Alabama-Based Firm Sells Bank Of America Shares: Birmingham Capital Management's Recent Trade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alabama-Based Firm Sells Bank of America Shares: Birmingham Capital Management's Recent Trade Sparks Investor Interest

Birmingham, AL – October 26, 2023 – Birmingham Capital Management, a prominent Alabama-based investment firm, has made headlines with its recent sale of Bank of America (BAC) shares. This significant trade has sparked considerable interest amongst investors and market analysts, prompting questions about the firm's investment strategy and the future outlook for Bank of America stock.

The exact number of shares sold and the reasoning behind the decision remain undisclosed by Birmingham Capital Management. However, the move comes amidst a period of fluctuating market conditions and uncertainty surrounding the financial sector. This secrecy has fueled speculation, with some suggesting it reflects a broader shift in the firm's portfolio allocation, while others point to potential concerns regarding Bank of America's future performance.

Understanding Birmingham Capital Management's Investment Strategy

Birmingham Capital Management is known for its conservative yet opportunistic approach to investing. They typically focus on long-term value creation, preferring established companies with strong fundamentals. While this recent trade deviates slightly from their perceived long-term holding strategy for Bank of America, it's important to remember that adjustments to portfolios are common practice, especially in response to evolving market dynamics. More information regarding the firm's overall investment philosophy can be found on their [website – insert link if available, otherwise remove this sentence].

Bank of America's Recent Performance and Market Outlook

Bank of America, a major player in the US financial landscape, has experienced mixed performance recently. While the bank has reported solid earnings in certain quarters, concerns about potential economic slowdowns and rising interest rates have cast a shadow over its future prospects. This uncertainty, coupled with broader market volatility, likely plays a significant role in influencing investment decisions from firms like Birmingham Capital Management.

Analysts are divided on the future outlook for BAC. Some remain bullish, citing the bank's strong balance sheet and diversified revenue streams. Others express caution, warning about potential loan defaults and the impact of a weakening economy. This divergence of opinion highlights the complex challenges faced by investors navigating the current market climate.

- Factors impacting Bank of America's stock price:

- Interest rate hikes

- Economic slowdown concerns

- Competition within the financial sector

- Regulatory changes

The Implications for Investors

Birmingham Capital Management's decision serves as a reminder of the inherent risks involved in investing in the stock market. Even seemingly stable, blue-chip companies like Bank of America can experience price fluctuations based on various macroeconomic and company-specific factors. For individual investors, this highlights the importance of conducting thorough due diligence before making any investment decisions and considering diversification to mitigate risk.

This situation underscores the need for a well-defined investment strategy tailored to individual risk tolerance and financial goals. Seeking advice from a qualified financial advisor is always recommended, particularly during periods of market uncertainty.

Conclusion: What's Next for Birmingham Capital Management and Bank of America?

The sale of Bank of America shares by Birmingham Capital Management remains a developing story. While the firm's exact motivations remain unknown, the trade highlights the dynamic nature of the investment landscape and the importance of staying informed about market trends. As more information becomes available, we will continue to update this story. Stay tuned for further developments concerning both Birmingham Capital Management's investment strategy and the future performance of Bank of America. In the meantime, remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alabama-Based Firm Sells Bank Of America Shares: Birmingham Capital Management's Recent Trade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pinduoduos Parent Company Pdd Holdings Announces Q1 2025 Earnings Date

May 27, 2025

Pinduoduos Parent Company Pdd Holdings Announces Q1 2025 Earnings Date

May 27, 2025 -

Dementi De L Elysee Rumeurs De Gifle Entre Macron Et Brigitte Au Vietnam Infondees

May 27, 2025

Dementi De L Elysee Rumeurs De Gifle Entre Macron Et Brigitte Au Vietnam Infondees

