Alabama Investment Firm Sells Bank Of America Stock: Birmingham Capital Management's Recent Activity

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alabama Investment Firm Sells Bank of America Stock: Birmingham Capital Management's Recent Activity Sparks Interest

Birmingham, AL – October 26, 2023 – Birmingham Capital Management (BCM), a prominent Alabama-based investment firm, has announced the sale of a significant portion of its Bank of America (BAC) stock holdings. This move, disclosed in recent SEC filings, has sparked considerable interest within the financial community, prompting speculation about BCM's overall investment strategy and the future outlook for Bank of America.

The precise amount of BAC stock sold by BCM remains undisclosed, fueling further intrigue. However, the news follows a period of fluctuating performance for Bank of America, mirroring broader trends within the financial sector. Experts suggest several potential factors behind BCM's decision, ranging from strategic portfolio diversification to a reassessment of Bank of America's long-term growth prospects.

Understanding Birmingham Capital Management's Investment Approach

Birmingham Capital Management is known for its conservative yet proactive investment approach. They focus on long-term value creation and carefully manage risk. This recent sale, therefore, doesn't necessarily indicate a negative outlook on Bank of America, but rather a strategic adjustment within their broader portfolio. BCM's history reflects a commitment to adapting to market shifts, optimizing returns for their clients. For a deeper dive into BCM's investment philosophy, you can explore their [website (link to BCM website, if available)].

Market Analysis and Implications for Bank of America

Bank of America's stock price has experienced volatility in recent months, influenced by factors including rising interest rates, inflation concerns, and the overall economic climate. While the bank remains a significant player in the financial industry, analysts are divided on its future trajectory. Some predict continued growth driven by strong lending activity, while others express caution regarding potential economic headwinds.

This uncertainty is likely a contributing factor to BCM’s decision. The sale allows BCM to re-allocate capital to potentially higher-yielding assets or to further diversify their portfolio, mitigating risk associated with the fluctuating financial market. Understanding the current market conditions is crucial to interpreting BCM's actions. For more detailed market analysis, you can refer to reputable financial news sources like [Bloomberg (link to Bloomberg)] and [The Wall Street Journal (link to WSJ)].

What Does This Mean for Investors?

BCM's move serves as a reminder of the dynamic nature of the investment world. Even established firms like BCM regularly adjust their portfolios in response to changing market conditions. For individual investors, this highlights the importance of:

- Diversification: Spreading investments across different asset classes to reduce overall risk.

- Regular Review: Periodically reviewing and adjusting your investment portfolio based on market trends and personal financial goals.

- Professional Advice: Seeking guidance from a qualified financial advisor to develop a personalized investment strategy.

This situation underscores the complexity of investment decisions and the need for informed choices. While BCM’s actions don't necessarily predict a dramatic downturn for Bank of America, they do emphasize the importance of proactive portfolio management in navigating the ever-changing financial landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alabama Investment Firm Sells Bank Of America Stock: Birmingham Capital Management's Recent Activity. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

June 2025 Social Security Payment Dates Complete Schedule For Us Beneficiaries

May 27, 2025

June 2025 Social Security Payment Dates Complete Schedule For Us Beneficiaries

May 27, 2025 -

Boost Your Plants 3 Practical Applications Of Coffee Grounds

May 27, 2025

Boost Your Plants 3 Practical Applications Of Coffee Grounds

May 27, 2025 -

Thousands Of Miles One Love One Tragedy A Dc Couples Story

May 27, 2025

Thousands Of Miles One Love One Tragedy A Dc Couples Story

May 27, 2025 -

Macron Agresse Par Brigitte Au Vietnam L Elysee Dement Formellement

May 27, 2025

Macron Agresse Par Brigitte Au Vietnam L Elysee Dement Formellement

May 27, 2025 -

Yankees Stanton Facing Potential Extended Absence

May 27, 2025

Yankees Stanton Facing Potential Extended Absence

May 27, 2025

Latest Posts

-

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025 -

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025 -

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025 -

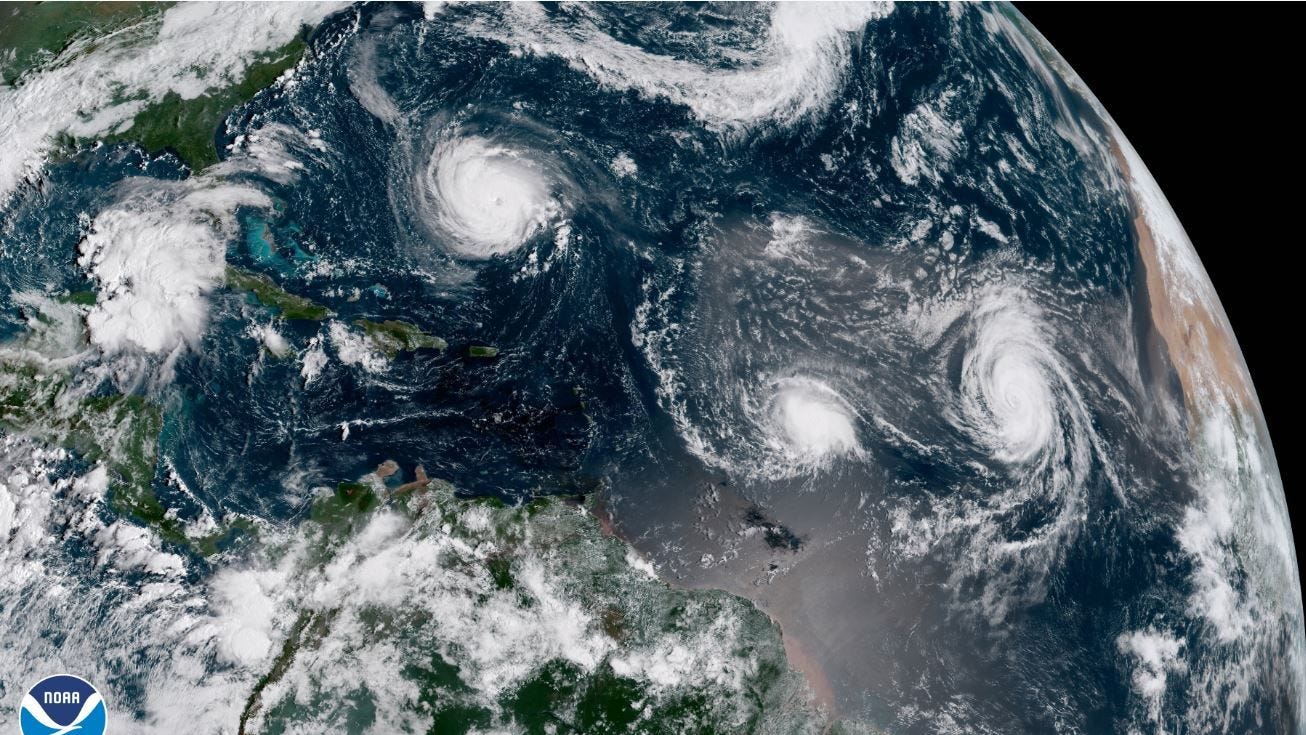

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025