560% Up: My Long-Term Amazon Stock Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

560% Up: My Long-Term Amazon Stock Strategy – A Case Study in Patient Investing

The tech world is a rollercoaster. One minute you're riding high on a groundbreaking innovation, the next you're plummeting into a market correction. But amidst the volatility, some investments stand the test of time. My long-term Amazon stock strategy is a prime example, yielding a staggering 560% return. This isn't about get-rich-quick schemes; it's about understanding a company's potential and holding on for the long haul. This article details my approach, highlighting key factors that contributed to this significant success.

Understanding the Amazon Phenomenon:

Before diving into the strategy, it's crucial to understand why Amazon was (and remains) an attractive long-term investment. From its humble beginnings as an online bookstore, Amazon transformed into a behemoth dominating e-commerce, cloud computing (AWS), and digital entertainment. This diversification is key. A reliance on a single revenue stream is risky; Amazon's multifaceted approach significantly reduces vulnerability.

My Long-Term Strategy: Patience and Research are Key

My success wasn't accidental. It stemmed from a meticulously researched investment strategy built on several pillars:

-

Fundamental Analysis: I didn't jump on the bandwagon. Before investing, I thoroughly analyzed Amazon's financial statements, revenue streams, market share, and competitive landscape. Understanding their profitability, growth trajectory, and future potential was paramount. Resources like proved invaluable.

-

Long-Term Vision: I wasn't looking for quick gains. My investment horizon was (and remains) long-term. I anticipated market fluctuations and understood that short-term dips are normal occurrences in the stock market. This patient approach allowed me to weather the storms and benefit from Amazon's consistent growth.

-

Diversification (within reason): While Amazon formed the core of this specific investment, it's crucial to remember the importance of diversification in your overall portfolio. Don't put all your eggs in one basket, even a seemingly golden one like Amazon.

-

Regular Monitoring (but not over-trading): I regularly monitored Amazon's performance, staying updated on industry news and financial reports. However, I avoided the trap of emotional trading based on short-term market swings.

Key Milestones and Lessons Learned:

The journey wasn't without its challenges. There were periods of uncertainty and market corrections that tested my resolve. However, sticking to the long-term strategy proved invaluable. Here are some key takeaways:

- Ignoring the Noise: Market speculation and short-term predictions are often misleading. Focus on the fundamentals and your long-term goals.

- Emotional Discipline: Fear and greed are powerful emotions that can lead to poor investment decisions. Maintaining emotional discipline is crucial for long-term success.

- Adaptability: The market is constantly evolving. Staying informed and adapting your strategy as needed is vital.

The Future of Amazon:

While my past performance is impressive, it's not a guarantee of future success. However, Amazon continues to innovate and expand into new markets. Their ongoing investments in areas like artificial intelligence, logistics, and healthcare suggest a bright future.

Conclusion:

My 560% return on Amazon stock is a testament to the power of a well-researched, long-term investment strategy. It's a case study demonstrating that patience, discipline, and a deep understanding of the company you invest in are crucial ingredients for long-term financial success. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions. This article serves as a personal account and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 560% Up: My Long-Term Amazon Stock Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Israeli Ultra Nationalists March In Jerusalem Amid Heightened Security

May 28, 2025

Israeli Ultra Nationalists March In Jerusalem Amid Heightened Security

May 28, 2025 -

Malaysian Government Confirms Brunei Sultan Undergoes Treatment In Kl Hospital For Fatigue

May 28, 2025

Malaysian Government Confirms Brunei Sultan Undergoes Treatment In Kl Hospital For Fatigue

May 28, 2025 -

Eleven Dead Four Identified Closure For Families After Wwii Bomber Crash

May 28, 2025

Eleven Dead Four Identified Closure For Families After Wwii Bomber Crash

May 28, 2025 -

Senior North Korean Official Detained Over Failed Warship Launch

May 28, 2025

Senior North Korean Official Detained Over Failed Warship Launch

May 28, 2025 -

Amazons Amzn Momentum A Deep Dive Into Current Market Trends

May 28, 2025

Amazons Amzn Momentum A Deep Dive Into Current Market Trends

May 28, 2025

Latest Posts

-

Nba Trade Deadline Dallas Mavericks Target Holiday Or Ball Bucks Keep Antetokounmpo

May 29, 2025

Nba Trade Deadline Dallas Mavericks Target Holiday Or Ball Bucks Keep Antetokounmpo

