6.46% Gain For Robinhood (HOOD) On June 3rd: Understanding The Market Movement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

6.46% Gain for Robinhood (HOOD) on June 3rd: Understanding the Market Movement

Robinhood (HOOD) experienced a significant surge on June 3rd, closing with a remarkable 6.46% gain. This unexpected jump sparked considerable interest amongst investors and market analysts, prompting questions about the underlying factors driving this positive movement. While pinpointing a single cause is difficult, several contributing elements likely contributed to this impressive performance. Let's delve into the potential reasons behind this noteworthy market shift.

Positive Sentiment and Brokerage Performance:

One key factor influencing HOOD's price increase could be a general improvement in investor sentiment towards the company. After a period of relative stagnation and market volatility, positive news or developments, even if not explicitly announced, can significantly impact stock prices. This could be fueled by improved user engagement metrics, increased trading volumes, or positive press coverage highlighting the platform's evolving features and services.

Overall Market Trends:

It's crucial to consider the broader market context. A positive overall market trend, with major indices experiencing gains, often creates a ripple effect, lifting even individual stocks like Robinhood. The tech sector, in particular, can be highly sensitive to overall market sentiment. If the broader market was experiencing positive momentum on June 3rd, HOOD's gains could be partly attributed to this general upward trend.

Speculation and Short Covering:

The possibility of short covering shouldn't be dismissed. If a significant number of investors were betting against Robinhood (short selling), a sudden shift in sentiment could trigger a wave of short covering, where these investors buy shares to limit potential losses, thus artificially inflating the stock price. This is a common occurrence in volatile markets, and analyzing short interest data around June 3rd could provide further insights.

Regulatory News and Future Outlook:

While no major regulatory announcements directly impacted HOOD on June 3rd, the ever-changing regulatory landscape for online brokerages is a constant factor influencing investor confidence. Any positive news concerning regulatory developments, even indirectly related to Robinhood, could contribute to increased investor optimism and subsequent price appreciation. Future growth projections and the company's overall long-term strategy also play a crucial role in influencing investor decisions.

Analyzing the Data:

To gain a more comprehensive understanding of the June 3rd surge, detailed analysis of trading volume, options activity, and investor sentiment indicators is necessary. Examining the price movements throughout the day, alongside other market data, provides a more nuanced picture. Resources like and offer valuable historical data for such analysis.

Conclusion:

The 6.46% gain for Robinhood (HOOD) on June 3rd was likely a confluence of factors, ranging from positive investor sentiment and broader market trends to potential short covering and future growth expectations. While isolating one single cause is challenging, a comprehensive analysis of market data and relevant news is crucial for understanding this significant price movement. Investors should continue monitoring HOOD's performance, paying close attention to company announcements, market trends, and regulatory developments for a clearer understanding of its future trajectory. Remember to always conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 6.46% Gain For Robinhood (HOOD) On June 3rd: Understanding The Market Movement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

