$500 Million Share Buyback: How Air Canada Aims To Increase Shareholder Returns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$500 Million Share Buyback: How Air Canada Aims to Increase Shareholder Returns

Air Canada's recent announcement of a $500 million share buyback program has sent ripples through the investment community. This significant move signals the airline's confidence in its future prospects and its commitment to enhancing shareholder value. But what does this mean for investors, and how does this strategy aim to boost returns? Let's delve into the details.

A Vote of Confidence in Air Canada's Recovery

The airline industry has faced unprecedented challenges in recent years, primarily due to the COVID-19 pandemic. Air Canada, like many of its competitors, experienced significant financial strain. However, the company has demonstrated a remarkable recovery, fueled by a rebound in travel demand and effective cost management strategies. This share buyback program serves as a powerful statement, demonstrating Air Canada's belief in its ability to continue this positive trajectory and generate substantial future profits.

How Share Buybacks Work and Benefit Shareholders

A share buyback, also known as a stock repurchase, is a corporate action where a company buys back its own outstanding shares from the open market. This reduces the number of shares in circulation. The primary benefit for shareholders is an increase in earnings per share (EPS). With fewer shares outstanding, the same level of net income is distributed among fewer shares, resulting in a higher EPS. This often leads to a higher stock price, benefiting existing shareholders.

Air Canada's Strategic Rationale:

Air Canada's decision to initiate a $500 million share buyback is a multifaceted strategy aiming to achieve several key objectives:

- Increased Earnings Per Share (EPS): As explained above, reducing the number of outstanding shares directly boosts EPS, a key metric for investor valuation.

- Return Capital to Shareholders: This demonstrates a commitment to returning value to investors, a crucial factor in attracting and retaining shareholder confidence. It's a more direct way to distribute profits than dividends.

- Signaling Confidence: The buyback signals management's confidence in the company's future growth and profitability. This positive sentiment can encourage further investment.

- Potential for Stock Price Appreciation: By decreasing supply and potentially increasing demand, the buyback can contribute to a rise in the share price.

Potential Risks and Considerations:

While share buybacks offer significant potential benefits, it's crucial to acknowledge potential drawbacks:

- Opportunity Cost: The capital used for buybacks could be used for other potentially more profitable investments, such as research and development or expansion projects.

- Market Timing: The effectiveness of a buyback depends heavily on market conditions. Purchasing shares at an inflated price can reduce the overall return.

- Impact on Dividend Policy: In some instances, a buyback might lead to a reduction or suspension of dividend payments.

Looking Ahead: Implications for Investors

Air Canada's share buyback program is a positive development for existing shareholders, potentially leading to higher share prices and increased returns. However, investors should carefully consider the inherent risks and conduct thorough due diligence before making any investment decisions. Staying informed about the company's financial performance and strategic initiatives will be crucial in assessing the long-term impact of this program.

Further Research: For more detailed financial information on Air Canada, visit the company's investor relations website and consult reputable financial news sources. Understanding financial statements and market analysis tools can significantly improve your investment decision-making process.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $500 Million Share Buyback: How Air Canada Aims To Increase Shareholder Returns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wardrobe Malfunction Stops Champion Runner In Their Tracks

