Accidental $4,200 Lollipop Purchase: How One Family Handled The Unexpected

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Accidental $4,200 Lollipop Purchase: How One Family Handled the Unexpected

A seemingly innocent trip to a candy store turned into a financial rollercoaster for the Miller family of Denver, Colorado, after a simple lollipop purchase ballooned into a shocking $4,200 charge. The incident, which quickly went viral on social media, highlights the importance of carefully reviewing purchases and underscores the complexities of handling unexpected large charges.

The Millers, while enjoying a family outing, stopped at a high-end confectionery known for its gourmet sweets and unique pricing. Young Timmy Miller, captivated by a dazzling, handcrafted lollipop adorned with edible gold leaf, insisted on buying it. What the family didn't realize at the time was that this seemingly ordinary treat carried an extraordinary price tag.

The Shocking Discovery

Upon returning home and reviewing their credit card statement, the Millers were stunned to discover a $4,200 charge from "Sweet Surrender Confectionery." Initial disbelief quickly turned to panic. The family immediately contacted their credit card company and Sweet Surrender Confectionery.

"We were absolutely speechless," said Sarah Miller, Timmy's mother, in an interview. "We assumed it was a mistake, a simple error in pricing. But it wasn't."

Sweet Surrender's Response and the Resolution

Sweet Surrender Confectionery, while acknowledging the unusual circumstances, maintained that the price was clearly displayed on the lollipop’s accompanying information card. However, they also admitted that the tiny print and the overall glitz of the presentation might have obscured the cost for the average customer.

Instead of demanding full payment, Sweet Surrender offered a unique solution: a family "confectionery experience" including a private tour of their production facility, a gourmet chocolate tasting, and a significantly discounted selection of other treats. The Millers, appreciative of the gesture, accepted the offer.

Lessons Learned: Avoiding Costly Mistakes

The Miller family's experience serves as a cautionary tale for all consumers. Here are some key takeaways to prevent similar situations:

- Always check the price: Before making a purchase, especially for high-value items, always confirm the price with the vendor, regardless of how obvious it seems.

- Review your statements meticulously: Regularly reviewing your bank and credit card statements is crucial to catch errors or fraudulent charges early. Setting up alerts for unusual transactions can also be highly beneficial.

- Understand the return policy: Familiarize yourself with the store's return policy before making a purchase. Knowing your rights as a consumer is essential.

- Consider using budgeting apps: Budgeting apps can help monitor spending and provide alerts for potential overspending.

Social Media Frenzy and Public Opinion

The story quickly spread across social media platforms like Twitter and Facebook, generating a mix of amusement, outrage, and sympathy. Many users commented on the absurdity of the situation, highlighting the need for clearer pricing in high-end stores. Others praised Sweet Surrender Confectionery for their fair and creative resolution.

The incident highlights the increasing need for transparency in pricing, particularly for high-value, unique products. The Miller family's experience, though initially shocking, ultimately had a surprisingly sweet ending, reminding us that even the most unexpected situations can be resolved with open communication and a bit of understanding.

Keywords: accidental purchase, expensive lollipop, $4200 lollipop, Sweet Surrender Confectionery, consumer rights, credit card error, financial mistake, social media viral, budgeting apps, high-end candy, gourmet sweets, pricing transparency, family outing, unexpected charge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Accidental $4,200 Lollipop Purchase: How One Family Handled The Unexpected. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2026 Maine Senate Race Collins Path To Re Election Faces Democratic Opposition

