$500 Million Issuer Bid: Air Canada Releases Preliminary Findings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$500 Million Issuer Bid: Air Canada Releases Preliminary Findings – What it Means for Investors

Air Canada's announcement of a preliminary $500 million issuer bid has sent ripples through the investment community. The move, unveiled [Insert Date], signals a significant strategic shift for the airline and raises several key questions for investors and analysts alike. This article delves into the preliminary findings, exploring the implications for Air Canada's future and offering insights for those interested in the company's stock.

Understanding the Issuer Bid

An issuer bid, simply put, is when a company buys back its own shares from its shareholders. Air Canada's proposed $500 million bid represents a substantial commitment to returning capital to shareholders. This type of action often indicates that the company believes its shares are undervalued in the current market. The bid is designed to reduce the number of outstanding shares, potentially increasing earnings per share (EPS) and boosting the value of the remaining shares.

Preliminary Findings: Key Highlights

While the full details of the bid are still pending, Air Canada's preliminary findings highlight several crucial aspects:

- Offer Price: The exact offer price per share hasn't yet been disclosed but will be a critical factor determining the success of the bid. Market speculation suggests a price [Insert speculated price range or reference to official statements if available].

- Timeline: The timeline for the bid's completion is crucial. Air Canada has indicated [Insert timeframe from official statements if available], with further updates expected in the coming weeks.

- Strategic Rationale: Air Canada likely sees this as a strategic move to improve shareholder returns and potentially signal confidence in the company's long-term prospects. This is especially important given the industry's recent challenges and recovery from the pandemic.

Implications for Investors

The $500 million issuer bid carries significant implications for Air Canada investors:

- Increased Share Value: A successful bid could lead to an increase in the share price due to reduced supply and potentially improved EPS.

- Return of Capital: For shareholders who tender their shares, this represents a direct return of capital.

- Signal of Confidence: The bid might be interpreted as a vote of confidence from management in the company's future performance.

However, there are also potential downsides:

- Opportunity Cost: The capital used for the buyback could have been used for other potentially lucrative investments, such as fleet expansion or technology upgrades.

- Market Conditions: The success of the bid will depend heavily on market conditions and investor sentiment.

Looking Ahead: What to Expect

The coming weeks will be crucial for Air Canada and its investors. The official announcement of the offer price and the detailed terms of the bid will provide further clarity. Investors should closely monitor these developments and consider consulting with their financial advisors before making any investment decisions. The complete details of the bid, including the acceptance period and other terms, will be available in the official offering documents.

Keywords: Air Canada, issuer bid, stock buyback, $500 million, investor, shares, stock price, EPS, earnings per share, shareholder return, market conditions, investment, airline industry, financial news.

Call to Action (subtle): Stay tuned to our website for further updates on this developing story and other important financial news. [Link to relevant section of your website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $500 Million Issuer Bid: Air Canada Releases Preliminary Findings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kennedy Cassidy Dispute A Clash Over Vaccine Panel Information

