9 Proven Ways To Fund Your Child's College Education (Even If You Started Late)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

9 Proven Ways to Fund Your Child's College Education (Even If You Started Late)

The soaring cost of higher education is a significant concern for many parents. The dream of sending your child to college can feel daunting, especially if you haven't started saving early. But don't despair! It's never too late to begin planning and securing funding for your child's higher education. This article outlines nine proven strategies to help you navigate the financial landscape and make college a reality, even if you're starting later than ideal.

1. Embrace the Power of 529 Plans:

529 education savings plans offer significant tax advantages. Contributions are often tax-deductible at the state level, and earnings grow tax-free as long as the funds are used for qualified education expenses. Even starting small, consistent contributions can make a substantial difference over time. Explore your state's 529 plan options and compare them to understand the benefits and potential drawbacks. [Link to a reputable source on 529 plans, e.g., Savingforcollege.com]

2. Explore Federal and State Grants:

Financial aid is crucial for many families. The Free Application for Federal Student Aid (FAFSA) is your gateway to federal grants, loans, and work-study opportunities. Submitting the FAFSA is vital, regardless of your income level. Furthermore, research state-specific grant programs, as many states offer additional financial assistance to their residents. [Link to the official FAFSA website]

3. Maximize Scholarships:

Don't underestimate the power of scholarships! Countless scholarships exist, targeting various demographics, talents, and academic achievements. Websites like Fastweb and Scholarships.com are excellent resources for searching and applying. Encourage your child to actively participate in the scholarship application process. The effort invested can significantly reduce the overall college costs.

4. Leverage Employer-Sponsored Tuition Assistance:

Many employers offer tuition reimbursement or assistance programs for their employees' children or dependents. Check with your human resources department to see if such a benefit is available. This can be a significant boost to your college funding strategy.

5. Consider Private Loans (with Caution):

Private student loans can fill the gap between other funding sources. However, approach them cautiously. Compare interest rates and terms carefully before committing. Understand the implications of borrowing, including potential long-term debt. [Link to a reputable source comparing student loan options]

6. Part-Time Jobs and Summer Employment:

Encourage your child to take on part-time jobs during the school year or full-time employment during summer breaks. This instills valuable work ethic and reduces the overall financial burden.

7. Explore Community College Options:

Consider starting with two years at a community college. Community colleges offer significantly lower tuition rates than four-year universities. Students can then transfer their credits to a four-year institution to complete their bachelor's degree.

8. Look Into Educational Loans from Family and Friends:

Discuss borrowing options with family and friends. Establishing a clear repayment plan with a written agreement is crucial for maintaining healthy relationships.

9. Reassess Spending Habits:

Review your family budget and identify areas where you can cut expenses. Every dollar saved contributes to your college savings goal. Consider creating a dedicated college savings account and regularly transferring funds.

Conclusion:

Funding your child's college education doesn't have to be an insurmountable challenge. By strategically employing these nine methods, you can significantly increase your chances of success, even if you started saving later than you'd hoped. Remember, proactive planning, diligent research, and a commitment to saving are key ingredients to achieving this important financial goal. Start today, and pave the way for your child's bright future!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 9 Proven Ways To Fund Your Child's College Education (Even If You Started Late). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

