9 Proven Methods To Fund Your Child's College Education

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

9 Proven Methods to Fund Your Child's College Education

The soaring cost of higher education is a major concern for many parents. Planning for your child's college education shouldn't be a daunting task; with careful planning and proactive strategies, you can significantly reduce the financial burden. This article outlines nine proven methods to help you fund your child's college education, easing the financial strain and paving the way for a brighter future.

1. Start Saving Early: The Power of Compound Interest

One of the most effective strategies is to begin saving early. The magic of compound interest allows your savings to grow exponentially over time. Even small, consistent contributions to a 529 plan or other college savings account can accumulate significantly over the years. Consider automating your savings to ensure regular contributions, no matter your income. The earlier you start, the less you'll need to save each month.

2. 529 Plans: A Tax-Advantaged Savings Vehicle

529 plans are state-sponsored education savings plans offering significant tax advantages. Contributions are often tax-deductible, and earnings grow tax-deferred. Withdrawals used for qualified education expenses are also tax-free. Research different 529 plans offered by various states to find the one that best suits your needs and offers the most favorable tax benefits. Learn more about the nuances of 529 plans on the .

3. Custodial Accounts (UTMA/UGMA): Flexibility and Growth

Uniform Transfer to Minors Act (UTMA) and Uniform Gift to Minors Act (UGMA) accounts allow you to gift assets to your child, which can be used for college expenses. These accounts offer flexibility, but keep in mind that the assets become the child's property at the age of majority (18 or 21 depending on the state). Consult a financial advisor to understand the implications and potential tax consequences.

4. ESAs (Education Savings Accounts): A Less Common but Potentially Beneficial Option

Education Savings Accounts (ESAs), while less prevalent than 529 plans, offer similar tax advantages. However, ESAs have contribution limits, and the funds must be used by the beneficiary's age 30. Research the benefits and limitations carefully before considering this option.

5. Scholarships and Grants: Free Money for College

Don't underestimate the power of scholarships and grants! These are forms of financial aid that don't need to be repaid. Begin searching for scholarships early, utilizing online databases like and . Explore scholarships based on merit, academic achievement, extracurricular activities, and community involvement.

6. Federal Student Loans: A Last Resort Option

Federal student loans should be considered a last resort, only after exploring all other funding options. While they can cover a significant portion of college costs, they come with the burden of repayment, along with accruing interest. Understanding the different types of federal student loans and repayment plans is crucial. Visit the for comprehensive information.

7. Private Student Loans: Proceed with Caution

Private student loans are offered by banks and credit unions. They often come with higher interest rates than federal loans and may require a co-signer. Explore this option carefully and only if you've exhausted all other avenues. Compare interest rates and repayment terms from different lenders before committing.

8. Part-Time Jobs and Summer Employment:

Encourage your child to explore part-time jobs or summer employment to contribute towards their college expenses. This not only reduces the financial burden but also instills valuable work ethic and financial responsibility.

9. Work-Study Programs:

Many colleges offer work-study programs, providing students with part-time employment opportunities on campus. These programs can help students earn money while pursuing their education.

Planning Ahead is Key

Funding your child's college education requires proactive planning and a diversified approach. By combining several of these strategies, you can create a comprehensive financial plan that significantly reduces the financial strain and sets your child up for success. Remember to consult with a financial advisor for personalized guidance based on your specific circumstances. Don't delay – start planning today!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 9 Proven Methods To Fund Your Child's College Education. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hardship Signing Fever Bolster Lineup At Point Guard

Jun 03, 2025

Hardship Signing Fever Bolster Lineup At Point Guard

Jun 03, 2025 -

New Years Day Hike Tragedy Body Of Missing Hiker Located In Dolomites

Jun 03, 2025

New Years Day Hike Tragedy Body Of Missing Hiker Located In Dolomites

Jun 03, 2025 -

Beat The Rush Find The Best Last Minute Summer Flight Deals

Jun 03, 2025

Beat The Rush Find The Best Last Minute Summer Flight Deals

Jun 03, 2025 -

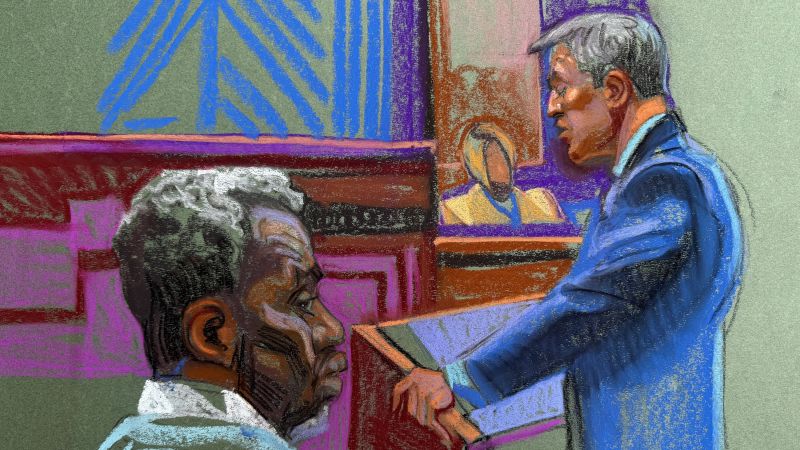

Sean Diddy Combs Faces Court A Look At The Ongoing Trial

Jun 03, 2025

Sean Diddy Combs Faces Court A Look At The Ongoing Trial

Jun 03, 2025 -

Tom Daley Speaks Out Providing Support For Closeted Athletes

Jun 03, 2025

Tom Daley Speaks Out Providing Support For Closeted Athletes

Jun 03, 2025

Latest Posts

-

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025 -

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025 -

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025 -

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025 -

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025