Alarming Statistics: 10% Of Britons Report Zero Savings, Says Financial Regulator

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alarming Statistics: 10% of Britons Report Zero Savings, Says Financial Regulator

The UK's financial landscape is facing a worrying trend, as a staggering 10% of Britons report having absolutely no savings, according to a recent report by the Financial Conduct Authority (FCA). This revelation highlights a growing vulnerability amongst a significant portion of the population, leaving them dangerously exposed to unexpected financial shocks. The findings underscore the urgent need for improved financial literacy and accessible savings solutions.

The FCA's report, released [Insert Date of Report Release], paints a stark picture of the nation's financial health. The 10% figure represents millions of individuals living on a financial knife-edge, with no safety net to fall back on in the face of job loss, illness, or unexpected expenses. This precarious position leaves them particularly susceptible to spiralling debt and financial hardship.

The Impact of Rising Living Costs

This alarming statistic is directly linked to the ongoing cost-of-living crisis gripping the UK. Soaring inflation, increased energy prices, and the rising cost of essential goods have left many households struggling to make ends meet. With disposable income squeezed, saving money has become an almost impossible task for a growing number of people.

- Increased energy bills: A major contributor to the financial strain on households, leaving less money available for savings.

- Food price inflation: The cost of groceries has risen significantly, forcing many families to cut back on non-essential spending and impacting their ability to save.

- Wage stagnation: While inflation has surged, wages haven't kept pace, leaving many feeling the pinch and unable to put money aside.

The Vulnerable Groups

The FCA's report doesn't just highlight a general trend; it also points to specific groups disproportionately affected by this lack of savings. These include:

- Young adults: Entering the workforce with high levels of student debt and facing the challenges of rising living costs makes saving particularly difficult.

- Low-income households: Those already struggling to make ends meet are least likely to have any savings buffer.

- Renters: Facing often unpredictable rent increases and lacking the equity associated with homeownership, renters are more susceptible to financial instability.

What Can Be Done?

The FCA's report serves as a wake-up call for both individuals and policymakers. Addressing this issue requires a multi-pronged approach:

- Improved financial literacy programs: Educating the population about budgeting, saving, and managing debt is crucial. [Link to a relevant government website on financial literacy].

- Accessible savings schemes: The government and financial institutions need to create more accessible and attractive savings options for low-income households.

- Targeted support programs: Implementing targeted support for vulnerable groups can help alleviate some of the financial pressures they face.

The 10% figure is a stark reminder of the inequalities within the UK's financial system. Urgent action is needed to prevent further financial hardship and ensure a more secure future for all Britons. The government and financial institutions must work together to develop effective strategies to improve financial inclusion and empower individuals to build a more secure financial future. This isn't simply a matter of personal responsibility; it's a societal challenge that requires collective effort. Let's hope for a future where such alarming statistics are a thing of the past.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alarming Statistics: 10% Of Britons Report Zero Savings, Says Financial Regulator. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Condo Owners Battle Developers Major Cracking Found In New York City High Rise

May 17, 2025

Condo Owners Battle Developers Major Cracking Found In New York City High Rise

May 17, 2025 -

Air Traffic Control Crisis At Newark Veteran Controller Exposes Staffing Shortages And Tech Failures

May 17, 2025

Air Traffic Control Crisis At Newark Veteran Controller Exposes Staffing Shortages And Tech Failures

