529 College Savings: How To Save More And Pay Less

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

529 College Savings: How to Save More and Pay Less for Your Child's Education

The soaring cost of higher education is a significant concern for many families. Tuition fees, room and board, and other expenses can quickly add up, creating a daunting financial hurdle. However, with careful planning and strategic use of tools like 529 college savings plans, you can significantly reduce the burden and pave the way for your child's academic success. This article explores effective strategies to maximize your 529 plan contributions and minimize the overall cost of college.

Understanding 529 Plans: A Powerful Savings Tool

529 plans are tax-advantaged savings plans designed specifically for education expenses. Contributions grow tax-deferred, and withdrawals used for qualified education expenses are typically tax-free. This significant tax advantage makes them a powerful tool for accumulating funds for college. There are two main types of 529 plans:

- State-sponsored plans: Offered by individual states, these plans often offer in-state tax deductions or credits. The investment options and fees vary depending on the state.

- Private plans: Managed by private companies, these plans typically offer a wider range of investment choices but may not have the same state tax benefits.

Strategies to Maximize Your 529 Savings

Saving for college requires a long-term commitment and consistent effort. Here are several strategies to boost your 529 contributions:

- Start Early: The earlier you begin contributing, the more time your investments have to grow, leveraging the power of compounding. Even small, regular contributions can make a significant difference over time.

- Automate Contributions: Set up automatic transfers from your checking or savings account directly into your 529 plan. This ensures consistent contributions without requiring manual effort.

- Contribute the Maximum: Familiarize yourself with your state's contribution limits and strive to contribute the maximum amount allowed.

- Take Advantage of Matching Programs: Some employers offer matching contributions to 529 plans. Be sure to explore this possibility to maximize your savings.

- Consider "Gift" Contributions: Grandparents, other family members, or friends can also contribute to a 529 plan, making it an ideal gift for birthdays or holidays. Remember to check the annual gift tax exclusion limits.

Minimizing the Overall Cost of College:

Beyond maximizing 529 contributions, consider these strategies to lower the overall cost of college:

- Explore Financial Aid Opportunities: Complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for grants, scholarships, and loans. Understanding your financial aid options is crucial. [Link to FAFSA website]

- Consider Community College: Starting at a community college for the first two years can significantly reduce tuition costs before transferring to a four-year university.

- Live at Home: If feasible, living at home during college can drastically reduce expenses associated with room and board.

- Apply for Scholarships and Grants: Actively search for scholarships and grants specific to your child's interests, academic achievements, or demographics. Many resources are available online. [Link to scholarship search website]

- Choose Affordable Colleges: Carefully research college costs and consider institutions that align with your budget.

Conclusion:

Planning for college expenses requires a proactive and strategic approach. By utilizing 529 college savings plans effectively and implementing cost-saving strategies, you can significantly reduce the financial burden and pave the way for your child's educational journey. Remember to regularly review your 529 plan and adjust your contributions as needed to stay on track. Start saving early, automate contributions, and explore all available resources to ensure a brighter future for your child.

Call to Action: Begin researching 529 plans in your state today and start saving for your child's future. Don't delay – the time to plan is now!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 529 College Savings: How To Save More And Pay Less. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

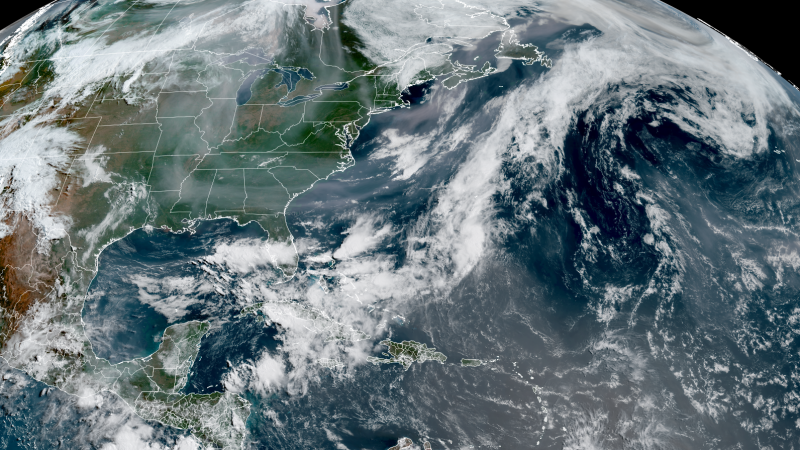

Double Threat African Dust And Canadian Wildfires Impose Air Quality Risks In Southern Us

