529 College Savings Plans: Making Education More Affordable

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

529 College Savings Plans: Making Education More Affordable

The soaring cost of higher education is a significant concern for many families. Tuition fees, room and board, and other expenses can quickly add up, creating a daunting financial hurdle for aspiring college students. However, there's a powerful tool that can help alleviate this burden: the 529 college savings plan. This article explores the benefits of 529 plans and how they can make a college education more accessible.

What are 529 College Savings Plans?

529 plans are tax-advantaged savings plans designed specifically to help families pay for qualified education expenses. Sponsored by states, states agencies, or educational institutions, these plans allow contributions to grow tax-deferred, meaning you don't pay taxes on the earnings until you withdraw them for qualified education expenses. This tax advantage is a significant benefit, allowing your savings to grow faster than they would in a taxable account.

Key Benefits of 529 Plans:

-

Tax-Deferred Growth: As mentioned, the earnings in your 529 plan grow tax-free. This is a crucial advantage, allowing your investment to compound over time without being eroded by annual taxes.

-

Tax-Free Withdrawals for Qualified Expenses: When you withdraw funds for qualified education expenses, such as tuition, fees, room and board, and even books and supplies, the withdrawals are typically tax-free at the federal level. (State tax benefits may vary.) This makes a substantial difference in the overall cost of college.

-

Flexibility: Many 529 plans offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and time horizon. You can choose from age-based options that automatically adjust the investment allocation as your child gets closer to college, or you can select specific funds based on your investment strategy.

-

Gifting Options: You can contribute significantly more to a 529 plan than you could to other types of accounts due to gifting rules. This allows grandparents and other family members to contribute to a child's education without exceeding annual gift tax limits.

How to Choose the Right 529 Plan:

Selecting the best 529 plan for your family depends on several factors, including:

- Investment Options: Research the available investment choices within each plan. Look for plans with a wide range of options and low expense ratios.

- Fees: Compare the fees charged by different plans. High fees can significantly impact your returns over time.

- State Benefits: Some states offer tax deductions or credits for contributions made to their own state's 529 plan. Check your state's regulations to see if this applies to you.

Beyond College: 529 Plan Flexibility

While primarily used for college expenses, some 529 plans offer expanded usage options, such as for K-12 tuition expenses or apprenticeships. Always confirm the specific rules of your chosen plan to understand what qualified expenses are covered.

Getting Started with a 529 Plan:

Opening a 529 plan is relatively straightforward. You can typically do so online through your state's website or through a financial advisor. Start saving early to maximize the benefits of tax-deferred growth and compound interest. Even small, consistent contributions can make a significant difference over time.

Conclusion:

529 college savings plans are an invaluable tool for families seeking to make higher education more affordable. By understanding the benefits and carefully selecting a plan, families can significantly reduce the financial burden of college and pave the way for their children's future success. Don't delay – start planning and saving for your child's education today! Learn more by visiting the .

Keywords: 529 plan, 529 college savings plan, college savings, higher education, education savings, tax-advantaged savings, tuition savings, college tuition, financial aid, saving for college, investment, tax benefits, tax-deferred growth, financial planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 529 College Savings Plans: Making Education More Affordable. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine Uses Drones To Send Powerful Message Impact On The Conflict

Jun 03, 2025

Ukraine Uses Drones To Send Powerful Message Impact On The Conflict

Jun 03, 2025 -

Missing June Ssi Payment Complete 2025 Schedule And Reasons For Delays

Jun 03, 2025

Missing June Ssi Payment Complete 2025 Schedule And Reasons For Delays

Jun 03, 2025 -

Jodie Comer And Aaron Taylor Johnsons Intense Chemistry On Display

Jun 03, 2025

Jodie Comer And Aaron Taylor Johnsons Intense Chemistry On Display

Jun 03, 2025 -

Harry Siegels Surge Understanding The Appeal Of A Socialist Candidate In The Democratic Primary

Jun 03, 2025

Harry Siegels Surge Understanding The Appeal Of A Socialist Candidate In The Democratic Primary