May 17, 2025 -

Analyzing The Effects Of Trumps Tariffs On Consumer Behavior In The Us

May 17, 2025

Analyzing The Effects Of Trumps Tariffs On Consumer Behavior In The Us

May 17, 2025 -

Roberts Smith Defamation Case Court Of Appeal Decision Announced

May 17, 2025

Roberts Smith Defamation Case Court Of Appeal Decision Announced

May 17, 2025 -

Ethical Concerns Companies Fund State Officials Roman Holiday

May 17, 2025

Ethical Concerns Companies Fund State Officials Roman Holiday

May 17, 2025

Latest Posts

-

Nao Bancava Mais Expatriados Americanos E O Exodo Militar Para O Brasil

May 18, 2025

Nao Bancava Mais Expatriados Americanos E O Exodo Militar Para O Brasil

May 18, 2025 -

Istanbul Da Yagisli Hava Durumu Hafta Sonu Planlariniz Icin Oenemli Bilgiler

May 18, 2025

Istanbul Da Yagisli Hava Durumu Hafta Sonu Planlariniz Icin Oenemli Bilgiler

May 18, 2025 -

Nine Dead After Russian Missile Hits Civilian Bus In Ukraine

May 18, 2025

Nine Dead After Russian Missile Hits Civilian Bus In Ukraine

May 18, 2025 -

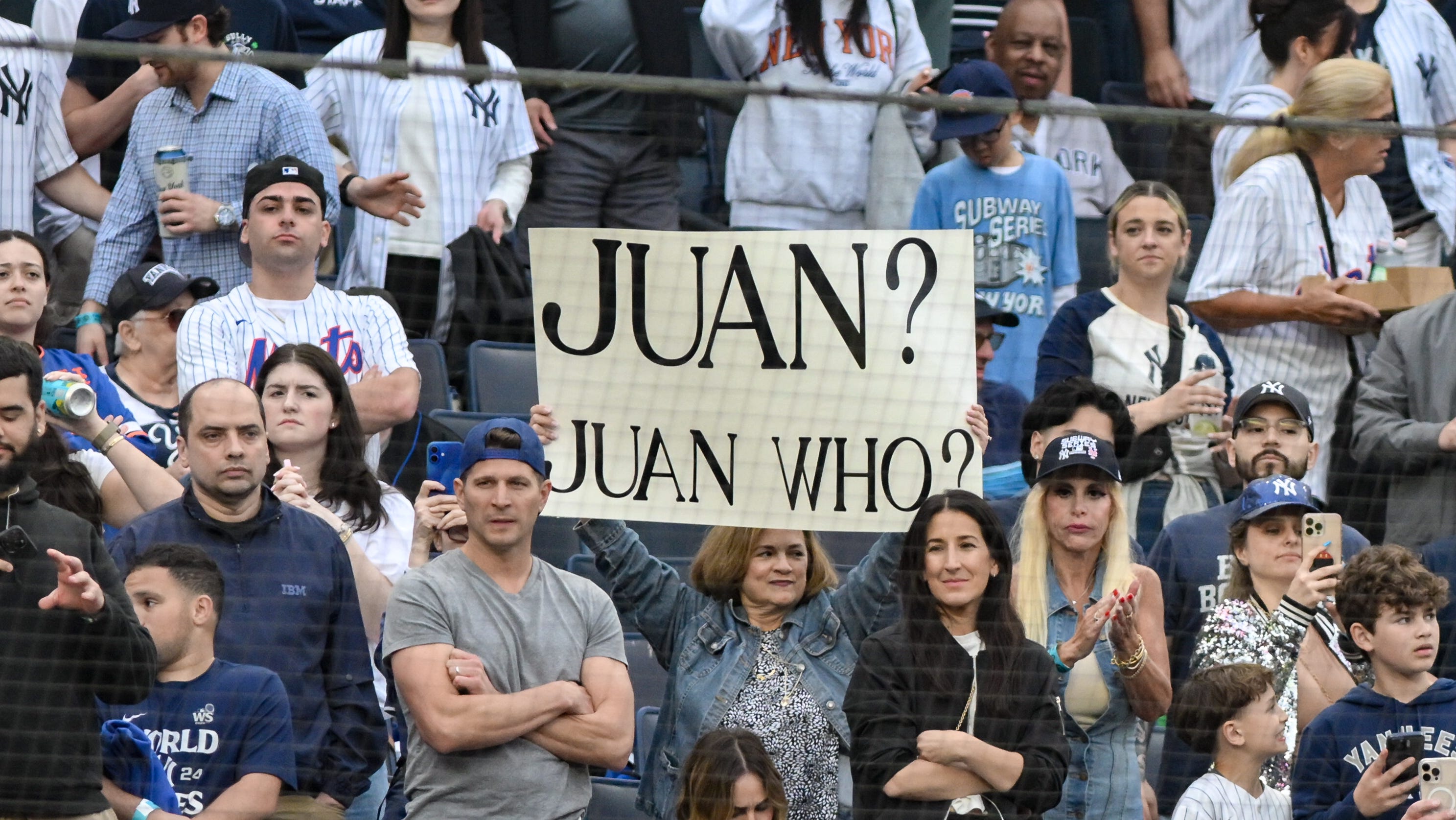

Yankees Vs Mets 2025 Subway Series Best Photos

May 18, 2025

Yankees Vs Mets 2025 Subway Series Best Photos

May 18, 2025 -

Exclusive Interview Jeffrey Dean Morgan On Destination X And His Career

May 18, 2025

Exclusive Interview Jeffrey Dean Morgan On Destination X And His Career

May 18, 2025