A 529 Account: Smart Investing For Your Child's College Fund

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

A 529 Account: Smart Investing for Your Child's College Fund

The soaring cost of higher education is a major concern for many parents. Tuition fees, room and board, books, and other expenses can quickly add up to a staggering amount. However, securing your child's future doesn't have to be daunting. One powerful tool that can significantly ease the financial burden is a 529 education savings plan, often referred to as a 529 account. This article explores the benefits and intricacies of 529 accounts, helping you make informed decisions about your child's college fund.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically to help families save for future education expenses. These plans are sponsored by states, state agencies, or educational institutions, and offer significant tax benefits for investors. The money you contribute grows tax-deferred, meaning you won't pay taxes on the investment earnings until they are withdrawn to pay for qualified education expenses. This tax advantage can dramatically increase the amount available for your child's education over time.

Key Advantages of a 529 Account:

- Tax Advantages: As mentioned, the biggest benefit is the tax-deferred growth and tax-free withdrawals for qualified education expenses. This means more money goes towards your child's education, not to Uncle Sam.

- Flexibility: Most 529 plans offer a variety of investment options, allowing you to tailor your investment strategy to your risk tolerance and financial goals. You can choose from age-based portfolios that automatically adjust risk levels as your child gets closer to college, or select individual investments.

- Contribution Limits: While contribution limits exist (varying by state), they are generally quite generous, allowing you to save a substantial amount over time. Check your state's specific limits for the most up-to-date information.

- Gift Tax Benefits: You can make significant contributions to a 529 plan without incurring gift tax implications, making it an ideal vehicle for grandparents or other family members to contribute to a child's education. Larger gifts can be spread over five years using the five-year gift tax exclusion.

- Beneficiary Changes: While typically set up for a specific beneficiary, many 529 plans allow you to change the beneficiary to another family member, providing flexibility if your child decides not to pursue higher education or if circumstances change.

Choosing the Right 529 Plan:

Selecting the right 529 plan requires careful consideration. Factors to consider include:

- Investment Options: Compare the investment options available in different plans. Some offer age-based portfolios, while others allow for more customized investment choices.

- Fees: Pay attention to expense ratios and other fees associated with the plan. Lower fees translate to greater growth for your savings.

- State Tax Deductions: Some states offer state income tax deductions or credits for contributions made to their own state's 529 plan. This can further enhance the tax benefits.

Qualified Education Expenses:

Remember, 529 plan withdrawals are tax-free only when used for qualified education expenses. These include:

- Tuition and fees

- Room and board

- Books and supplies

- Certain technology expenses (laptops, etc.)

- K-12 tuition expenses (up to a certain limit)

Non-Qualified Withdrawals:

Withdrawals used for non-qualified expenses are subject to income tax and a 10% penalty. Therefore, careful planning and accurate record-keeping are essential.

Conclusion:

A 529 account is a powerful tool for securing your child's financial future. By leveraging the tax advantages and investment opportunities offered by these plans, you can significantly reduce the financial burden of higher education. Remember to research different plans, compare fees, and choose the option that best aligns with your financial goals and risk tolerance. Start saving early and watch your child's college fund grow! For more detailed information, consider consulting a qualified financial advisor.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on A 529 Account: Smart Investing For Your Child's College Fund. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Late Start No Problem 9 Strategies To Save For College

Jun 04, 2025

Late Start No Problem 9 Strategies To Save For College

Jun 04, 2025 -

Is This The Next Big Netflix Hit Fans Demand Season 2 Of Hilarious New Show

Jun 04, 2025

Is This The Next Big Netflix Hit Fans Demand Season 2 Of Hilarious New Show

Jun 04, 2025 -

Mets Call Up Ronny Mauricio A Look At His Minor League Performance

Jun 04, 2025

Mets Call Up Ronny Mauricio A Look At His Minor League Performance

Jun 04, 2025 -

Tom Daley Opens Up About Growing Up Gay And Achieving Olympic Glory

Jun 04, 2025

Tom Daley Opens Up About Growing Up Gay And Achieving Olympic Glory

Jun 04, 2025 -

Texas Mother Credits Fish Skin Treatment For Daughters Preemie Wound Healing

Jun 04, 2025

Texas Mother Credits Fish Skin Treatment For Daughters Preemie Wound Healing

Jun 04, 2025

Latest Posts

-

After Seven Years Paige De Sorbo Confirms Exit From Bravos Summer House

Jun 06, 2025

After Seven Years Paige De Sorbo Confirms Exit From Bravos Summer House

Jun 06, 2025 -

Official Villanova Wildcats Accept Patriot League Invitation For Football In 2026