Jun 27, 2025

Wardrobe Malfunction Stops Champion Runner In Their Tracks

Jun 27, 2025 -

Warning Ivf Concierge Clinics Face Scrutiny After 15 000 Loss

Jun 27, 2025

Warning Ivf Concierge Clinics Face Scrutiny After 15 000 Loss

Jun 27, 2025 -

Photographer Captures Stunning Close Up Images Of Tiny Creatures

Jun 27, 2025

Photographer Captures Stunning Close Up Images Of Tiny Creatures

Jun 27, 2025 -

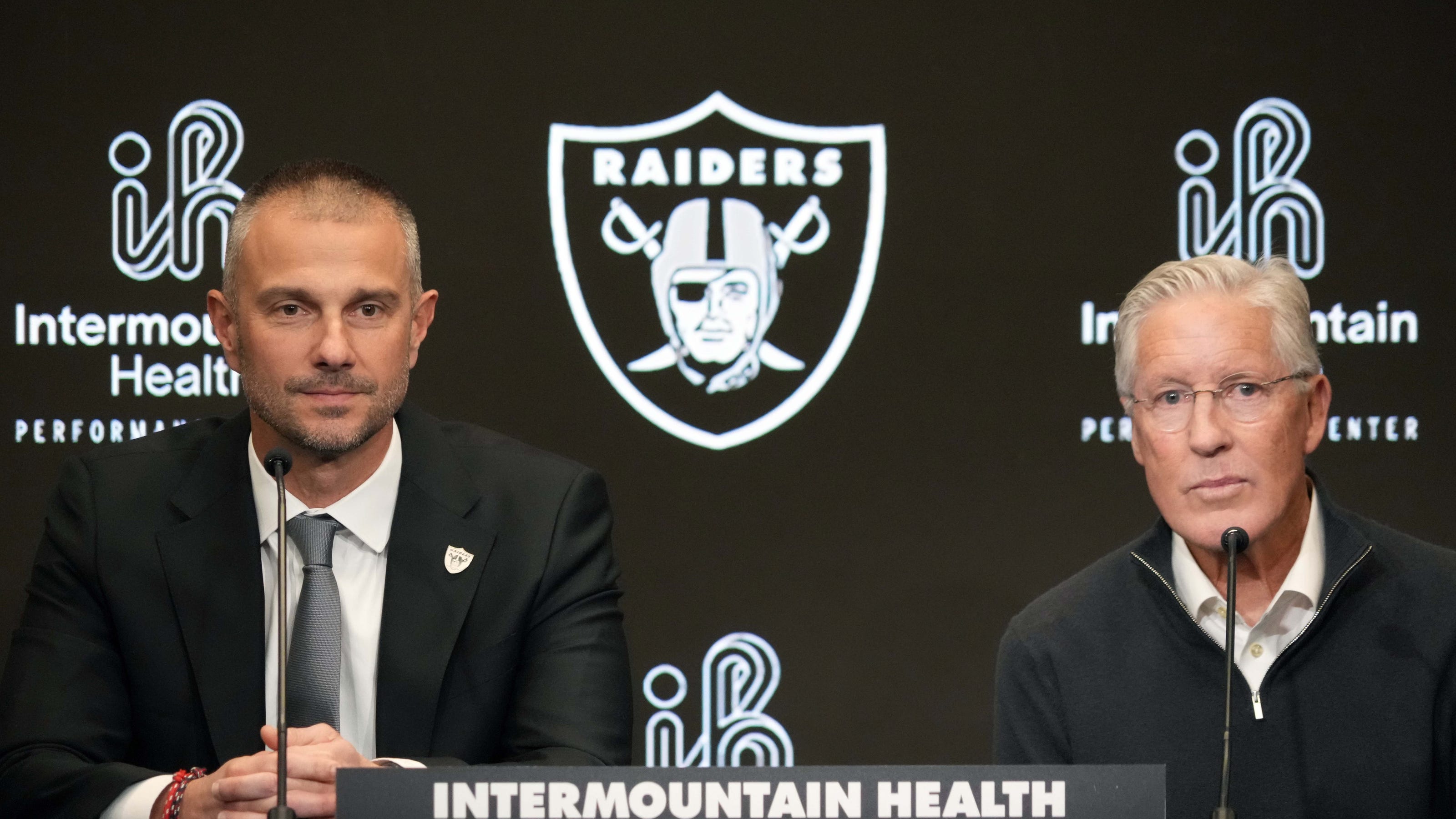

2025 Nfl Offseason Raiders On The Athletics List Of Biggest Winners

Jun 27, 2025

2025 Nfl Offseason Raiders On The Athletics List Of Biggest Winners

Jun 27, 2025 -

Air Canadas Successful 500 Million Share Buyback A Detailed Look

Jun 27, 2025

Air Canadas Successful 500 Million Share Buyback A Detailed Look

Jun 27, 2025

Latest Posts

-

Love You Dad Chet Hanks Pays Tribute To Tom Hanks In New Video

Jun 27, 2025

Love You Dad Chet Hanks Pays Tribute To Tom Hanks In New Video

Jun 27, 2025 -

Tragic Hike Drone Video Shows Juliana Marins Before Deadly Accident In Brazil

Jun 27, 2025

Tragic Hike Drone Video Shows Juliana Marins Before Deadly Accident In Brazil

Jun 27, 2025 -

Warwickshire Council Leaders Shock Resignation 18 Year Old Takes The Reins

Jun 27, 2025

Warwickshire Council Leaders Shock Resignation 18 Year Old Takes The Reins

Jun 27, 2025 -

100 Degree Heatwave Texas Power Grid Prepared To Avoid Blackouts

Jun 27, 2025

100 Degree Heatwave Texas Power Grid Prepared To Avoid Blackouts

Jun 27, 2025 -

Breaking Barriers From Benefits To Employment

Jun 27, 2025

Breaking Barriers From Benefits To Employment

Jun 27, 2025