529 Account Advantages: Saving More For Your Child's Education

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

529 Account Advantages: Saving More for Your Child's Education

The soaring cost of higher education is a major concern for many parents. Tuition fees, room and board, books, and other expenses can quickly add up, creating a significant financial burden. Fortunately, there's a powerful savings tool designed to help families navigate this challenge: the 529 college savings plan. Understanding the advantages of a 529 account is crucial for securing your child's future educational opportunities.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically to help families save for future education costs. These plans are sponsored by states, state agencies, or educational institutions, and offer several significant benefits that make them an attractive option for college savings. There are two main types: state-sponsored plans and private plans. The best plan for you will depend on factors like your state of residence and the specific features offered.

Key Advantages of a 529 Account:

-

Tax-Deferred Growth: This is perhaps the most significant advantage. Earnings within a 529 account grow tax-deferred, meaning you don't pay taxes on the investment gains until you withdraw the money for qualified education expenses. This allows your savings to compound significantly over time.

-

Tax-Free Withdrawals for Qualified Expenses: When you withdraw funds for qualified education expenses, such as tuition, fees, room and board, and even some books and supplies, the withdrawals are generally tax-free at the federal level. This is a huge advantage compared to other savings vehicles where withdrawals might be subject to income tax. Check your state's regulations, as some states may offer additional tax benefits.

-

Flexibility: While primarily designed for college, 529 plans offer some flexibility. Many plans allow for withdrawals for K-12 tuition expenses, though this is often subject to limitations. Furthermore, some states permit limited withdrawals for apprenticeships or other vocational training programs. Always consult your plan's specific guidelines.

-

Gift Tax Advantages: You can contribute a significant amount to a 529 plan upfront without incurring gift tax penalties. The current federal limit allows for a contribution of up to $80,000 per beneficiary without triggering gift tax consequences, though this can be spread over five years. This makes it an ideal vehicle for grandparents or other family members who want to contribute to a child's education.

Choosing the Right 529 Plan:

Selecting the best 529 plan requires careful consideration. Factors to evaluate include:

- Investment Options: Different plans offer various investment options, ranging from conservative to more aggressive strategies. Choose options that align with your risk tolerance and time horizon.

- Fees: Compare the expense ratios and other fees associated with different plans. Lower fees mean more of your money is working towards your child's education.

- State Tax Benefits: Some states offer additional tax deductions or credits for contributions to their own state's 529 plan.

Beyond the Financial Benefits:

The advantages of a 529 plan extend beyond just the financial aspects. It fosters a sense of responsibility and planning for the future, teaching children and families the importance of saving and investing. It provides a tangible way to actively participate in securing your child's educational journey.

Getting Started:

Opening a 529 account is relatively straightforward. Many state websites provide detailed information and online applications. Consult a financial advisor to determine the best plan and investment strategy for your family's specific needs and circumstances. Starting early is key to maximizing the power of compounding and securing your child's future educational success. Don't delay—take the first step towards a brighter future today!

Related Resources:

This information is for general knowledge and does not constitute financial advice. Consult a qualified financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 529 Account Advantages: Saving More For Your Child's Education. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thames Waters Preferred Bidder Pulls Out Project In Jeopardy

Jun 04, 2025

Thames Waters Preferred Bidder Pulls Out Project In Jeopardy

Jun 04, 2025 -

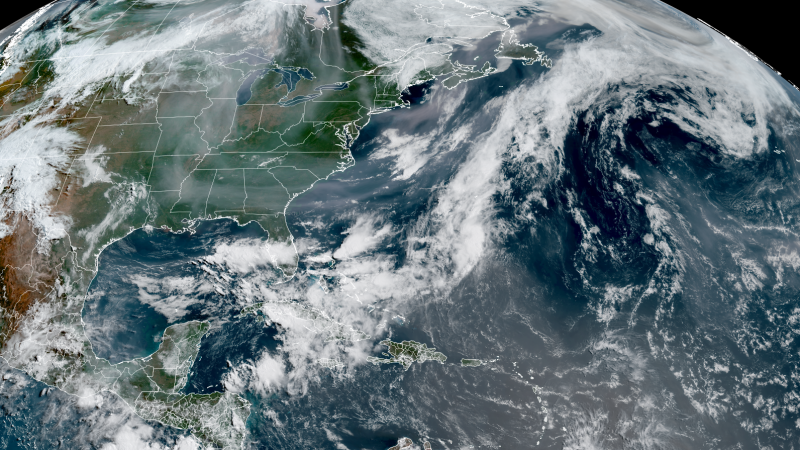

Canadian Wildfire Smoke And African Dust Plume Set To Collide Over Southern Us

Jun 04, 2025

Canadian Wildfire Smoke And African Dust Plume Set To Collide Over Southern Us

Jun 04, 2025 -

New Music Grace Potter Discusses Her Overlooked Album

Jun 04, 2025

New Music Grace Potter Discusses Her Overlooked Album

Jun 04, 2025 -

Tom Daley Opens Up About Growing Up Gay And Achieving Olympic Glory

Jun 04, 2025

Tom Daley Opens Up About Growing Up Gay And Achieving Olympic Glory

Jun 04, 2025 -

New Netflix Comedy Series Has Viewers Hooked Renewal Demand Soars

Jun 04, 2025

New Netflix Comedy Series Has Viewers Hooked Renewal Demand Soars

Jun 04, 2025

Latest Posts

-

Official Villanova Football To Become Patriot League Associate Member

Jun 06, 2025

Official Villanova Football To Become Patriot League Associate Member

Jun 06, 2025 -

Portugal Police Confirm Body Found In Search For Missing Scottish Stag Party Guest

Jun 06, 2025

Portugal Police Confirm Body Found In Search For Missing Scottish Stag Party Guest

Jun 06, 2025 -

May Jobs Report Shows Significant Slowdown Private Sector Hiring At 2 Year Low

Jun 06, 2025

May Jobs Report Shows Significant Slowdown Private Sector Hiring At 2 Year Low

Jun 06, 2025 -

Report Joe Sacco Leaving Boston Bruins For Coaching Position

Jun 06, 2025

Report Joe Sacco Leaving Boston Bruins For Coaching Position

Jun 06, 2025 -

Winter Fuel Payment Details Of The Chancellors Policy U Turn

Jun 06, 2025

Winter Fuel Payment Details Of The Chancellors Policy U Turn

Jun 06, 2025