Alarming UK Savings Statistics: 10% Have No Emergency Fund, FCA Reports

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alarming UK Savings Statistics: 10% Have No Emergency Fund, FCA Reports

The UK's financial stability is facing a stark reality, with a concerning number of individuals lacking the vital safety net of an emergency fund, according to a recent report from the Financial Conduct Authority (FCA). The findings reveal a worrying trend: a staggering 10% of UK adults possess no savings whatsoever to cover unexpected expenses, leaving them dangerously vulnerable to financial hardship. This alarming statistic highlights the urgent need for improved financial literacy and accessible savings solutions across the nation.

The FCA Report: Unveiling a Precarious Financial Landscape

The FCA's report, released earlier this month, paints a picture of widespread financial fragility. The data, collected through extensive surveys and analysis, doesn't just highlight the 10% without any savings; it also reveals a significant portion of the population with insufficient savings to cover even minor emergencies. This lack of preparedness leaves millions susceptible to spiralling debt when faced with unexpected events like job loss, illness, or car repairs.

Why is this such a significant problem?

The consequences of inadequate savings can be devastating. A single unexpected bill can push vulnerable households into a cycle of debt, impacting their credit rating and overall well-being. This can lead to:

- Increased Stress and Anxiety: The constant worry about financial stability significantly impacts mental health.

- Difficulty Accessing Credit: A lack of savings often translates to higher interest rates on loans and credit cards.

- Increased Vulnerability to Scams: Individuals facing financial hardship are more likely to fall victim to predatory lending practices and scams.

- Delaying Necessary Healthcare: Without savings, essential medical care might be delayed or forgone entirely, further impacting long-term health and well-being.

What are the contributing factors?

Several factors contribute to this alarming situation, including:

- Stagnant Wages: Many households struggle to make ends meet with the current cost of living, leaving little room for saving.

- Rising Inflation: The increasing cost of essential goods and services further erodes disposable income.

- Lack of Financial Education: Many individuals lack the knowledge and skills to effectively manage their finances and build savings.

- High levels of existing debt: Many households are struggling with existing debt, making it difficult to save.

What can be done to address this crisis?

Tackling this issue requires a multi-pronged approach:

- Improved Financial Education: Schools and community organizations should prioritize financial literacy programs to equip individuals with the skills to manage their finances effectively. Resources like the offer valuable tools and information.

- Government Initiatives: Government schemes and incentives could encourage saving, potentially through matching contributions or tax breaks on savings accounts.

- Accessible Savings Products: Financial institutions need to offer a wider range of accessible savings products tailored to different income levels and financial needs.

- Debt Management Support: Enhanced support for individuals struggling with debt is crucial to help them get back on their feet and start building savings.

The Path to Financial Security Starts Now

The FCA's report serves as a wake-up call. The lack of emergency funds amongst a significant portion of the UK population is a serious concern that demands immediate attention. By prioritizing financial education, promoting accessible savings solutions, and implementing supportive government policies, we can work towards a more financially secure future for all. Taking small steps towards building an emergency fund, even if it's just a small amount each month, can make a significant difference in protecting against unforeseen circumstances. Don't delay – start building your financial resilience today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alarming UK Savings Statistics: 10% Have No Emergency Fund, FCA Reports. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Singer Chris Brown Charged With Assault In London

