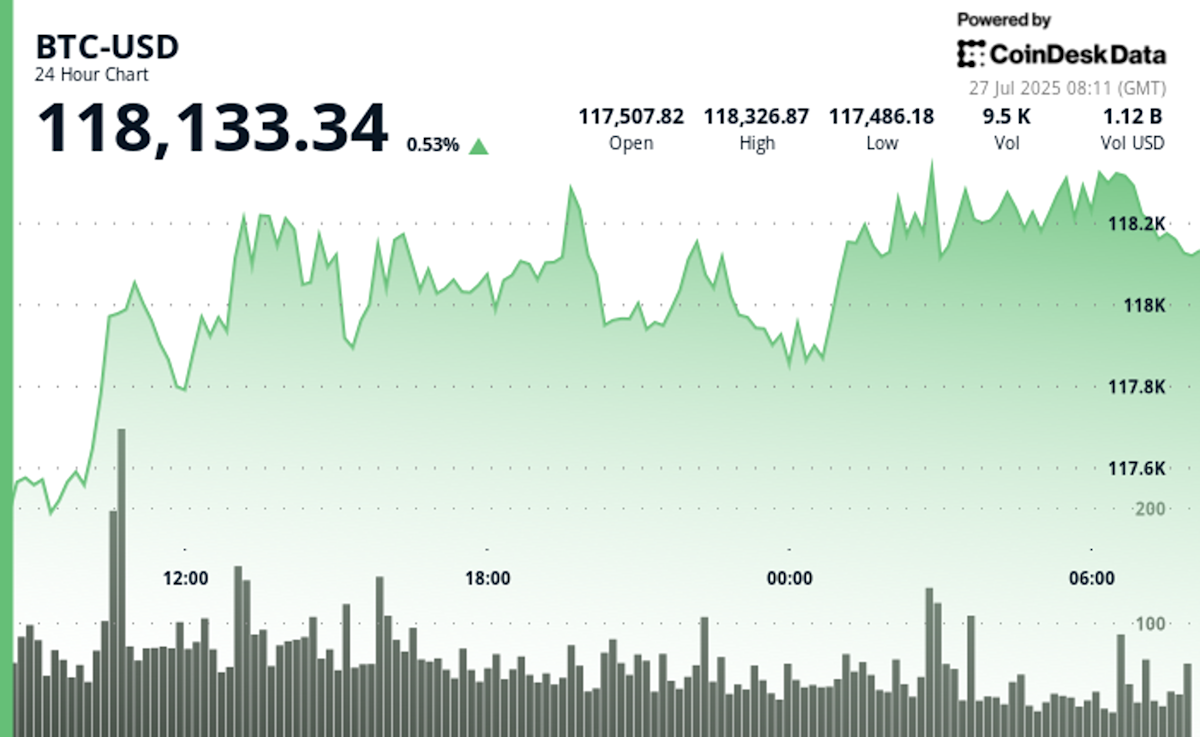

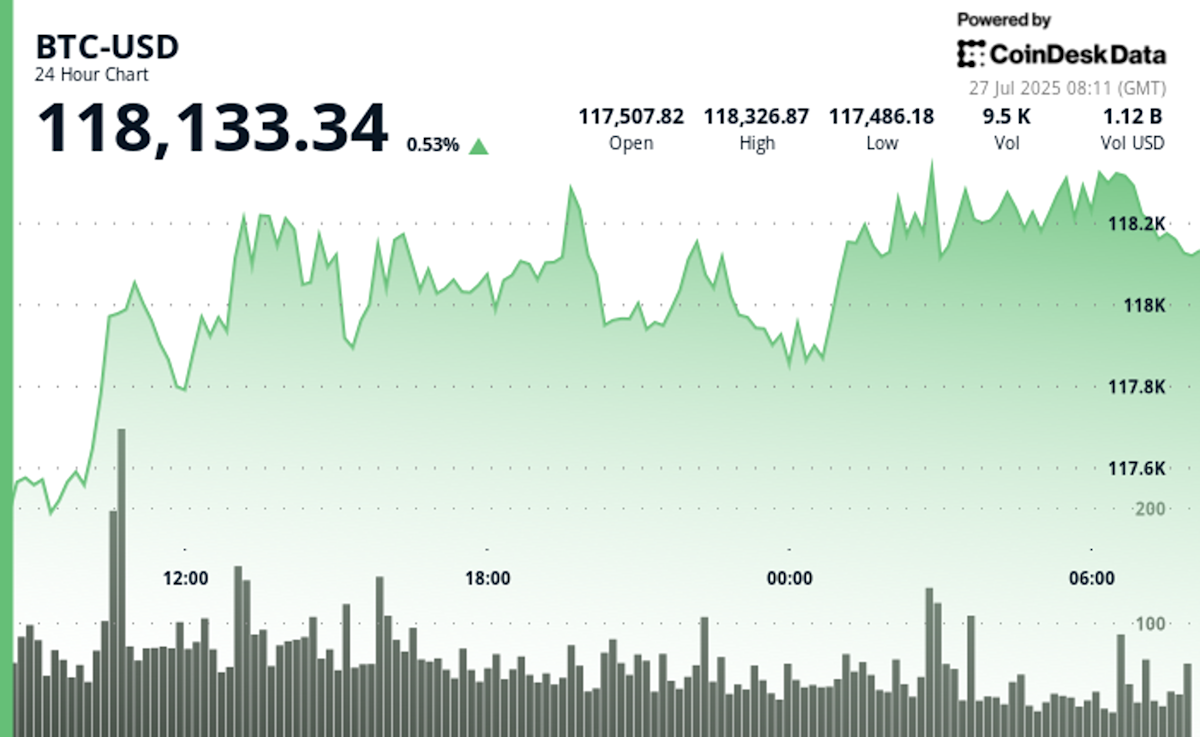

$9 Billion Bitcoin Sell-Off: A Sign Of Market Weakness?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$9 Billion Bitcoin Sell-Off: A Sign of Market Weakness or a Buying Opportunity?

The cryptocurrency market experienced a significant shockwave last week, with a staggering $9 billion sell-off in Bitcoin (BTC) sending ripples through the digital asset landscape. This dramatic drop sparked immediate concerns amongst investors, prompting questions about the overall health and future direction of the Bitcoin market. Is this a sign of underlying weakness, or a temporary dip presenting a strategic buying opportunity for savvy investors? Let's delve into the details and explore the possible interpretations.

The $9 Billion Question: What Caused the Sell-Off?

Pinpointing the exact cause of such a substantial sell-off is challenging, as multiple factors often intertwine to create market volatility. However, several key elements likely contributed to the recent downturn:

-

Regulatory Uncertainty: Ongoing regulatory scrutiny of cryptocurrencies, particularly in the United States, continues to create uncertainty and nervousness among investors. The SEC's aggressive stance on certain crypto projects fuels fear and prompts some to liquidate holdings. [Link to relevant SEC news article]

-

Macroeconomic Factors: Global macroeconomic conditions, including high inflation and rising interest rates, significantly impact investor sentiment. These factors often lead investors to shift their capital towards more conservative assets, reducing investment in riskier ventures like Bitcoin. [Link to relevant macroeconomic news article]

-

Whale Activity: The actions of large institutional investors, often referred to as "whales," can significantly influence market prices. A large-scale liquidation by a significant holder could trigger a cascade effect, leading to a rapid price drop. Analyzing on-chain data can sometimes shed light on such activities, though confirming specific actors remains difficult. [Link to on-chain analysis resource]

-