David Joseph Craigs I Dont Understand You A Directorial Coming Of Age Story

Jun 04, 2025

David Joseph Craigs I Dont Understand You A Directorial Coming Of Age Story

Jun 04, 2025 -

Cant Stop Watching Netflix Series Hooks Viewers With Eight Episode Story

Jun 04, 2025

Cant Stop Watching Netflix Series Hooks Viewers With Eight Episode Story

Jun 04, 2025 -

Impact Of Ronny Mauricios Call Up On The Mets Lineup

Jun 04, 2025

Impact Of Ronny Mauricios Call Up On The Mets Lineup

Jun 04, 2025 -

Warren Buffetts Portfolio Shakeup Bank Of America Down Consumer Brand Up

Jun 04, 2025

Warren Buffetts Portfolio Shakeup Bank Of America Down Consumer Brand Up

Jun 04, 2025 -

Etna Volcano Erupts In Italy Significant Ash Plume Reported

Jun 04, 2025

Etna Volcano Erupts In Italy Significant Ash Plume Reported

Jun 04, 2025

Latest Posts

-

Official Villanova Wildcats Accept Patriot League Invitation For Football

Jun 06, 2025

Official Villanova Wildcats Accept Patriot League Invitation For Football

Jun 06, 2025 -

Analysis Villanovas Decision To Depart Caa Football Conference

Jun 06, 2025

Analysis Villanovas Decision To Depart Caa Football Conference

Jun 06, 2025 -

Singer Jessie J Reveals Battle With Early Stage Breast Cancer

Jun 06, 2025

Singer Jessie J Reveals Battle With Early Stage Breast Cancer

Jun 06, 2025 -

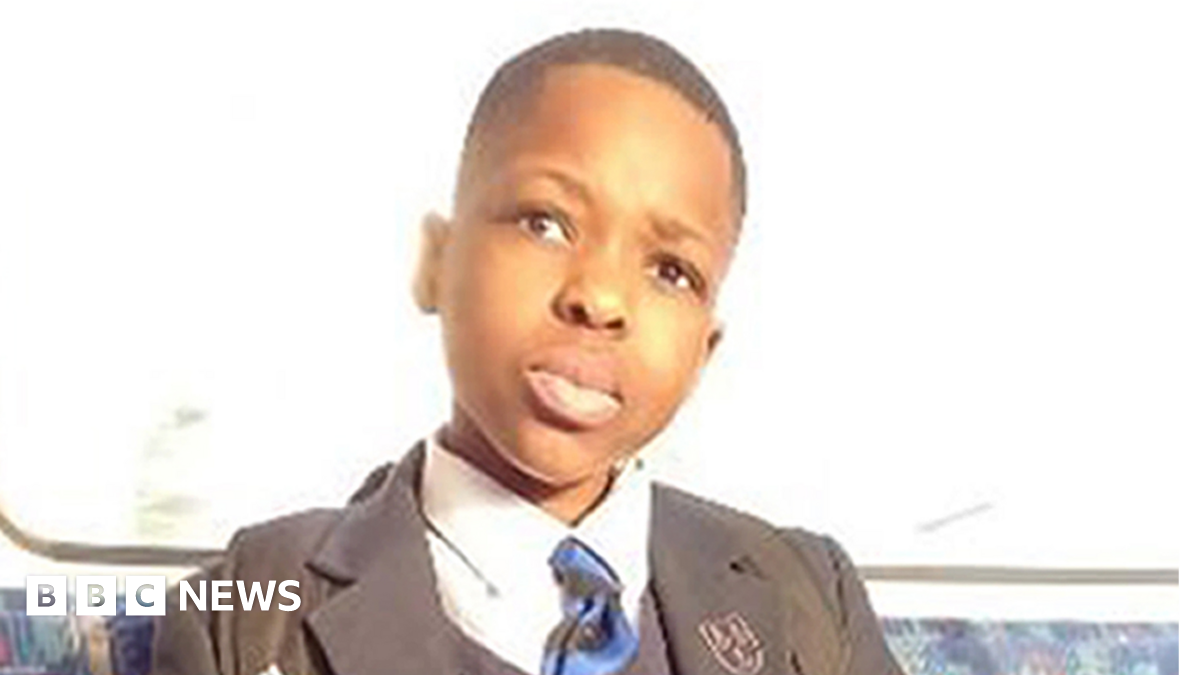

Daniel Anjorin Murder Case Accused Marcus Monzos Intent Revealed In Court

Jun 06, 2025

Daniel Anjorin Murder Case Accused Marcus Monzos Intent Revealed In Court

Jun 06, 2025 -

Paige De Sorbos Summer House Era Concludes After Season 7

Jun 06, 2025

Paige De Sorbos Summer House Era Concludes After Season 7

Jun 06, 2025