$9 Billion Bitcoin Exit: Early Investors Cashing Out?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$9 Billion Bitcoin Exit: Are Early Investors Finally Cashing Out?

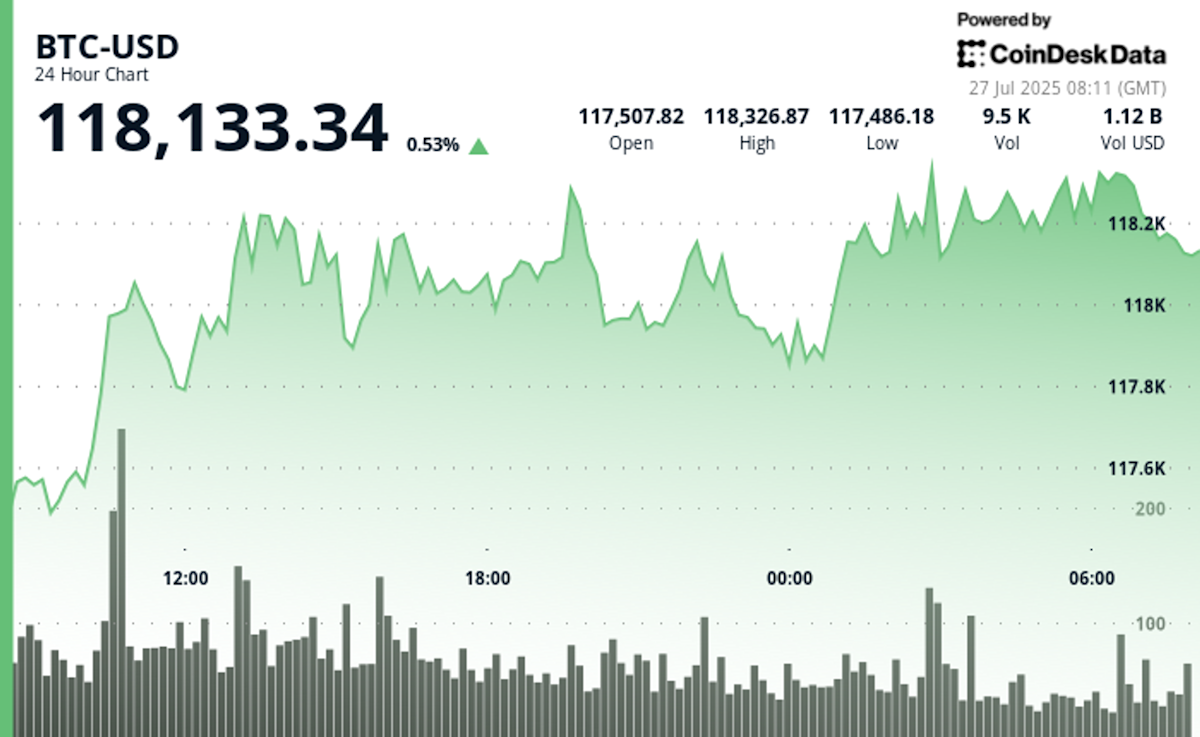

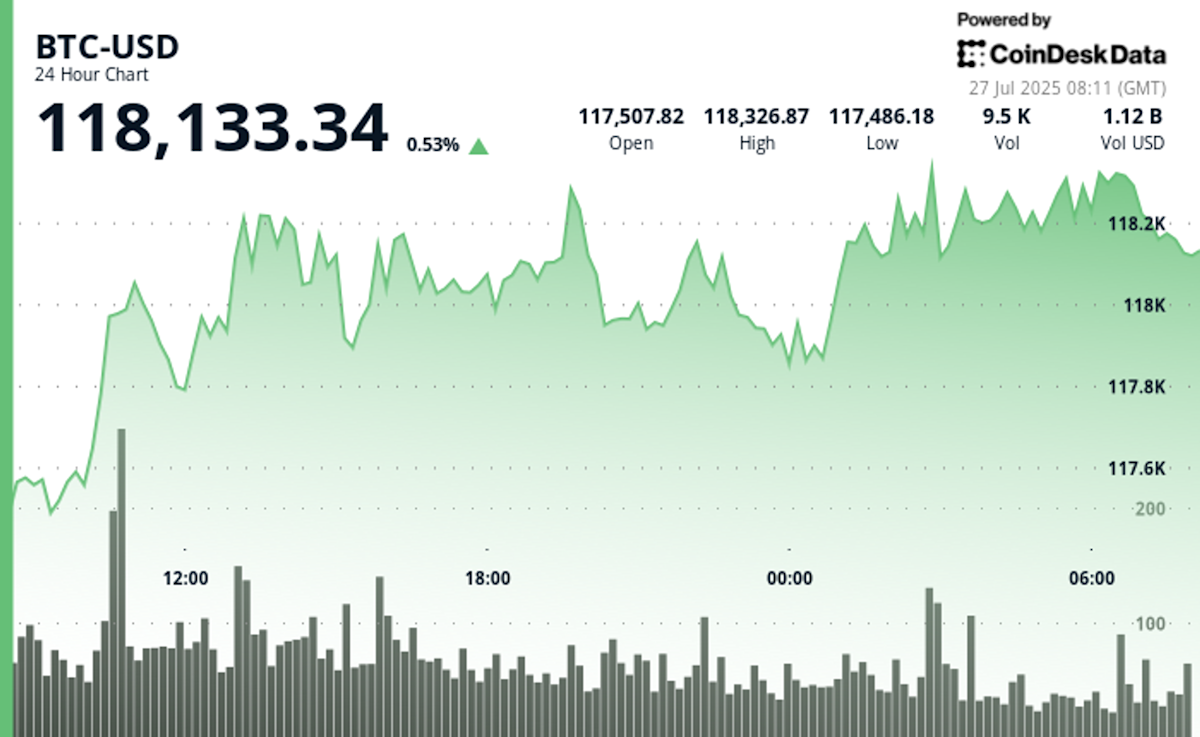

The cryptocurrency market has witnessed a significant outflow of Bitcoin, with approximately $9 billion worth of the digital asset reportedly leaving exchanges in recent weeks. This massive movement has sparked intense speculation, with many analysts questioning whether early Bitcoin investors are finally realizing their long-held gains. This unprecedented shift raises crucial questions about the future trajectory of Bitcoin's price and the overall health of the cryptocurrency market.

The Significance of the $9 Billion Outflow

The sheer scale of the Bitcoin exodus is undeniably noteworthy. Nine billion dollars represents a substantial portion of the daily trading volume, suggesting a coordinated or significantly large-scale movement of funds. This isn't just small-time traders; this points to significant players exiting the market. Such a large-scale withdrawal could indicate several factors, including:

- Profit-Taking: Early Bitcoin investors, who accumulated their holdings at significantly lower prices, might be taking profits after years of waiting for substantial returns. With Bitcoin reaching record highs in the past, this seems a plausible explanation.

- Regulatory Uncertainty: Growing regulatory scrutiny of cryptocurrencies globally could be prompting some investors to secure their assets outside of exchange platforms, perceived as vulnerable targets.

- Market Consolidation: Large institutional investors might be consolidating their holdings, moving their Bitcoin to more secure, private wallets. This strategy minimizes exposure to exchange vulnerabilities and potential hacks.

- Shifting Market Sentiment: A potential bearish market sentiment, fueled by macroeconomic factors or negative news impacting the crypto space, could be driving investors to secure their gains.

Who Are the Players? Identifying the Source of the Outflow

Pinpointing the exact source of this massive outflow remains a challenge. The decentralized nature of Bitcoin makes tracing the movement of funds difficult. However, several potential scenarios exist:

- Whales: Large institutional investors, often referred to as "whales," possess enough Bitcoin to significantly impact the market. Their actions, whether selling or moving their holdings, can trigger significant price fluctuations.

- Early Adopters: Individuals who invested in Bitcoin during its early days are now sitting on substantial profits, creating an incentive to cash out, at least partially.