May 13, 2025

2026 Maine Senate Race Collins Path To Re Election Faces Democratic Opposition

May 13, 2025 -

Mexican Governors Us Visa Revocation Sparks Outrage

May 13, 2025

Mexican Governors Us Visa Revocation Sparks Outrage

May 13, 2025 -

Chris Pratt Faces Fan Outrage Anna Faris Absent From Another Mothers Day Tribute

May 13, 2025

Chris Pratt Faces Fan Outrage Anna Faris Absent From Another Mothers Day Tribute

May 13, 2025 -

Bbc News Teams West Bank Incident A Tense Encounter With A Sanctioned Settler

May 13, 2025

Bbc News Teams West Bank Incident A Tense Encounter With A Sanctioned Settler

May 13, 2025 -

From Undrafted To Nhl Reilly Smiths Golden Knights Journey

May 13, 2025

From Undrafted To Nhl Reilly Smiths Golden Knights Journey

May 13, 2025

Latest Posts

-

Water Restrictions Force Ban On Tanker Deliveries To Us Billionaires Estate

Sep 13, 2025

Water Restrictions Force Ban On Tanker Deliveries To Us Billionaires Estate

Sep 13, 2025 -

Star Trek Strange New Worlds Season 3 Finale Showrunner Interview Breakdown

Sep 13, 2025

Star Trek Strange New Worlds Season 3 Finale Showrunner Interview Breakdown

Sep 13, 2025 -

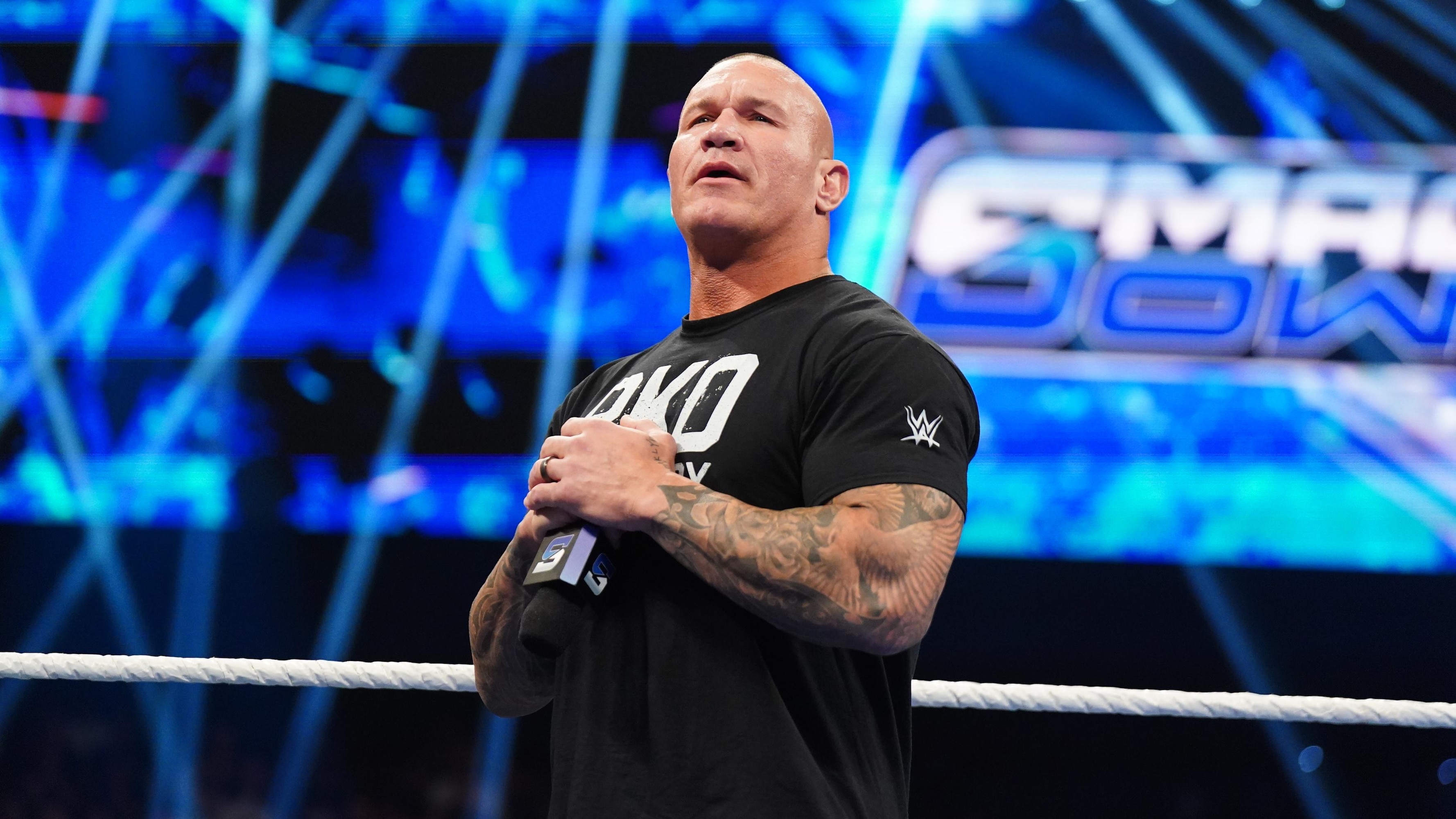

Where Does Randy Orton Go After Wwe Retirement Exploring His Next Chapter

Sep 13, 2025

Where Does Randy Orton Go After Wwe Retirement Exploring His Next Chapter

Sep 13, 2025 -

The End Of Restrictions How Wnba Players Won Style Autonomy

Sep 13, 2025

The End Of Restrictions How Wnba Players Won Style Autonomy

Sep 13, 2025 -

Simple Solutions For Fussy Eaters Expert Guidance For Peaceful Meals

Sep 13, 2025

Simple Solutions For Fussy Eaters Expert Guidance For Peaceful Meals

Sep 13, 2025