May 17, 2025

Singer Chris Brown Charged With Assault In London

May 17, 2025 -

Stars Jets Game 5 Five Observations On Dallas Offensive Struggles

May 17, 2025

Stars Jets Game 5 Five Observations On Dallas Offensive Struggles

May 17, 2025 -

Ryan Loutos Returns To Dodgers Justin Wrobleski Sent Down

May 17, 2025

Ryan Loutos Returns To Dodgers Justin Wrobleski Sent Down

May 17, 2025 -

Re Examined The Harvard Magna Carta From Discounted Copy To Verified Original

May 17, 2025

Re Examined The Harvard Magna Carta From Discounted Copy To Verified Original

May 17, 2025 -

On Brink Of Collapse Uk Prisons Face Crisis After Brexit Impacts Eu Cooperation

May 17, 2025

On Brink Of Collapse Uk Prisons Face Crisis After Brexit Impacts Eu Cooperation

May 17, 2025

Latest Posts

-

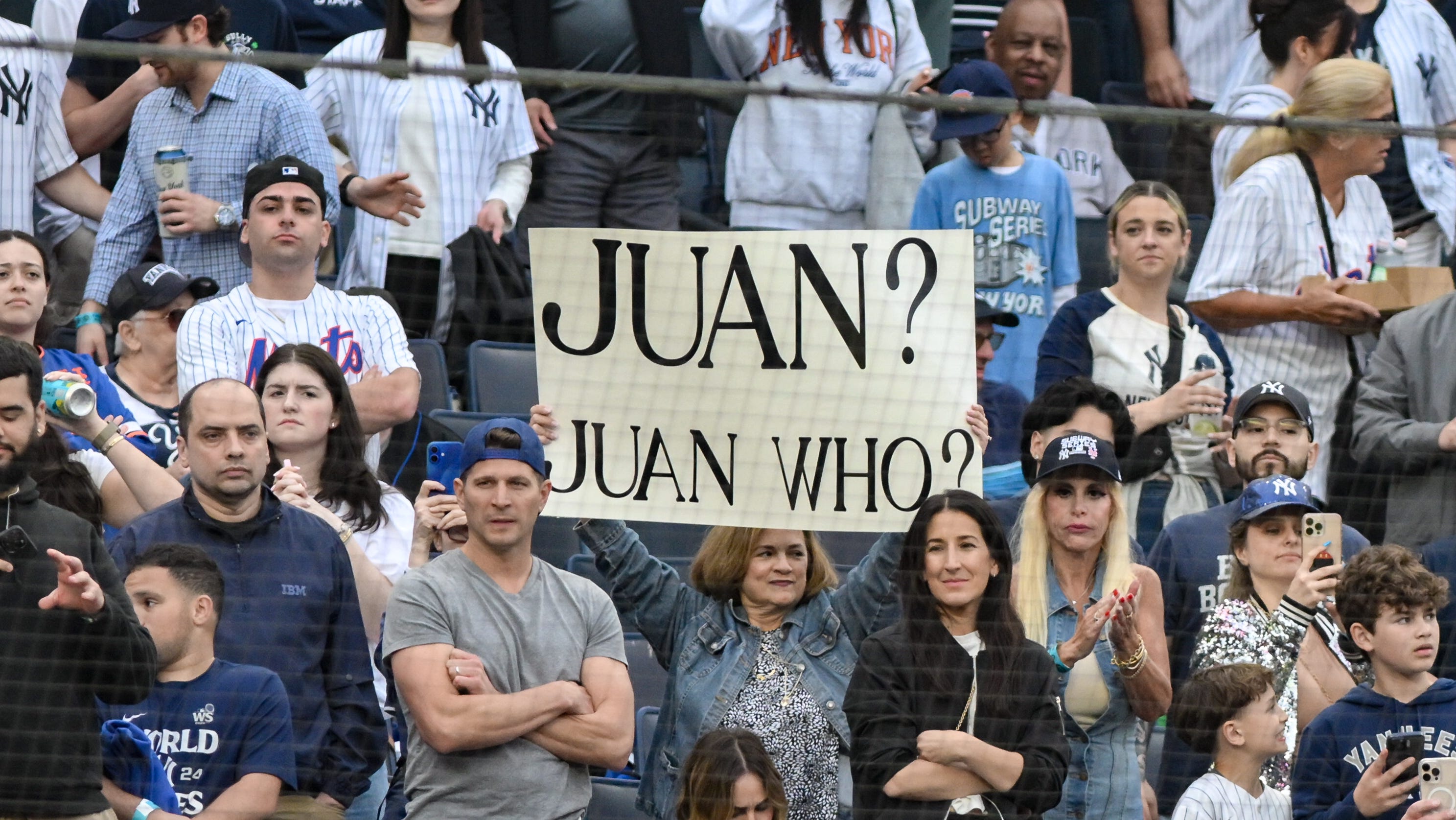

2025 Subway Series Photo Gallery Yankees And Mets Face Off

May 18, 2025

2025 Subway Series Photo Gallery Yankees And Mets Face Off

May 18, 2025 -

Texts Surface Diddys Communication With Cassie Post Assault In L A

May 18, 2025

Texts Surface Diddys Communication With Cassie Post Assault In L A

May 18, 2025 -

San Francisco Police Officer Arrested Following Dui Crash Multiple Injuries Reported

May 18, 2025

San Francisco Police Officer Arrested Following Dui Crash Multiple Injuries Reported

May 18, 2025 -

Cannes Before Smartphones Hilarious And Unbelievable Images

May 18, 2025

Cannes Before Smartphones Hilarious And Unbelievable Images

May 18, 2025 -

Kerri Pegg And The Encro Chat Scandal Details Of A Forbidden Relationship

May 18, 2025

Kerri Pegg And The Encro Chat Scandal Details Of A Forbidden Relationship

May 18, 2025