- Institutional Investors: Major financial institutions that have cautiously entered the crypto market might be adjusting their portfolios, leading to the observed outflow.

Impact on Bitcoin Price and Market Sentiment

The $9 billion Bitcoin exit has already created ripples in the market. While the price hasn't plummeted drastically, it has experienced some volatility. The impact on long-term price trends remains uncertain. However, this significant sell-off could signal a period of consolidation or even a temporary correction. [Link to a reputable cryptocurrency news source discussing recent price fluctuations].

Looking Ahead: What Does This Mean for the Future of Bitcoin?

While the recent outflow is undeniably significant, it doesn't necessarily signal the end of Bitcoin's journey. The long-term potential of Bitcoin as a decentralized digital currency remains strong, backed by growing adoption and technological advancements. The crucial factor to watch is whether this outflow signals a broader trend or simply a temporary correction in the market. Further analysis is needed to accurately predict the long-term consequences.

Call to Action: Stay informed about cryptocurrency market trends by following reputable news sources and engaging in informed discussions within the community. Remember, investing in cryptocurrencies carries inherent risks, and conducting thorough research before making any decisions is crucial.

Keywords: Bitcoin, Cryptocurrency, $9 Billion, Bitcoin Outflow, Exchange Outflow, Bitcoin Price, Cryptocurrency Market, Bitcoin Investors, Whale, Institutional Investors, Regulatory Uncertainty, Market Sentiment, Crypto News, Cryptocurrency Investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $9 Billion Bitcoin Exit: Early Investors Cashing Out?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Summer I Turned Pretty Episode Release Schedule When And How To Watch

Jul 31, 2025

The Summer I Turned Pretty Episode Release Schedule When And How To Watch

Jul 31, 2025 -

Second Times The Charm Drake Cancels Remaining Australia New Zealand Shows

Jul 31, 2025

Second Times The Charm Drake Cancels Remaining Australia New Zealand Shows

Jul 31, 2025 -

Google Expands Ai Search Capabilities To The United Kingdom

Jul 31, 2025

Google Expands Ai Search Capabilities To The United Kingdom

Jul 31, 2025 -

Eu Vs China Comparing Trumps Trade Approaches And Their Effectiveness

Jul 31, 2025

Eu Vs China Comparing Trumps Trade Approaches And Their Effectiveness

Jul 31, 2025 -

Ueniversite Tercihinde Yol Haritaniz 2 Yillik Ve 4 Yillik Boeluem Taban Puanlari Ve Siralamalari

Jul 31, 2025

Ueniversite Tercihinde Yol Haritaniz 2 Yillik Ve 4 Yillik Boeluem Taban Puanlari Ve Siralamalari

Jul 31, 2025