$500 Million Share Buyback: How Air Canada Is Increasing Shareholder Value

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$500 Million Share Buyback: How Air Canada Is Increasing Shareholder Value

Air Canada's recent announcement of a $500 million share buyback program has sent ripples through the financial markets, signaling a vote of confidence in the airline's future and a clear strategy to boost shareholder value. This move comes as the airline industry continues its recovery from the pandemic, presenting both challenges and opportunities for major players like Air Canada. But what does this buyback actually mean, and how will it benefit investors? Let's delve into the details.

Understanding Share Buybacks: A Key Corporate Strategy

A share buyback, also known as a stock repurchase, occurs when a company uses its own funds to buy back its outstanding shares from the open market. This reduces the number of shares in circulation, thereby increasing the ownership percentage of remaining shareholders. This can lead to several positive outcomes, including:

- Increased Earnings Per Share (EPS): With fewer shares outstanding, the same net income is distributed among fewer shareholders, leading to a higher EPS. This is often a key metric for investors.

- Higher Stock Price: The reduced supply of shares can increase demand, potentially driving up the stock price.

- Improved Return on Equity (ROE): By reducing the number of shares, the company's equity base shrinks, potentially leading to a higher return on equity.

- Signaling Confidence: A share buyback often signals that a company's management believes its stock is undervalued, a strong indicator of future growth prospects.

Air Canada's Rationale: A Strategic Move in a Recovering Market

Air Canada's $500 million share buyback program is a significant commitment, reflecting its positive outlook on the airline industry's recovery and its own financial strength. The company has faced considerable headwinds in recent years, navigating the pandemic's impact and fluctuating fuel prices. However, the rebound in travel demand has provided a significant boost, and this buyback is a strategic response to capitalize on that growth.

The Impact on Investors and the Market

The announcement has been generally well-received by investors. The buyback demonstrates Air Canada's commitment to returning value to its shareholders and suggests a positive outlook for the company's future earnings. While the exact impact on the stock price remains to be seen, it's expected that the buyback will contribute to a higher share price in the long term. Analysts are closely monitoring the execution of the buyback program and its effect on Air Canada's overall financial performance.

Beyond the Buyback: Air Canada's Broader Strategy

It's important to understand that the share buyback is just one piece of Air Canada's overall strategy for growth and shareholder value creation. The airline continues to invest in its fleet, expand its network, and enhance its customer experience. These broader initiatives complement the buyback, creating a synergistic effect that strengthens the company's position in the market.

Looking Ahead: Opportunities and Challenges

While the future of the airline industry is promising, Air Canada, like its competitors, still faces several challenges. Fluctuating fuel prices, economic uncertainty, and potential geopolitical events could impact its performance. Nevertheless, the share buyback demonstrates a confident approach to navigating these challenges and maximizing opportunities for growth and shareholder return.

Conclusion: A Positive Sign for Investors

Air Canada's $500 million share buyback represents a significant strategic move that demonstrates confidence in the company's future. While the market is always subject to fluctuations, the buyback signals a commitment to shareholder value creation and positions Air Canada for continued success in the recovering airline industry. Investors interested in the airline sector should keep a close eye on Air Canada's progress in executing this buyback program and its overall performance in the coming quarters. For more in-depth financial analysis, consult with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $500 Million Share Buyback: How Air Canada Is Increasing Shareholder Value. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Debate Intensifies Should Soldiers Risk Lives To Retrieve Hostages Body In Gaza

Jun 26, 2025

Debate Intensifies Should Soldiers Risk Lives To Retrieve Hostages Body In Gaza

Jun 26, 2025 -

Kennedy Cassidy Clash Dispute Erupts Over Vaccine Panel Information

Jun 26, 2025

Kennedy Cassidy Clash Dispute Erupts Over Vaccine Panel Information

Jun 26, 2025 -

Jessie Js Cancer Journey A Story Of Strength And Vulnerability

Jun 26, 2025

Jessie Js Cancer Journey A Story Of Strength And Vulnerability

Jun 26, 2025 -

Space X Launches Axiom 1 And Starlink Missions A Florida Doubleheader

Jun 26, 2025

Space X Launches Axiom 1 And Starlink Missions A Florida Doubleheader

Jun 26, 2025 -

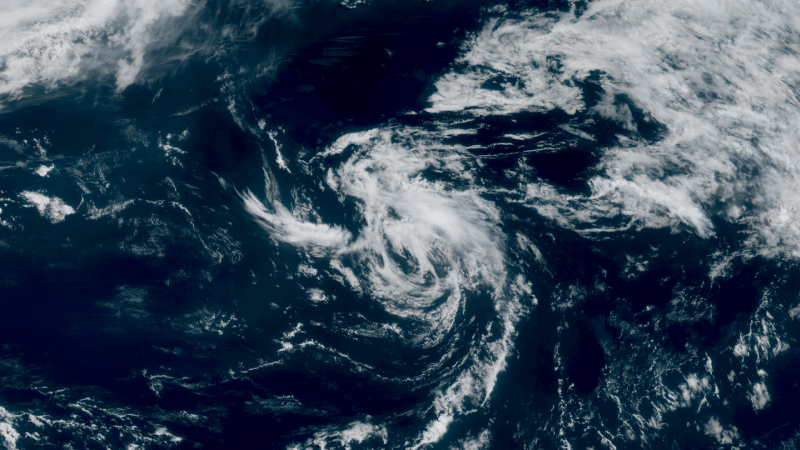

Andrea Intensifies Atlantic Hurricane Seasons First Tropical Storm

Jun 26, 2025

Andrea Intensifies Atlantic Hurricane Seasons First Tropical Storm

Jun 26, 2025

Latest Posts

-

Solve Todays Wordle June 26 1468 Clues And Answer

Jun 26, 2025

Solve Todays Wordle June 26 1468 Clues And Answer

Jun 26, 2025 -

Death Stranding 2 Graphics Norman Reedus Comparison Highlights Stunning Visual Fidelity

Jun 26, 2025

Death Stranding 2 Graphics Norman Reedus Comparison Highlights Stunning Visual Fidelity

Jun 26, 2025 -

Iran Crisis Trump Confirms Putin Offered Help According To Cnn

Jun 26, 2025

Iran Crisis Trump Confirms Putin Offered Help According To Cnn

Jun 26, 2025 -

Cnn On Iran Pro Government Demonstrators Reject Ceasefire As Solution

Jun 26, 2025

Cnn On Iran Pro Government Demonstrators Reject Ceasefire As Solution

Jun 26, 2025 -

Historic Night The Weeknds Empower Field Performance In Pictures

Jun 26, 2025

Historic Night The Weeknds Empower Field Performance In Pictures

Jun 26, 2025