May 29, 2025 -

Beef Costs Fuel Highest Food Inflation In A Year

May 29, 2025

Beef Costs Fuel Highest Food Inflation In A Year

May 29, 2025 -

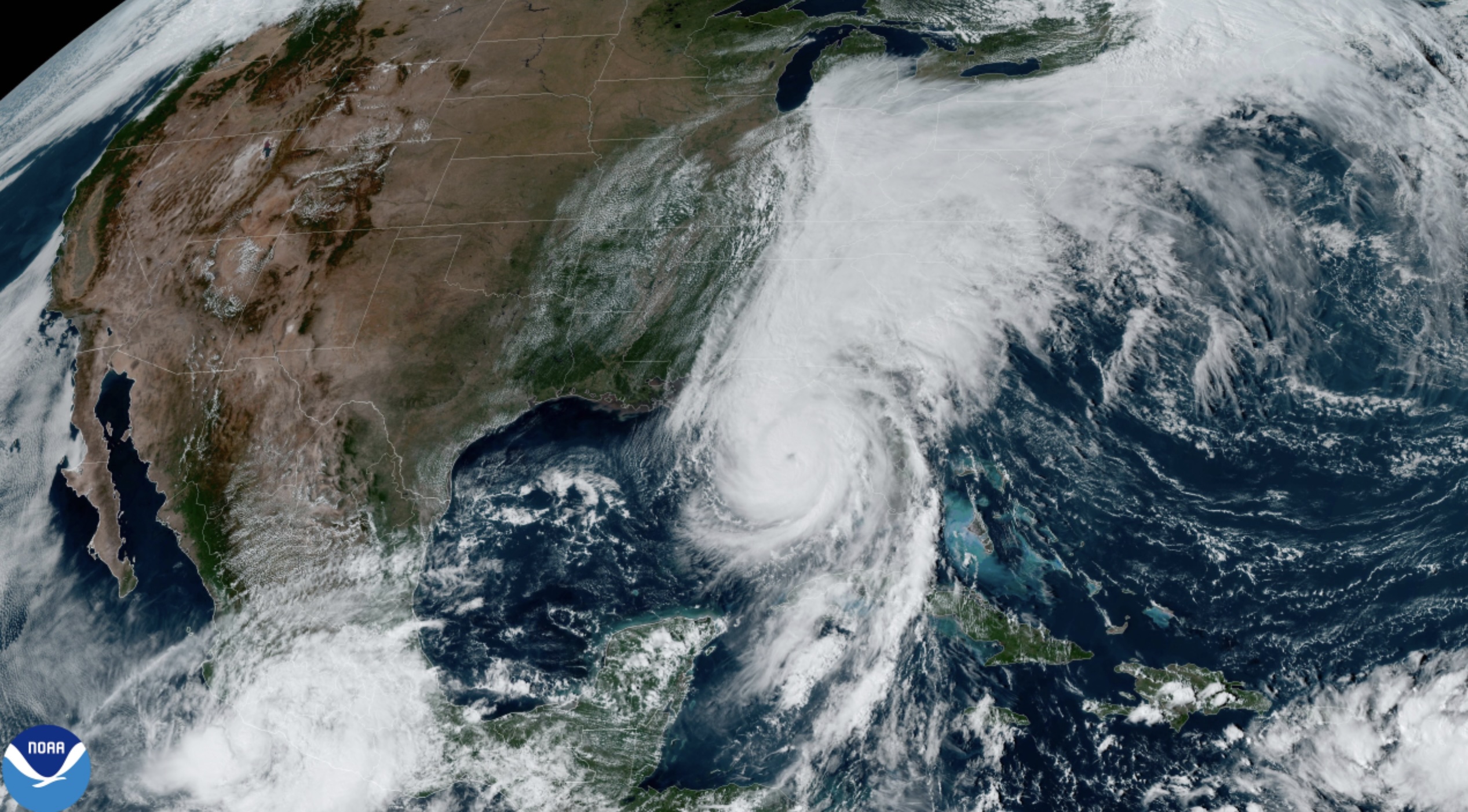

Us Summer Hurricane Forecast Above Normal Conditions Mean Increased Storm Risk

May 29, 2025

Us Summer Hurricane Forecast Above Normal Conditions Mean Increased Storm Risk

May 29, 2025 -

Harvards Elitism Fueling Trumps Political Attacks

May 29, 2025

Harvards Elitism Fueling Trumps Political Attacks

May 29, 2025 -

Cnn Investigation Into Truck Explosion After Possible Propane Leak

May 29, 2025

Cnn Investigation Into Truck Explosion After Possible Propane Leak

May 29, 2025