9 Proven Methods To Fund Your Child's College Education (Even If You Started Late)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

9 Proven Methods to Fund Your Child's College Education (Even if You Started Late)

Planning for your child's college education can feel overwhelming, especially if you feel you've started late. The rising cost of tuition makes saving seem like an insurmountable task, but don't despair! With careful planning and a proactive approach, you can still secure a bright future for your child. This article outlines nine proven methods to fund your child's college education, even if you're facing a time crunch.

The Importance of Early Planning (But It's Not Too Late!)

While starting early is ideal, it's never too late to begin saving. The sooner you start, the more time your investments have to grow, leveraging the power of compounding interest. However, even if you're behind schedule, several strategies can help you bridge the funding gap. Let's explore them:

1. 529 Plans: A Powerful Savings Vehicle

529 plans are tax-advantaged savings plans designed specifically for education expenses. Contributions grow tax-deferred, and withdrawals used for qualified education expenses are tax-free. Many states offer state-sponsored plans with potential tax benefits for residents. Learn more about . (This is an example external link – replace with relevant links based on location).

2. ESAs (Education Savings Accounts): Another Tax-Advantaged Option

Education Savings Accounts, or ESAs, offer similar tax advantages to 529 plans but with slightly different contribution limits and usage rules. They're worth considering as a supplemental savings tool. Explore the to determine the best fit for your needs. (This is an example external link – replace with relevant links based on location).

3. Custodial Accounts: Investing for the Future

Custodial accounts, like UTMA (Uniform Transfers to Minors Act) or UGMA (Uniform Gift to Minors Act) accounts, allow you to invest money in your child's name. While the assets belong to the child upon reaching the age of majority, the early start allows for significant growth potential. However, be mindful of the potential impact on financial aid eligibility.

4. Government Grants and Scholarships: Free Money for College

Don't underestimate the power of free money! Numerous federal and state grants, as well as private scholarships, are available. Diligent research and application are key. Websites like and are excellent resources to explore.

5. Federal Student Loans: A Last Resort (But Still an Option)

Federal student loans offer relatively low interest rates compared to private loans. While borrowing should be a last resort, they can play a vital role in bridging funding gaps. Carefully explore repayment options and understand the long-term implications of student loan debt. Learn more about .

6. Part-Time Jobs and Summer Employment: Teaching Financial Responsibility

Encourage your child to work part-time jobs or take on summer employment. This instills financial responsibility and can significantly contribute towards college expenses.

7. Community College: A Cost-Effective Alternative

Consider starting with community college for the first two years. Community colleges offer significantly lower tuition rates than four-year universities, allowing you to save money while your child earns credits that can often be transferred.

8. Negotiate Tuition: Explore Options for Reduced Costs

Don't hesitate to negotiate tuition with the college or university. Many institutions offer financial aid packages based on demonstrated need, and some might be willing to negotiate based on your circumstances.

9. Crowdfunding Platforms: Harness the Power of Community

Consider utilizing crowdfunding platforms to raise funds. While it requires effort and transparency, it can be a surprisingly effective method, especially if you have a strong network of family and friends.

Conclusion: Planning is Key, Even When Time is Short

Funding your child's college education requires proactive planning and a multifaceted approach. While starting early is ideal, it's crucial to remember that it's never too late to begin. By strategically utilizing the methods outlined above, you can significantly increase your chances of achieving your financial goals, paving the way for your child's successful future. Remember to seek professional financial advice tailored to your specific circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 9 Proven Methods To Fund Your Child's College Education (Even If You Started Late). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