May 27, 2025 -

Salman Rushdie Responds To Attackers Sentencing

May 27, 2025

Salman Rushdie Responds To Attackers Sentencing

May 27, 2025 -

Apple Ends Support For I Os 18 4 1 Downgrade Restrictions Explained

May 27, 2025

Apple Ends Support For I Os 18 4 1 Downgrade Restrictions Explained

May 27, 2025 -

Kuala Lumpur Hospital Admission Brunei Sultans Fatigue Prompts Medical Care

May 27, 2025

Kuala Lumpur Hospital Admission Brunei Sultans Fatigue Prompts Medical Care

May 27, 2025

Latest Posts

-

Sbet Stocks 1000 Jump Understanding The Market Drivers

May 31, 2025

Sbet Stocks 1000 Jump Understanding The Market Drivers

May 31, 2025 -

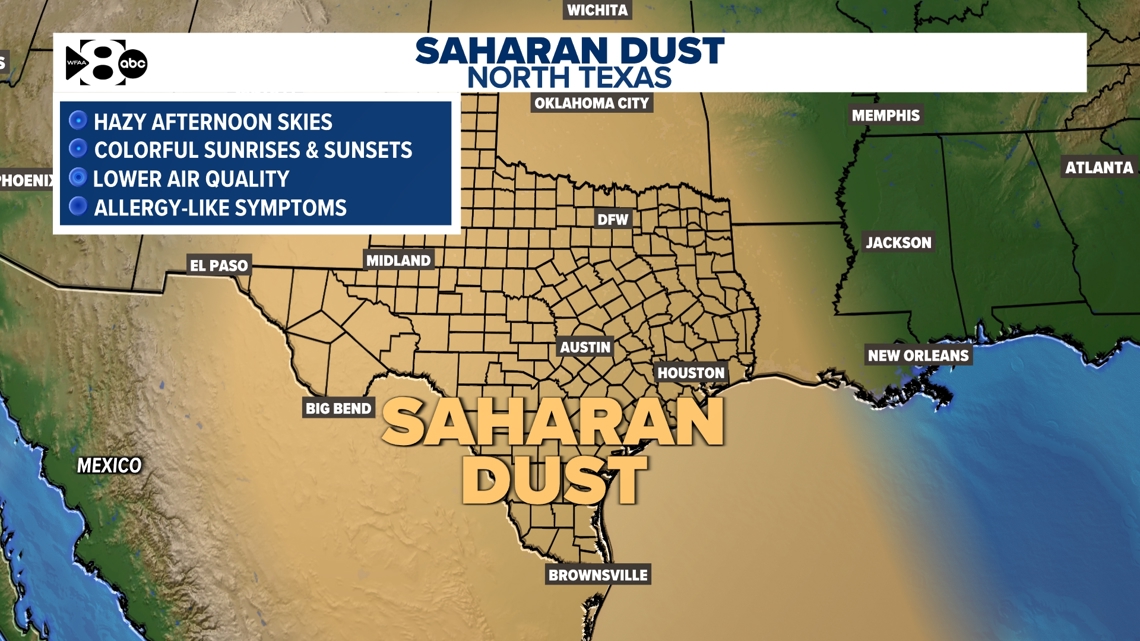

Saharan Dust Cloud Understanding Its 5 000 Mile Trek To North Texas

May 31, 2025

Saharan Dust Cloud Understanding Its 5 000 Mile Trek To North Texas

May 31, 2025 -

Duke Energy Ohio Rate Hike June 1 Increase Explained

May 31, 2025

Duke Energy Ohio Rate Hike June 1 Increase Explained

May 31, 2025 -

Global Tariffs Challenged Us Trade Court Sides Against Trump Administration

May 31, 2025

Global Tariffs Challenged Us Trade Court Sides Against Trump Administration

May 31, 2025 -

Us Open Faces Backlash Presale Issues Spark Outrage Among Tennis Fans

May 31, 2025

Us Open Faces Backlash Presale Issues Spark Outrage Among Tennis Fans

May 31, 2025