Technical Indicators: Various technical indicators, such as moving averages and Relative Strength Index (RSI), may have suggested an overbought condition before the sell-off, prompting some traders to take profits or even initiate short positions. Understanding these indicators requires a solid grasp of technical analysis. [Link to educational resource on technical analysis]

Is this the Beginning of a Bear Market?

While the $9 billion sell-off is undoubtedly concerning, labeling it definitive proof of a bear market is premature. Historically, Bitcoin’s price has experienced significant fluctuations, and short-term volatility is a characteristic feature of the cryptocurrency market.

Several analysts suggest that this could be a temporary correction within a longer-term bullish trend. They point to the underlying adoption of Bitcoin by institutional investors and its potential as a hedge against inflation as reasons for optimism.

Opportunities Amidst the Volatility?

For experienced and risk-tolerant investors, this sell-off might present a strategic buying opportunity. The discounted price could offer a chance to accumulate Bitcoin at a lower cost, potentially reaping significant rewards if the market rebounds. However, it's crucial to remember that investing in cryptocurrencies carries substantial risk.

Conclusion: Navigating the Crypto Landscape

The $9 billion Bitcoin sell-off highlights the inherent volatility of the cryptocurrency market. While the causes are multi-faceted and complex, understanding these influencing factors is vital for informed decision-making. The sell-off shouldn't necessarily be interpreted as an immediate sign of a prolonged bear market, but rather as a reminder of the risks involved in cryptocurrency investments. Always conduct thorough research and only invest what you can afford to lose.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves significant risk, and past performance is not indicative of future results. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $9 Billion Bitcoin Sell-Off: A Sign Of Market Weakness?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Canadas Palestine Recognition Impact On Us Canada Trade Relations