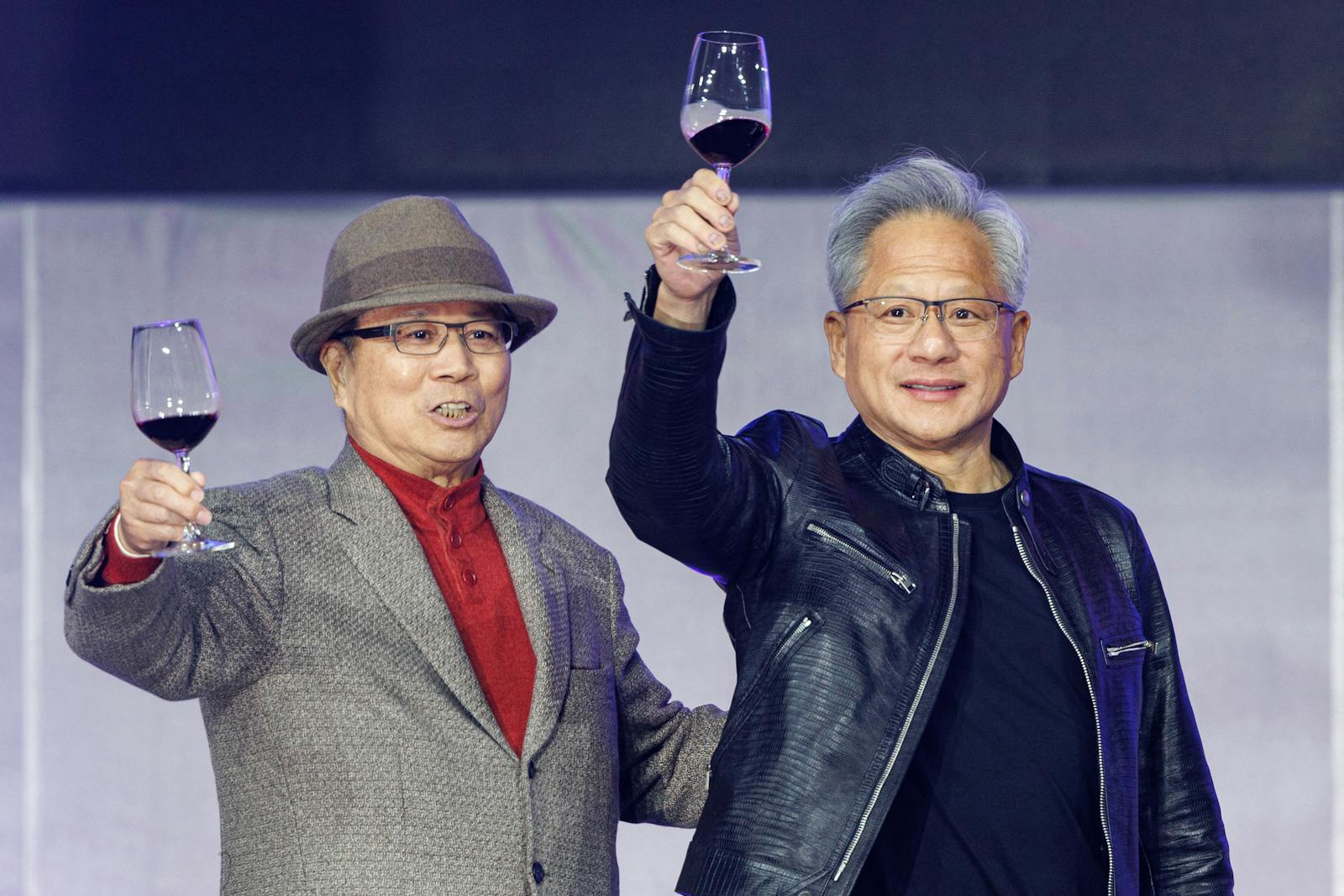

Is Nvidias Core Weave Set To Dominate Analyzing Its Path To Us Business Leadership

Jun 06, 2025

Is Nvidias Core Weave Set To Dominate Analyzing Its Path To Us Business Leadership