Jun 04, 2025

Double Threat African Dust And Canadian Wildfires Impose Air Quality Risks In Southern Us

Jun 04, 2025 -

The Tariff Squeeze Why Dollar General Is Thriving In A Tough Economy

Jun 04, 2025

The Tariff Squeeze Why Dollar General Is Thriving In A Tough Economy

Jun 04, 2025 -

Two Us Stocks Dumped By Warren Buffett Should You Follow Suit

Jun 04, 2025

Two Us Stocks Dumped By Warren Buffett Should You Follow Suit

Jun 04, 2025 -

French Open Day 8 2025 Complete Match Results And Highlights

Jun 04, 2025

French Open Day 8 2025 Complete Match Results And Highlights

Jun 04, 2025 -

Olympic Diver Tom Daley Discusses Identity Family And Overcoming Challenges

Jun 04, 2025

Olympic Diver Tom Daley Discusses Identity Family And Overcoming Challenges

Jun 04, 2025

Latest Posts

-

Watch Taylor Lewans Awful First Pitch Goes Hilariously Wrong

Jun 06, 2025

Watch Taylor Lewans Awful First Pitch Goes Hilariously Wrong

Jun 06, 2025 -

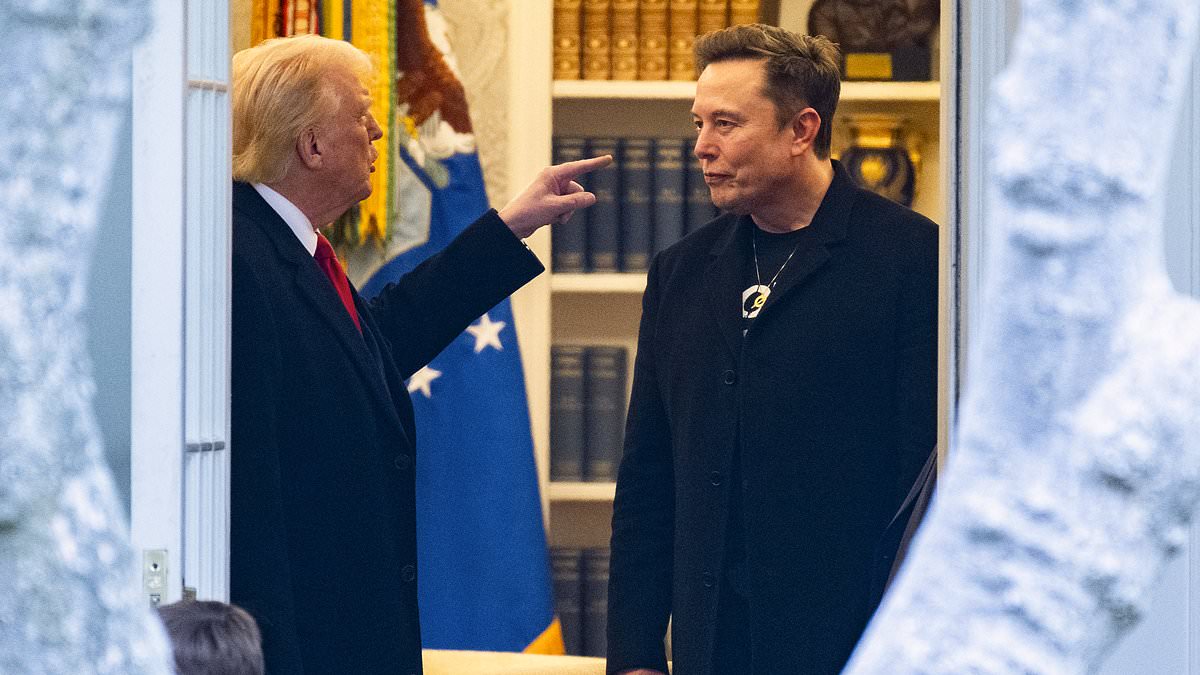

Behind Trump And Musks Rift The Influence Of One Advisor

Jun 06, 2025

Behind Trump And Musks Rift The Influence Of One Advisor

Jun 06, 2025 -

Matthew Hussey Announces First Pregnancy With Wife After Camila Cabello Relationship

Jun 06, 2025

Matthew Hussey Announces First Pregnancy With Wife After Camila Cabello Relationship

Jun 06, 2025 -

Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025

Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025 -

Investigation Launched Into President Bidens Actions And Autopen Use Following Trumps Allegations

Jun 06, 2025

Investigation Launched Into President Bidens Actions And Autopen Use Following Trumps Allegations

Jun 06, 2025