Jun 03, 2025 -

Candace Parker Number 3 Jersey Retirement Ceremony Announced

Jun 03, 2025

Candace Parker Number 3 Jersey Retirement Ceremony Announced

Jun 03, 2025

Latest Posts

-

Analyzing Cyberpunk 2077s Potential On Switch 2 An Xbox Series S Comparison

Aug 03, 2025

Analyzing Cyberpunk 2077s Potential On Switch 2 An Xbox Series S Comparison

Aug 03, 2025 -

Enduring Legacy Remembering Nypd Officer Didarul Islam

Aug 03, 2025

Enduring Legacy Remembering Nypd Officer Didarul Islam

Aug 03, 2025 -

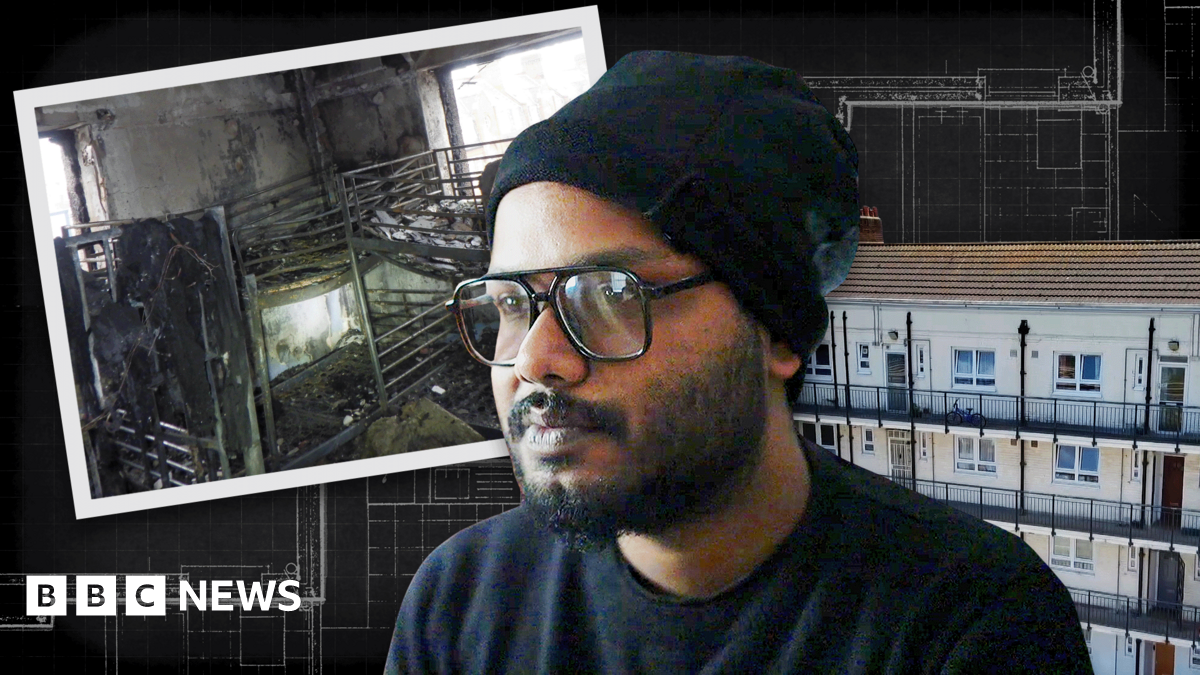

Illegal House Shares A Dangerous Mix Of Rats Mold And Overcrowding

Aug 03, 2025

Illegal House Shares A Dangerous Mix Of Rats Mold And Overcrowding

Aug 03, 2025 -

El Salvador Reeleccion Presidencial Indefinida Y Extension Del Periodo A 6 Anos Analisis Politico

Aug 03, 2025

El Salvador Reeleccion Presidencial Indefinida Y Extension Del Periodo A 6 Anos Analisis Politico

Aug 03, 2025 -

Dexters Return Analyzing The Performance Anxiety In Resurrection

Aug 03, 2025

Dexters Return Analyzing The Performance Anxiety In Resurrection

Aug 03, 2025