Jul 31, 2025

Canadas Palestine Recognition Impact On Us Canada Trade Relations

Jul 31, 2025 -

Ice Cube Faces Alien Invasion War Of The Worlds Trailer Breakdown

Jul 31, 2025

Ice Cube Faces Alien Invasion War Of The Worlds Trailer Breakdown

Jul 31, 2025 -

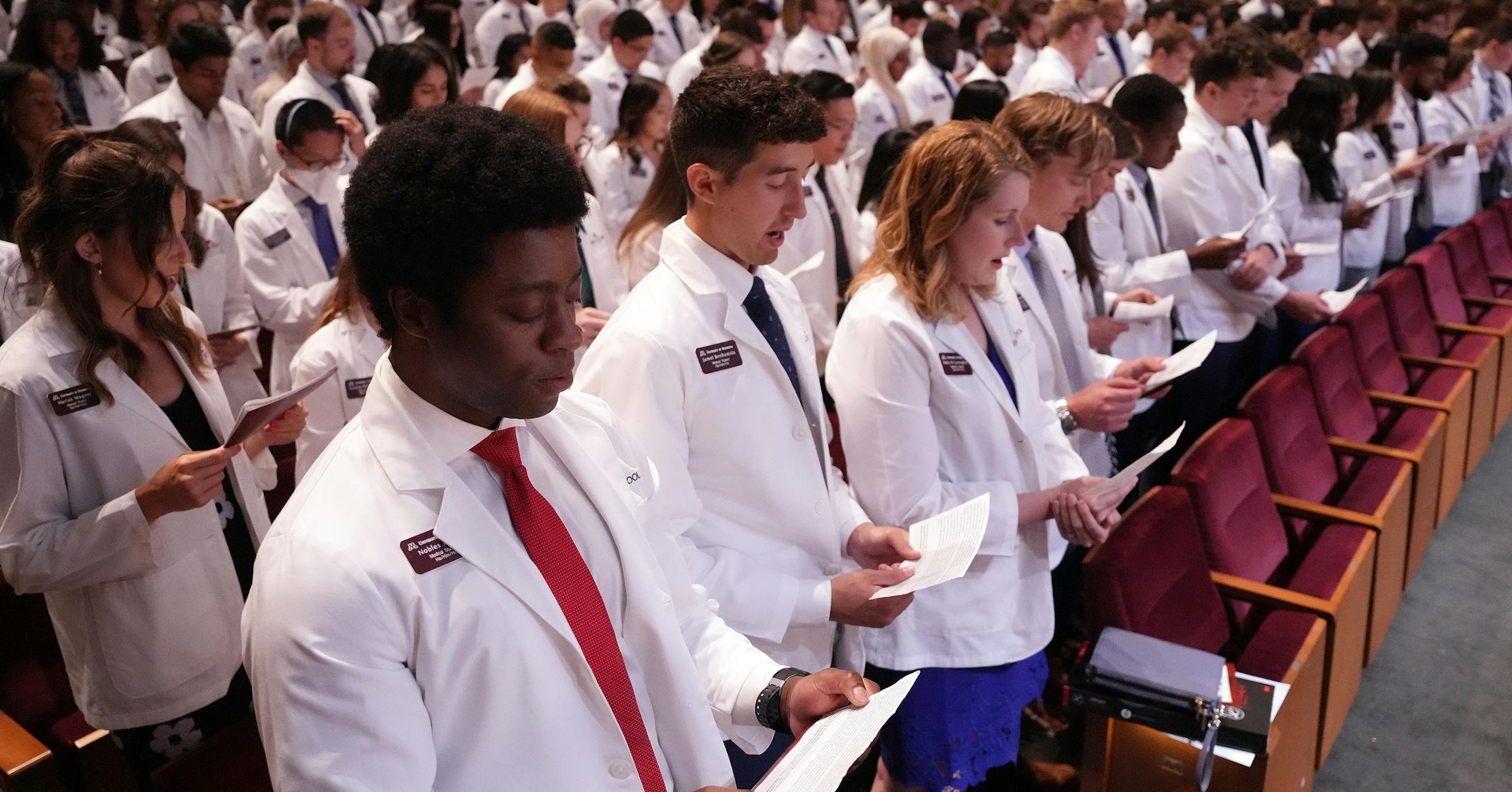

Federal Student Loan Changes Impact On Law And Medical School Aspirations

Jul 31, 2025

Federal Student Loan Changes Impact On Law And Medical School Aspirations

Jul 31, 2025 -

Shopping Addiction Impact On Mental Health And Financial Wellbeing

Jul 31, 2025

Shopping Addiction Impact On Mental Health And Financial Wellbeing

Jul 31, 2025 -

Is Air Travel Getting Bumpier The Rise Of Turbulence Explained

Jul 31, 2025

Is Air Travel Getting Bumpier The Rise Of Turbulence Explained

Jul 31, 2025

Latest Posts

-

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025 -

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025 -

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025 -

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025