the future.

- Development of the Bitcoin Ecosystem: The increased investment could further fuel the development of Bitcoin-related technologies and services.

Navigating the Bitcoin ETF Landscape

For investors interested in exploring Bitcoin ETFs, it's essential to carefully consider the fees, expense ratios, and investment strategies of different funds. Comparing various ETFs and understanding their risk profiles is crucial before making any investment decisions. Remember to consult with a qualified financial advisor before investing in any cryptocurrency.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you could lose money.

Further Reading:

This article aims to provide valuable information on the recent Bitcoin ETF investment boom. By understanding the factors driving this growth and potential implications, investors can make more informed decisions about their investment strategies. Remember to always do your own research and seek professional advice before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Recent Investment Boom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rare St Louis Tornado Leaves Trail Of Destruction Community Resilience Shines

May 21, 2025

Rare St Louis Tornado Leaves Trail Of Destruction Community Resilience Shines

May 21, 2025 -

Ufc Accused By Jon Jones Of Withholding Aspinall Fight Information

May 21, 2025

Ufc Accused By Jon Jones Of Withholding Aspinall Fight Information

May 21, 2025 -

Animal Rescue Emergency Delaware Shelter Struggles To Care For Abandoned Chicks From Usps Truck

May 21, 2025

Animal Rescue Emergency Delaware Shelter Struggles To Care For Abandoned Chicks From Usps Truck

May 21, 2025 -

Olympic Champions Damning Testimony The Price Of Gold A Coachs Harsh Methods

May 21, 2025

Olympic Champions Damning Testimony The Price Of Gold A Coachs Harsh Methods

May 21, 2025 -

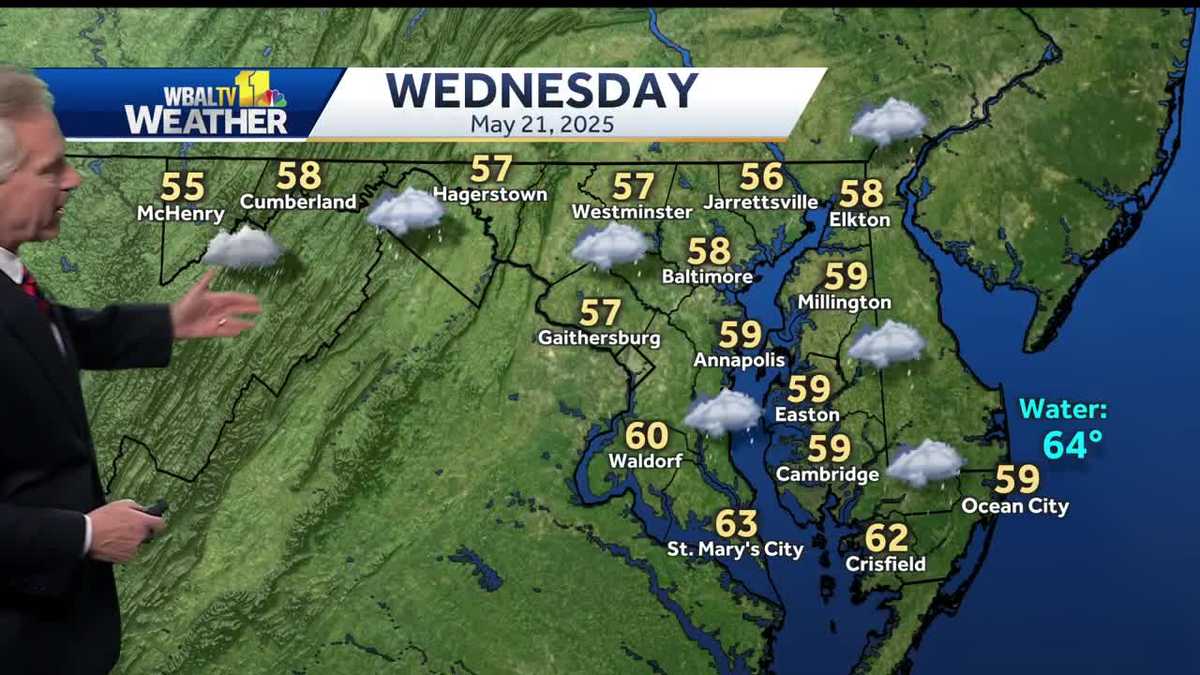

Rain And Chilly Temperatures Sweep Through Region Wednesday

May 21, 2025

Rain And Chilly Temperatures Sweep Through Region Wednesday

May 21, 2025

Latest Posts

-

Tim Dillon Cnn Interview On Politicians And Comedy

May 21, 2025

Tim Dillon Cnn Interview On Politicians And Comedy

May 21, 2025 -

Ellen De Generes Social Media Return After Loss Stirs Fan Frenzy

May 21, 2025

Ellen De Generes Social Media Return After Loss Stirs Fan Frenzy

May 21, 2025 -

Shifting Sands How The Trump Putin Call Impacts Ukraines Future

May 21, 2025

Shifting Sands How The Trump Putin Call Impacts Ukraines Future

May 21, 2025 -

Analysis Trump Putin And The Changing Landscape Of Ukraine Peace Efforts

May 21, 2025

Analysis Trump Putin And The Changing Landscape Of Ukraine Peace Efforts

May 21, 2025 -

Ingenious Or Inept Cats Prison Drug Run Ends In Capture Costa Rica

May 21, 2025

Ingenious Or Inept Cats Prison Drug Run Ends In Capture Costa Rica

May 21, 2025