Alabama Investment Firm Sells Bank Of America Stock: Birmingham Capital Management's Recent Move

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alabama Investment Firm Sells Bank of America Stock: Birmingham Capital Management's Strategic Shift

Birmingham, AL – October 26, 2023 – Birmingham Capital Management (BCM), a prominent Alabama-based investment firm, has announced the divestment of its Bank of America (BAC) stock holdings. This significant move has sparked considerable interest within the financial community, raising questions about BCM's investment strategy and the future outlook for Bank of America.

The exact amount of BAC stock sold by BCM remains undisclosed. However, sources close to the firm suggest the sale represents a substantial portion of their portfolio. This decision comes amidst a period of fluctuating market conditions and increasing regulatory scrutiny within the financial sector.

Why the Sale? Analyzing Birmingham Capital Management's Decision

While BCM hasn't issued a formal public statement explaining the rationale behind the sale, several factors could be contributing to this strategic shift. Analysts point to several possibilities:

-

Market Volatility: The current economic climate is characterized by significant uncertainty. Rising interest rates, inflation concerns, and geopolitical instability all contribute to market volatility, making some investors reassess their risk profiles. BCM’s decision might reflect a move towards a more conservative investment strategy in light of these uncertainties.

-

Sectoral Rotation: Investment firms often engage in sectoral rotation, shifting assets from one sector to another based on perceived growth opportunities and risk assessments. BCM may have identified more promising sectors for investment, leading to the sale of Bank of America stock. This reallocation of capital could signal a belief in the stronger potential of other sectors.

-

Company-Specific Concerns: While Bank of America generally enjoys a strong reputation, specific concerns regarding its performance or future prospects might have influenced BCM's decision. This could involve factors ranging from regulatory changes impacting the banking sector to internal company developments.

-

Diversification Strategy: Diversification is a cornerstone of successful investment management. BCM might have chosen to diversify its portfolio further by reducing its exposure to a single financial institution, regardless of Bank of America's overall health.

Implications for Bank of America and the Broader Market

The sale of BCM's Bank of America stock, while significant for the firm, is unlikely to dramatically impact Bank of America's overall stock performance. However, it does contribute to the broader narrative of market adjustments and the shifting investment strategies of major players. This move serves as a reminder of the dynamic nature of the financial markets and the importance of ongoing portfolio review.

This event highlights the importance of staying informed about market trends and the decisions of key players in the investment world. Investors should consult with financial advisors before making any significant investment decisions.

Looking Ahead: What to Expect from Birmingham Capital Management

Following this significant divestment, many are watching Birmingham Capital Management closely. Their future investment moves will be closely analyzed for clues about prevailing market sentiment and future investment opportunities. The firm's next steps will likely provide further insight into their strategic vision and how they navigate the evolving financial landscape. We will continue to provide updates as more information becomes available.

Keywords: Birmingham Capital Management, Bank of America, BAC stock, Alabama investment firm, stock market, investment strategy, portfolio diversification, market volatility, financial news, investment news, sectoral rotation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alabama Investment Firm Sells Bank Of America Stock: Birmingham Capital Management's Recent Move. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

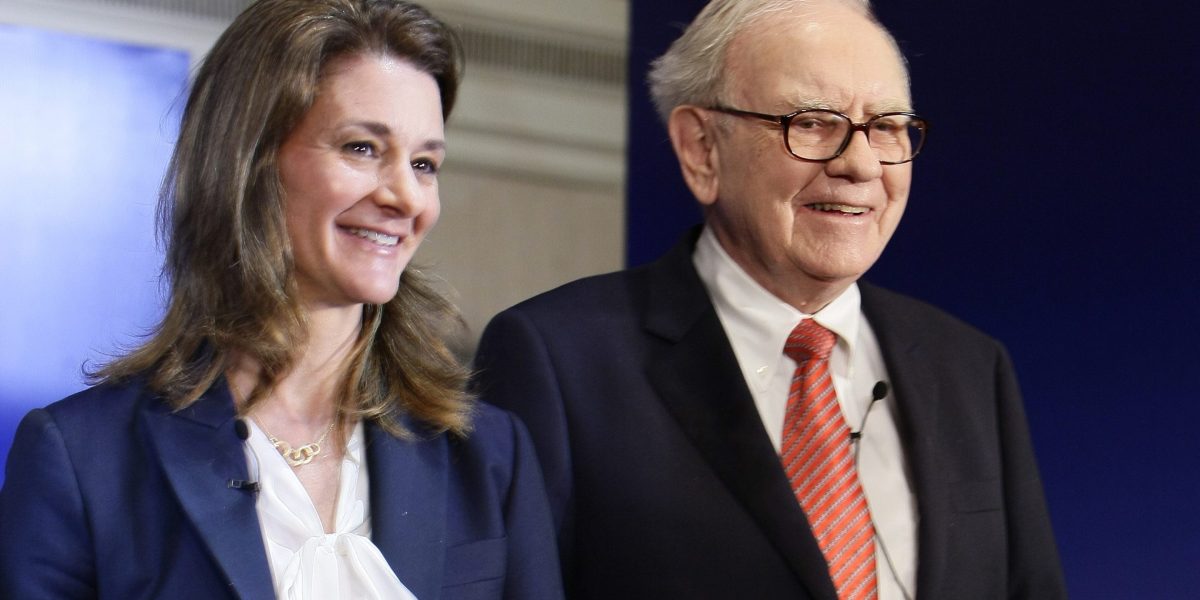

Beyond Gates And Buffett A 600 Billion Commitment Reshapes Billionaire Philanthropy

May 28, 2025

Beyond Gates And Buffett A 600 Billion Commitment Reshapes Billionaire Philanthropy

May 28, 2025 -

Should Investors Hold Or Sell Sirius Xm Stock A Deep Dive

May 28, 2025

Should Investors Hold Or Sell Sirius Xm Stock A Deep Dive

May 28, 2025 -

Ultra Nationalist March In Jerusalem Ignites Fresh Wave Of Violence

May 28, 2025

Ultra Nationalist March In Jerusalem Ignites Fresh Wave Of Violence

May 28, 2025 -

Important Social Security Update 5 108 Payments Scheduled This Week

May 28, 2025

Important Social Security Update 5 108 Payments Scheduled This Week

May 28, 2025 -

Unlock Value 2025 Memorial Tournament Odds Predictions And Sleeper Bets

May 28, 2025

Unlock Value 2025 Memorial Tournament Odds Predictions And Sleeper Bets

May 28, 2025

Latest Posts

-

New Details Emerge Police Concerns Surface In Leaked Recording Of Abortion Case

May 29, 2025

New Details Emerge Police Concerns Surface In Leaked Recording Of Abortion Case

May 29, 2025 -

Residential Homes Damaged In Truck Explosion Possible Propane Leak Investigated

May 29, 2025

Residential Homes Damaged In Truck Explosion Possible Propane Leak Investigated

May 29, 2025 -

Us Backed Gaza Aid Group Begins Distribution Key Details

May 29, 2025

Us Backed Gaza Aid Group Begins Distribution Key Details

May 29, 2025 -

Analysis Of The Liverpool Fc Parade Facts Reports And Reactions

May 29, 2025

Analysis Of The Liverpool Fc Parade Facts Reports And Reactions

May 29, 2025 -

Nba Trade Deadline Will Jrue Holiday Or Lonzo Ball Join The Dallas Mavericks Antetokounmpo Update

May 29, 2025

Nba Trade Deadline Will Jrue Holiday Or Lonzo Ball Join The Dallas Mavericks Antetokounmpo Update

May 29, 2025