Jun 27, 2025

Kennedy Cassidy Dispute A Clash Over Vaccine Panel Information

Jun 27, 2025 -

Did Putin Offer Trump Help With Iran A Cnn Report

Jun 27, 2025

Did Putin Offer Trump Help With Iran A Cnn Report

Jun 27, 2025 -

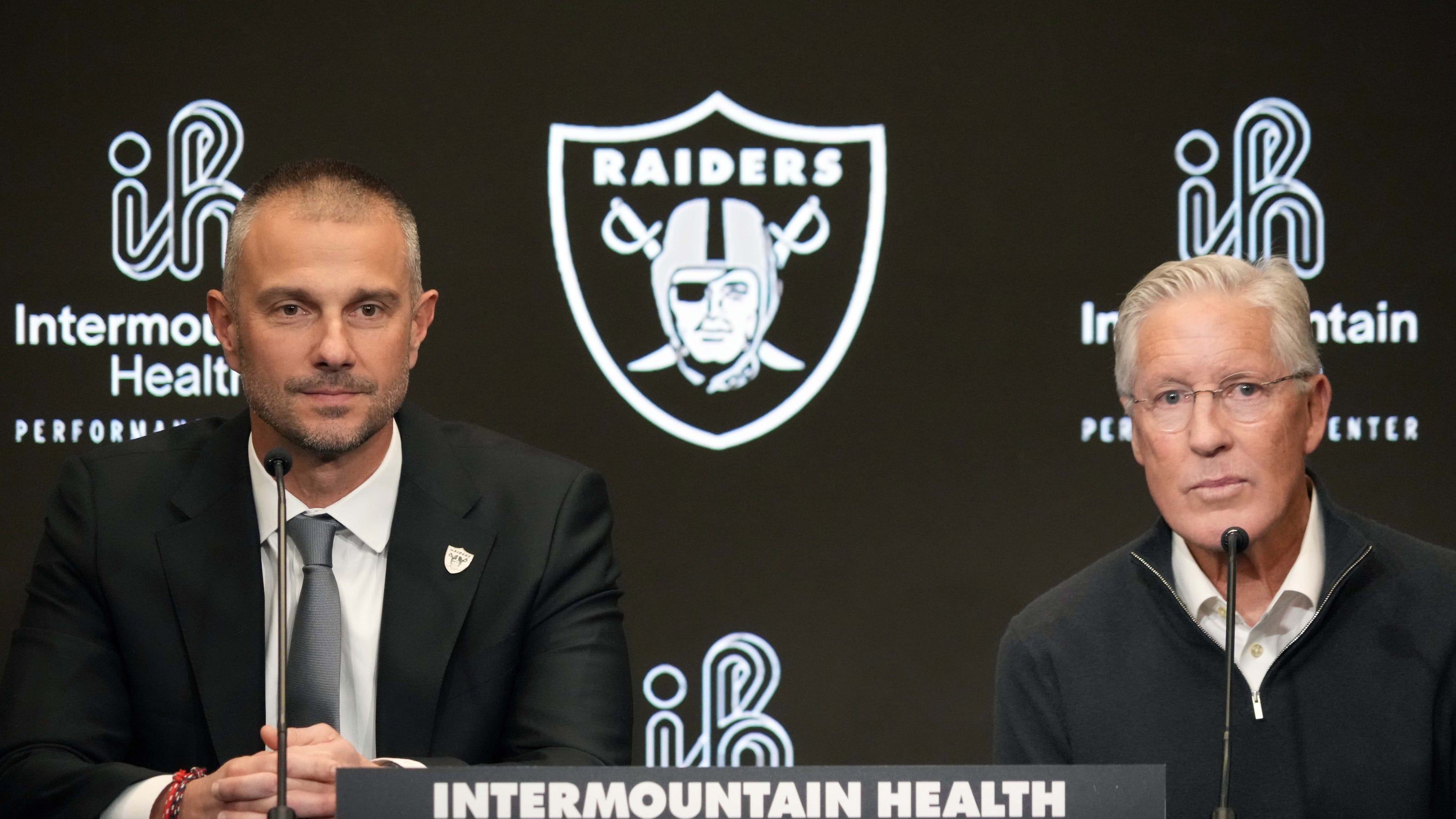

Raiders Smart Offseason Strategy A Contender For 2025 Nfl Success Says The Athletic

Jun 27, 2025

Raiders Smart Offseason Strategy A Contender For 2025 Nfl Success Says The Athletic

Jun 27, 2025 -

Officials Suspect In California Fertility Clinic Bombing Dies

Jun 27, 2025

Officials Suspect In California Fertility Clinic Bombing Dies

Jun 27, 2025 -

Exploring The Louis Vuitton Spring 2026 Collection For Men

Jun 27, 2025

Exploring The Louis Vuitton Spring 2026 Collection For Men

Jun 27, 2025

Latest Posts

-

Love You Dad Chet Hanks Pays Tribute To Tom Hanks In New Video

Jun 27, 2025

Love You Dad Chet Hanks Pays Tribute To Tom Hanks In New Video

Jun 27, 2025 -

Tragic Hike Drone Video Shows Juliana Marins Before Deadly Accident In Brazil

Jun 27, 2025

Tragic Hike Drone Video Shows Juliana Marins Before Deadly Accident In Brazil

Jun 27, 2025 -

Warwickshire Council Leaders Shock Resignation 18 Year Old Takes The Reins

Jun 27, 2025

Warwickshire Council Leaders Shock Resignation 18 Year Old Takes The Reins

Jun 27, 2025 -

100 Degree Heatwave Texas Power Grid Prepared To Avoid Blackouts

Jun 27, 2025

100 Degree Heatwave Texas Power Grid Prepared To Avoid Blackouts

Jun 27, 2025 -

Breaking Barriers From Benefits To Employment

Jun 27, 2025

Breaking Barriers From Benefits To Employment

Jun 27, 2025