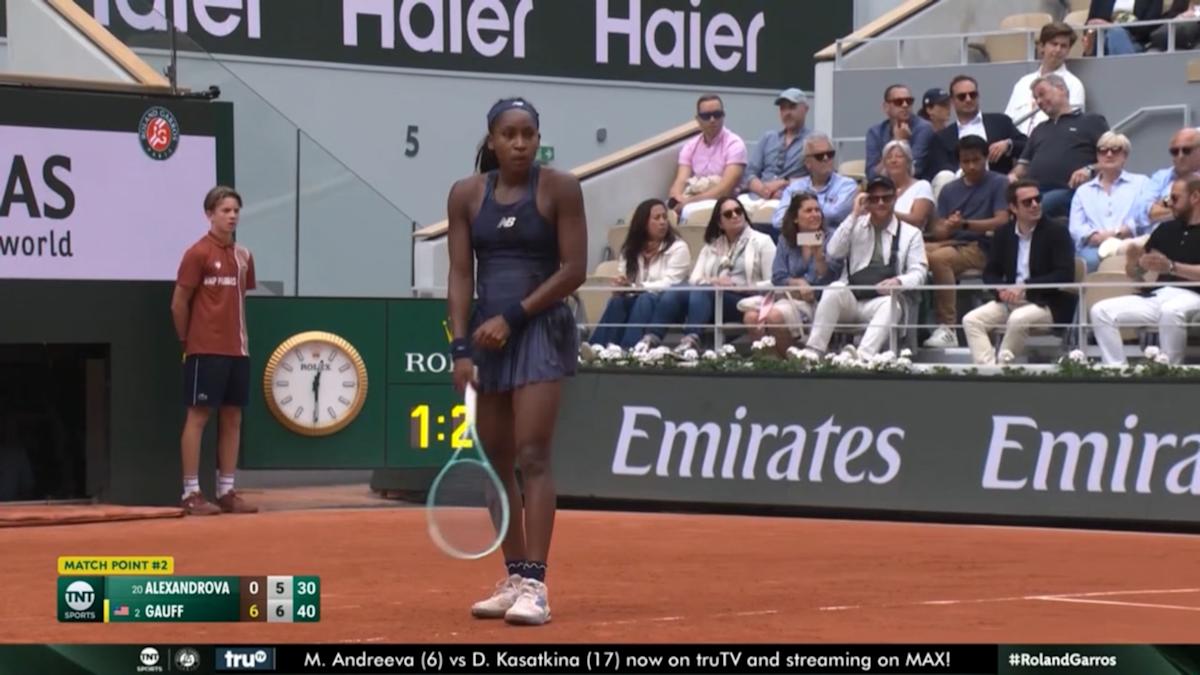

Strong Us Showing Eight Americans Move On At Roland Garros

Jun 04, 2025

Strong Us Showing Eight Americans Move On At Roland Garros

Jun 04, 2025 -

Grace Potter Unlocking The Archives A Deep Dive Into Her Musical Vault

Jun 04, 2025

Grace Potter Unlocking The Archives A Deep Dive Into Her Musical Vault

Jun 04, 2025 -

Supreme Court Agrees To Review Illinois Absentee Ballot Lawsuit

Jun 04, 2025

Supreme Court Agrees To Review Illinois Absentee Ballot Lawsuit

Jun 04, 2025 -

Premature Babys Wound Healed With Fish Skin A Texas Familys Story Of Hope

Jun 04, 2025

Premature Babys Wound Healed With Fish Skin A Texas Familys Story Of Hope

Jun 04, 2025 -

Katherine Hill Pontardawe Mother Sentenced For Misappropriating Daughters Funds

Jun 04, 2025

Katherine Hill Pontardawe Mother Sentenced For Misappropriating Daughters Funds

Jun 04, 2025

Latest Posts

-

Paige De Sorbo Leaving Summer House After Season 7

Jun 05, 2025

Paige De Sorbo Leaving Summer House After Season 7

Jun 05, 2025 -

Robinhood Stock Is It Still A Buy In 2024

Jun 05, 2025

Robinhood Stock Is It Still A Buy In 2024

Jun 05, 2025 -

Robinhood Markets Inc Hood 6 46 Share Price Increase On June 3rd

Jun 05, 2025

Robinhood Markets Inc Hood 6 46 Share Price Increase On June 3rd

Jun 05, 2025 -

Confirmed Joe Sacco Parts Ways With Bruins Joins Team Name

Jun 05, 2025

Confirmed Joe Sacco Parts Ways With Bruins Joins Team Name

Jun 05, 2025 -

Investigation Launched Into Cardiac Surgery Deaths At Uk Nhs Hospital

Jun 05, 2025

Investigation Launched Into Cardiac Surgery Deaths At Uk Nhs Hospital

Jun 05, 2025