Jun 06, 2025

Official Villanova Wildcats Accept Patriot League Invitation For Football In 2026

Jun 06, 2025 -

Ryan Goslings Potential As Marvels White Black Panther Post Ketema Casting

Jun 06, 2025

Ryan Goslings Potential As Marvels White Black Panther Post Ketema Casting

Jun 06, 2025 -

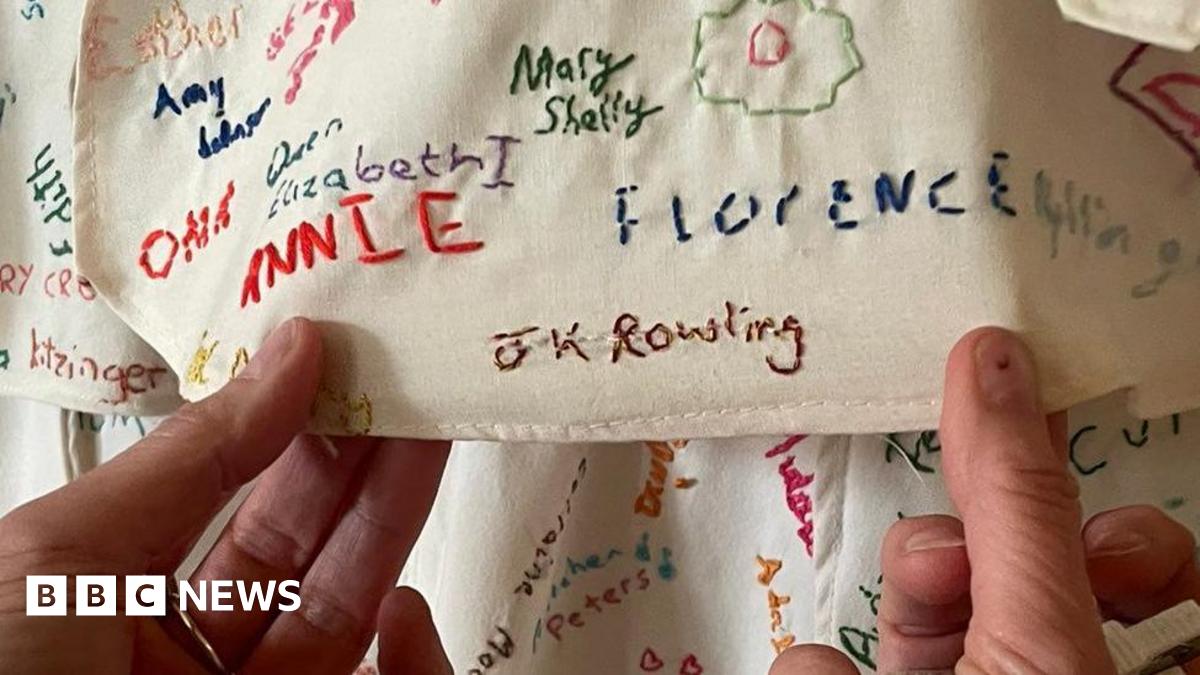

Damaged J K Rowling Artwork Covered Up At Derbyshire National Trust Property

Jun 06, 2025

Damaged J K Rowling Artwork Covered Up At Derbyshire National Trust Property

Jun 06, 2025 -

Navy Ship Named After Harvey Milk Faces Renaming Order

Jun 06, 2025

Navy Ship Named After Harvey Milk Faces Renaming Order

Jun 06, 2025