Air Canada's $500 Million Share Buyback: Boosting Shareholder Value

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Air Canada's $500 Million Share Buyback: A Vote of Confidence in the Future?

Air Canada, one of North America's leading airlines, recently announced a significant $500 million share buyback program, sending ripples through the financial markets. This move represents a substantial investment in shareholder value and signals the company's confidence in its future prospects. But what does this mean for investors, and what are the potential implications for the airline industry as a whole?

A Strategic Move to Enhance Shareholder Returns

The share buyback program, approved by Air Canada's board of directors, allows the company to repurchase its own outstanding shares on the open market. This reduces the number of shares available, potentially increasing earnings per share (EPS) and boosting the stock price. This strategy is often employed by companies that believe their shares are undervalued, providing a way to return capital to shareholders and enhance returns.

Why the Buyback Now? A Look at Air Canada's Performance

Air Canada's decision comes on the heels of a period of recovery from the significant challenges posed by the COVID-19 pandemic. While the airline industry faced unprecedented disruption, Air Canada has demonstrated resilience, adapting to changing travel patterns and navigating the complexities of fluctuating fuel prices and global economic uncertainty. This buyback suggests a belief that the worst is behind them and a strong recovery is underway. The company's recent financial reports likely played a key role in this decision, showcasing improving profitability and a strong cash position. Access for the latest financial data.

Potential Benefits and Risks of the Share Buyback

The potential benefits of Air Canada's share buyback are clear:

- Increased Earnings Per Share (EPS): Fewer outstanding shares mean earnings are distributed among a smaller number of shareholders, theoretically increasing EPS.

- Higher Stock Price: The reduction in share supply can drive up demand, potentially leading to a higher share price.

- Enhanced Shareholder Value: Ultimately, the goal is to increase the overall value of each share held by investors.

However, there are also potential risks to consider:

- Opportunity Cost: The capital used for the buyback could have been invested in other potentially lucrative projects, such as fleet modernization or expansion into new markets.

- Market Volatility: The success of a buyback is dependent on market conditions. A downturn could negate the positive effects.

- Impact on Long-Term Growth: Some critics argue that buybacks can hinder long-term growth by diverting resources away from crucial investments.

Industry Implications and Future Outlook

Air Canada's move could influence other airlines to consider similar strategies, particularly those who have recovered strongly from the pandemic. The move reflects a broader trend of companies returning value to shareholders, a sign of confidence in the economy and their own performance.

Conclusion: A Strategic Bet on the Future?

Air Canada's $500 million share buyback represents a bold strategic decision. While the long-term impact remains to be seen, it reflects the airline's confidence in its recovery and its commitment to maximizing shareholder value. Whether this gamble pays off will depend on various factors, including the overall health of the travel industry and the continued successful execution of Air Canada's business strategy. Investors will be closely watching to see how this significant investment unfolds. Stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Air Canada's $500 Million Share Buyback: Boosting Shareholder Value. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

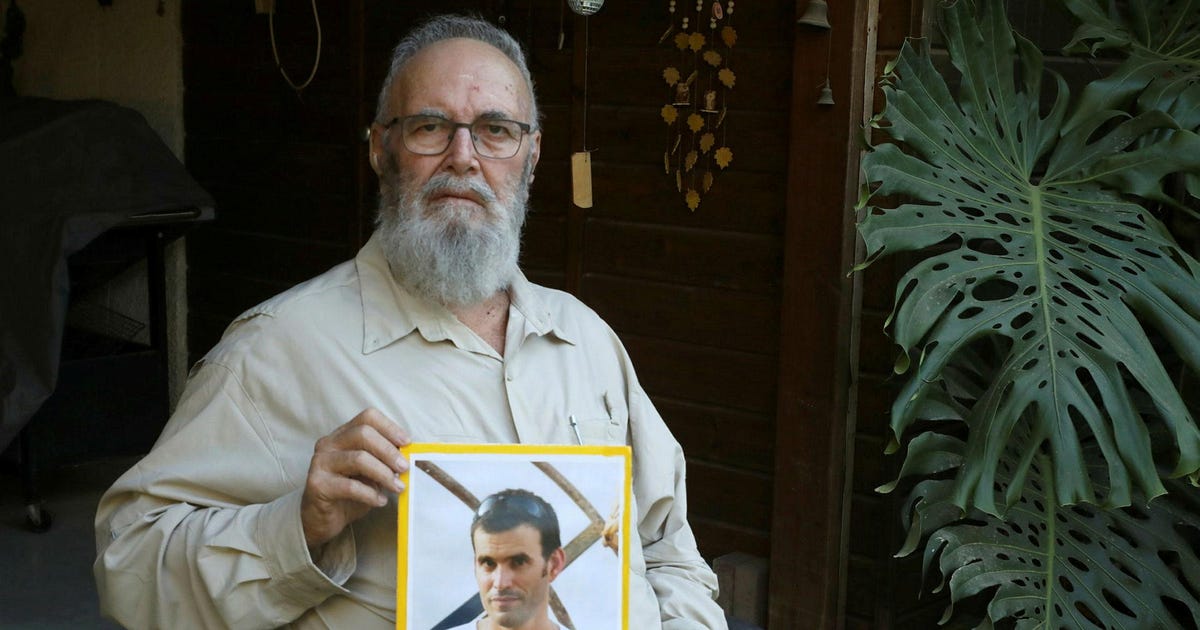

Venezuelan Tik Tok Star Shot Dead While Live Streaming Criticism Of Police And Gang Violence

Jun 26, 2025

Venezuelan Tik Tok Star Shot Dead While Live Streaming Criticism Of Police And Gang Violence

Jun 26, 2025 -

In Memoriam Dennis Richmonds Enduring Impact

Jun 26, 2025

In Memoriam Dennis Richmonds Enduring Impact

Jun 26, 2025 -

Military Dilemma In Gaza Balancing Risk To Soldiers And Recovery Of Hostage Remains

Jun 26, 2025

Military Dilemma In Gaza Balancing Risk To Soldiers And Recovery Of Hostage Remains

Jun 26, 2025 -

Ivf Concierge Clinics Warning After 15 000 Loss

Jun 26, 2025

Ivf Concierge Clinics Warning After 15 000 Loss

Jun 26, 2025 -

Key Trends From Louis Vuittons Spring 2026 Menswear Show

Jun 26, 2025

Key Trends From Louis Vuittons Spring 2026 Menswear Show

Jun 26, 2025

Hytales Uncertain Future Impact Of Studio Disbandment On Fans

Hytales Uncertain Future Impact Of Studio Disbandment On Fans

Hytale Officially Cancelled What Happened To The Hyped Game

Hytale Officially Cancelled What Happened To The Hyped Game