Jun 06, 2025 -

Ukraines Recent Airfield Attacks A Strategic Turning Point Or Tactical Success

Jun 06, 2025

Ukraines Recent Airfield Attacks A Strategic Turning Point Or Tactical Success

Jun 06, 2025 -

Statement Regarding Villanova Universitys Departure From Caa Football

Jun 06, 2025

Statement Regarding Villanova Universitys Departure From Caa Football

Jun 06, 2025 -

Joe Sacco From Bruins To New Nhl Team Staff Role Confirmed

Jun 06, 2025

Joe Sacco From Bruins To New Nhl Team Staff Role Confirmed

Jun 06, 2025 -

Is Marvels New Black Panther A Step Forward Or A Misstep Fan Reactions Explode

Jun 06, 2025

Is Marvels New Black Panther A Step Forward Or A Misstep Fan Reactions Explode

Jun 06, 2025

Latest Posts

-

Trumps 12 Country Travel Ban Details And Ongoing Controversy

Jun 07, 2025

Trumps 12 Country Travel Ban Details And Ongoing Controversy

Jun 07, 2025 -

The Stakes Are High Germanys New Leader And His First Meeting With Trump

Jun 07, 2025

The Stakes Are High Germanys New Leader And His First Meeting With Trump

Jun 07, 2025 -

Environmental Emergency Diesel Spill At Baltimores Inner Harbor

Jun 07, 2025

Environmental Emergency Diesel Spill At Baltimores Inner Harbor

Jun 07, 2025 -

White Lotus Stars Address The Rumors Goggins And Wood On Instagram Unfollows And A Cut Love Scene

Jun 07, 2025

White Lotus Stars Address The Rumors Goggins And Wood On Instagram Unfollows And A Cut Love Scene

Jun 07, 2025 -

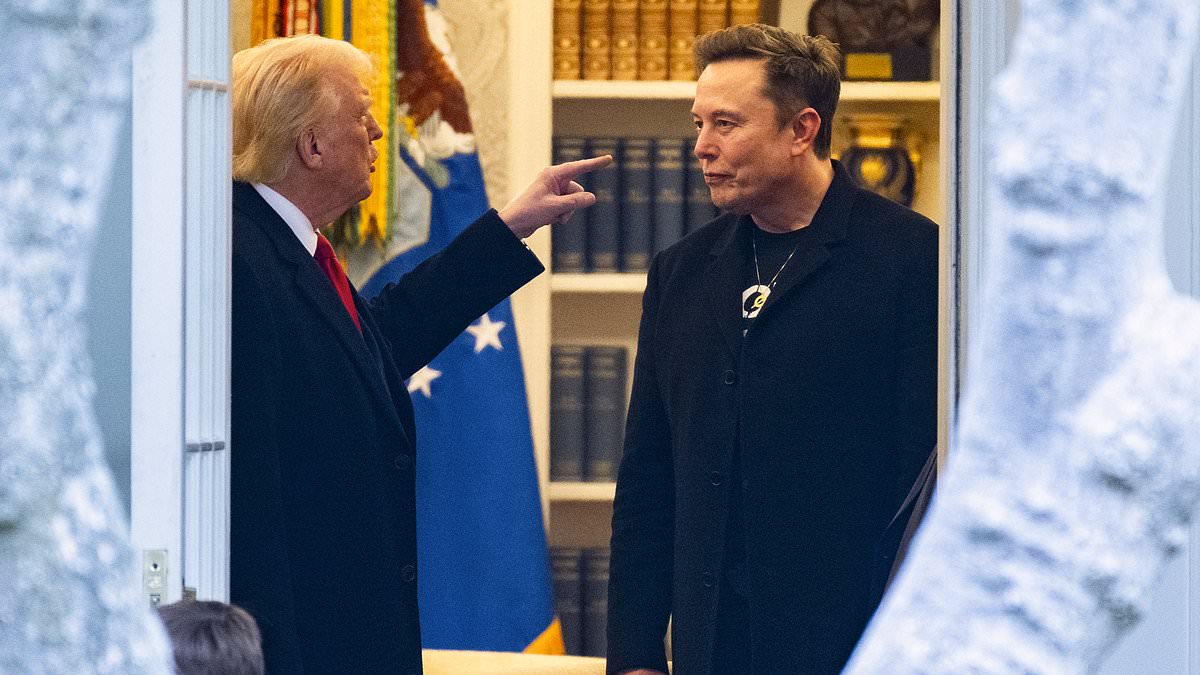

Behind Trump And Musks Rift A Powerful Advisors Influence

Jun 07, 2025

Behind Trump And Musks Rift A Powerful Advisors Influence

Jun 07, 2025