529 Plans And Rising Tuition: How Ohio Parents Are Adapting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

529 Plans and Rising Tuition: How Ohio Parents are Adapting

Tuition costs are skyrocketing, leaving Ohio parents scrambling to find affordable ways to fund their children's higher education. But amidst the rising costs, 529 college savings plans are proving to be a vital tool for families navigating this challenging financial landscape. This article explores how Ohio parents are leveraging 529 plans and other strategies to secure their children's futures.

The cost of a college education in Ohio, and across the nation, has increased significantly faster than inflation over the past few decades. This makes securing funding for higher education a major concern for many families. While scholarships and grants are helpful, they often don't cover the entire cost, leaving a significant gap many parents must fill.

The Power of 529 Plans in Ohio

Ohio's 529 plan, the Ohio Tuition Trust Authority (OTTA) 529 Plan, offers several key advantages for families saving for college:

- Tax Advantages: Contributions to a 529 plan are often made with after-tax dollars, but earnings grow tax-deferred, and withdrawals used for qualified education expenses are typically tax-free at the federal level. Ohio also offers its own state tax deduction for contributions. This makes 529 plans a powerful tool for tax-efficient saving.

- Flexibility: While primarily used for college tuition, 529 plans can also be used for a range of qualified education expenses, including room and board, books, and even some K-12 expenses.

- Investment Options: OTTA offers a diverse range of investment options, allowing parents to tailor their savings strategy to their risk tolerance and time horizon. This flexibility is crucial, allowing for adjustments based on the child's age and the ever-changing market.

Strategies Ohio Parents are Employing

Facing rising tuition costs, Ohio parents are adopting several strategies in conjunction with their 529 plans:

- Early Start: Many parents are starting to save for college as early as possible, even before their child is born. This allows for the power of compounding interest to maximize savings over time.

- Regular Contributions: Consistent, even small, contributions to a 529 plan are more effective than sporadic large contributions. Auto-drafting from a checking account is a popular method to maintain this consistency.

- Exploring Financial Aid: Parents are actively researching and applying for financial aid, grants, and scholarships to supplement their 529 savings. Understanding the FAFSA process is vital. [Link to FAFSA website]

- Considering Community Colleges: Many families are exploring the option of community colleges for the first two years of their child's education to reduce overall tuition costs. This can significantly lower expenses and allow for more 529 funds to be allocated to a four-year institution later.

- Budgeting and Saving: Families are implementing strict budgeting strategies to increase their savings capacity and maximize contributions to their 529 plans.

Looking Ahead:

While the rising cost of tuition presents significant challenges, Ohio parents are demonstrating resourcefulness and foresight in using 529 plans strategically to ensure their children have access to higher education. By understanding the benefits of 529 plans, actively exploring financial aid options, and adopting smart saving strategies, families can better navigate the complexities of funding a college education. The key is planning ahead and taking advantage of all available resources.

Call to Action: Are you an Ohio parent concerned about college costs? Learn more about the Ohio 529 Plan and start planning for your child's future today! [Link to Ohio 529 Plan website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 529 Plans And Rising Tuition: How Ohio Parents Are Adapting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding The Financial Implications Of The New Republican Retirement Plan

Jun 04, 2025

Understanding The Financial Implications Of The New Republican Retirement Plan

Jun 04, 2025 -

Mount Etna Volcano Erupts Tourist Video Captures Dramatic Evacuation

Jun 04, 2025

Mount Etna Volcano Erupts Tourist Video Captures Dramatic Evacuation

Jun 04, 2025 -

Critics And Fans Agree This New Netflix Comedy Is A Must Watch

Jun 04, 2025

Critics And Fans Agree This New Netflix Comedy Is A Must Watch

Jun 04, 2025 -

Is This The Next Big Netflix Hit Fans Cant Stop Watching This Hilarious New Show

Jun 04, 2025

Is This The Next Big Netflix Hit Fans Cant Stop Watching This Hilarious New Show

Jun 04, 2025 -

Emmy Winner John Brenkus Dead At 54 After Depression Battle

Jun 04, 2025

Emmy Winner John Brenkus Dead At 54 After Depression Battle

Jun 04, 2025

Latest Posts

-

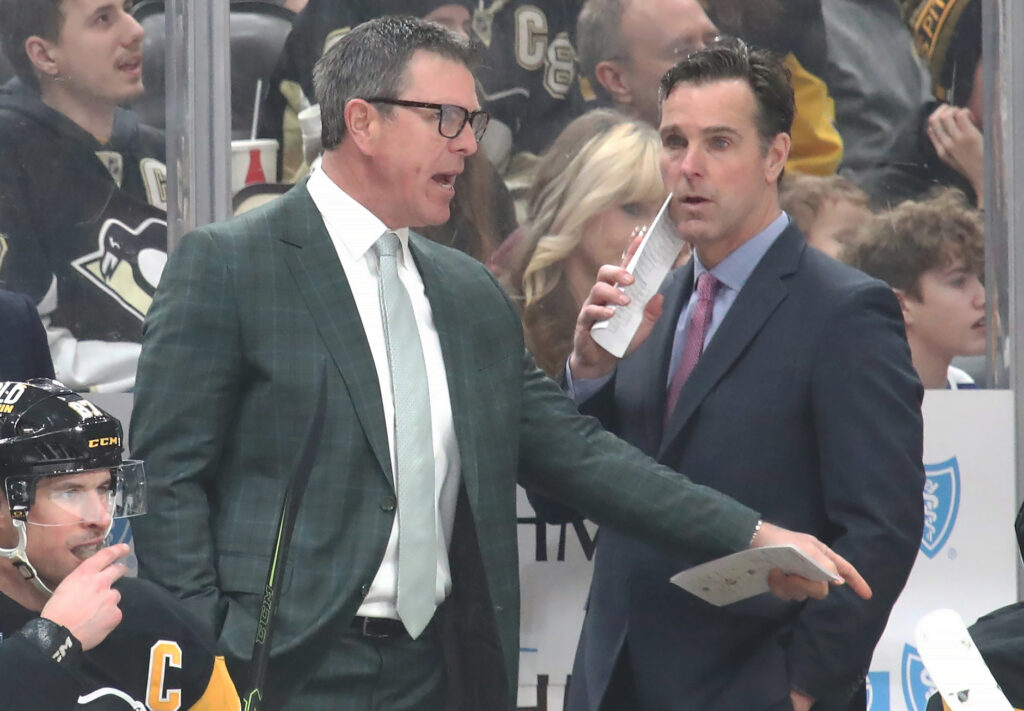

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025