560% Return On Amazon: A Case Study In Long-Term Stock Holding

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

560% Return on Amazon: A Case Study in Long-Term Stock Holding

Investing in the long term can yield incredible results, and Amazon's stock performance serves as a prime example. While get-rich-quick schemes often fail, a patient, research-based approach to investing can generate significant wealth. This case study examines the remarkable 560% return experienced by investors who held Amazon (AMZN) stock over the long term, highlighting the importance of patience, due diligence, and understanding a company's potential.

The Amazon Story: From Online Bookstore to Global Giant

Amazon's journey began as an online bookstore in 1994. Jeff Bezos's vision extended far beyond books, however. His commitment to customer experience, technological innovation, and aggressive expansion transformed Amazon into a global e-commerce behemoth, dominating online retail, cloud computing (AWS), and digital entertainment. This dramatic growth is directly reflected in its stock performance.

A 560% Return: Breaking Down the Numbers

Imagine investing a modest sum in Amazon's initial public offering (IPO) in 1997. While the exact entry price varies depending on the timing, a hypothetical investment of $1,000 could have blossomed into over $6,600 today, representing a staggering 560% return. This demonstrates the power of compounding returns over time. This phenomenal growth wasn't a straight line, however. There were periods of volatility and correction, showcasing the inherent risks in the stock market.

Key Factors Contributing to Amazon's Success (and Stock Performance):

- First-Mover Advantage: Amazon's early entry into the burgeoning e-commerce market gave it a significant head start.

- Customer-Centric Approach: Bezos's relentless focus on customer satisfaction built a loyal customer base.

- Technological Innovation: Amazon's continuous investment in technology and logistics has kept it ahead of the curve.

- Diversification: Expanding beyond online retail into cloud computing (AWS), digital media, and more, mitigated risk and spurred further growth.

- Strategic Acquisitions: Acquisitions like Whole Foods Market expanded Amazon's reach into new markets.

Lessons Learned: Investing for the Long Term

The Amazon case study provides several valuable lessons for long-term investors:

- Thorough Due Diligence: Before investing, understand the company's business model, financials, and competitive landscape. Resources like are crucial for this research.

- Patience is Key: Short-term market fluctuations are inevitable. Focus on the long-term potential of the company.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes.

- Emotional Discipline: Avoid panic selling during market downturns. Stick to your investment strategy.

- Consider Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, reducing the risk of investing a lump sum at a market peak.

Conclusion: The Power of Long-Term Investing

The 560% return on Amazon stock highlights the potential rewards of long-term investing. While past performance is not indicative of future results, this case study emphasizes the importance of thorough research, patience, and a well-defined investment strategy. Remember to consult with a financial advisor before making any investment decisions. Are you ready to embrace the long-term investment strategy? Share your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 560% Return On Amazon: A Case Study In Long-Term Stock Holding. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Increased Police Presence Needed After Seaside Heights Boardwalk Violence

May 27, 2025

Increased Police Presence Needed After Seaside Heights Boardwalk Violence

May 27, 2025 -

Closure After Decades Four Wwii Bomber Crash Victims Identified Repatriated

May 27, 2025

Closure After Decades Four Wwii Bomber Crash Victims Identified Repatriated

May 27, 2025 -

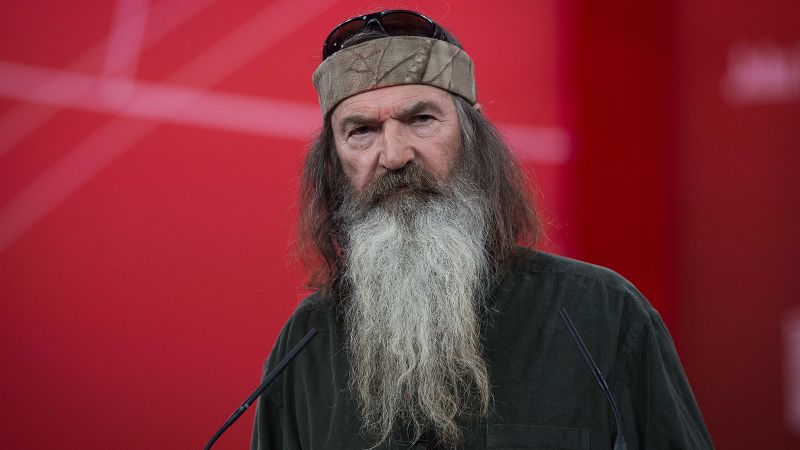

Phil Robertson Dies At 79 Remembering The Duck Dynasty Icon

May 27, 2025

Phil Robertson Dies At 79 Remembering The Duck Dynasty Icon

May 27, 2025 -

Memorial Day Parade In Hillsborough A Community Remembrance

May 27, 2025

Memorial Day Parade In Hillsborough A Community Remembrance

May 27, 2025 -

Gary Linekers Legacy 26 Years At Match Of The Day Conclude

May 27, 2025

Gary Linekers Legacy 26 Years At Match Of The Day Conclude

May 27, 2025

Latest Posts

-

Emergency Response Following Huge Explosion At Chinese Chemical Plant

May 28, 2025

Emergency Response Following Huge Explosion At Chinese Chemical Plant

May 28, 2025 -

Massive Blast Devastates Chinese Chemical Facility Emergency Response Launched

May 28, 2025

Massive Blast Devastates Chinese Chemical Facility Emergency Response Launched

May 28, 2025 -

Abortion Arrest Controversy Internal Police Recording Raises Questions

May 28, 2025

Abortion Arrest Controversy Internal Police Recording Raises Questions

May 28, 2025 -

Red Carpet Reveal Analyzing Alexandra Daddarios Transparent Gown

May 28, 2025

Red Carpet Reveal Analyzing Alexandra Daddarios Transparent Gown

May 28, 2025 -

King Charles Iiis Impactful Canadian Tour A Royal Visit During Political Upheaval

May 28, 2025

King Charles Iiis Impactful Canadian Tour A Royal Visit During Political Upheaval

May 28, 2025