Alarming UK Savings Statistics: One In Ten Lack Savings, FCA Finds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alarming UK Savings Statistics: One in Ten Lack Any Savings, FCA Finds

The UK's financial fragility is laid bare in a new report from the Financial Conduct Authority (FCA), revealing that a staggering one in ten adults hold no savings whatsoever. This alarming statistic highlights a growing vulnerability within the UK population, leaving millions exposed to unexpected financial shocks. The findings underscore the urgent need for improved financial literacy and accessible savings options.

The FCA's report, published [insert publication date here], paints a concerning picture of the nation's savings habits. It’s not just the absence of savings that's worrying; the report also delves into the precarious positions of many who do have savings. Many are found to be holding insufficient funds to weather even minor financial emergencies.

The Depth of the Problem: More Than Just a Lack of Savings

The 10% figure, while shocking in itself, only scratches the surface of the issue. The FCA's research also highlighted:

- Low savings levels across demographics: While the lack of savings affects all demographics, certain groups are disproportionately impacted, including younger adults, those on low incomes, and individuals from certain ethnic minority backgrounds. This points to systemic inequalities impacting access to financial security.

- Vulnerability to financial shocks: The inability to cope with unexpected expenses, such as a boiler breakdown or unexpected medical bills, leaves millions vulnerable to debt spirals and financial hardship. This can have devastating consequences, impacting housing, health, and overall well-being.

- The impact of the cost of living crisis: The ongoing cost of living crisis has undoubtedly exacerbated this issue, pushing more people into precarious financial situations and depleting existing savings. Inflation continues to outpace wage growth for many, further compounding the problem.

What Can Be Done? Addressing the Savings Gap

The FCA's report calls for a multi-pronged approach to tackling this issue. This includes:

- Improving financial literacy: Greater emphasis on financial education in schools and communities is crucial, equipping individuals with the knowledge and skills to manage their finances effectively. The government and financial institutions need to collaborate on initiatives promoting responsible saving habits.

- Increasing access to affordable savings products: The availability of easy-access, low-fee savings accounts is essential for those on low incomes. Encouraging innovation in the savings market to better cater to vulnerable groups is key.

- Strengthening consumer protection: The FCA's role in protecting consumers from exploitative financial products and practices needs to be strengthened, ensuring transparency and fairness within the financial services sector.

The FCA's findings serve as a wake-up call. The lack of savings amongst a significant portion of the UK population presents a substantial challenge, with far-reaching social and economic implications. Addressing this issue requires a concerted effort from government, financial institutions, and individuals alike. Only through collaborative action can we hope to build a more financially secure future for all.

Call to Action: Learn more about the FCA's report and how you can improve your own financial well-being by visiting [link to FCA website]. Consider exploring options for building your savings, even small amounts can make a difference. Financial well-being is crucial for overall happiness and security – take steps today to secure your future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alarming UK Savings Statistics: One In Ten Lack Savings, FCA Finds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Post Game Report Jets Secure 4 0 Win Against Stars May 15 2025

May 17, 2025

Post Game Report Jets Secure 4 0 Win Against Stars May 15 2025

May 17, 2025 -

Benefit System Overhaul Urged To Safeguard Vulnerable Claimants

May 17, 2025

Benefit System Overhaul Urged To Safeguard Vulnerable Claimants

May 17, 2025 -

Newark Airport Delays Air Traffic Controller Reveals Staffing And Tech Issues

May 17, 2025

Newark Airport Delays Air Traffic Controller Reveals Staffing And Tech Issues

May 17, 2025 -

Mlb Roster Moves Dodgers Recall Pitcher From Triple A

May 17, 2025

Mlb Roster Moves Dodgers Recall Pitcher From Triple A

May 17, 2025 -

Friendship Soars Tim Robinsons Film Hits Top Markets Detroit Premiere Details

May 17, 2025

Friendship Soars Tim Robinsons Film Hits Top Markets Detroit Premiere Details

May 17, 2025

Latest Posts

-

Japan Seeks Extradition Of British Citizens For Major Jewellery Theft

May 18, 2025

Japan Seeks Extradition Of British Citizens For Major Jewellery Theft

May 18, 2025 -

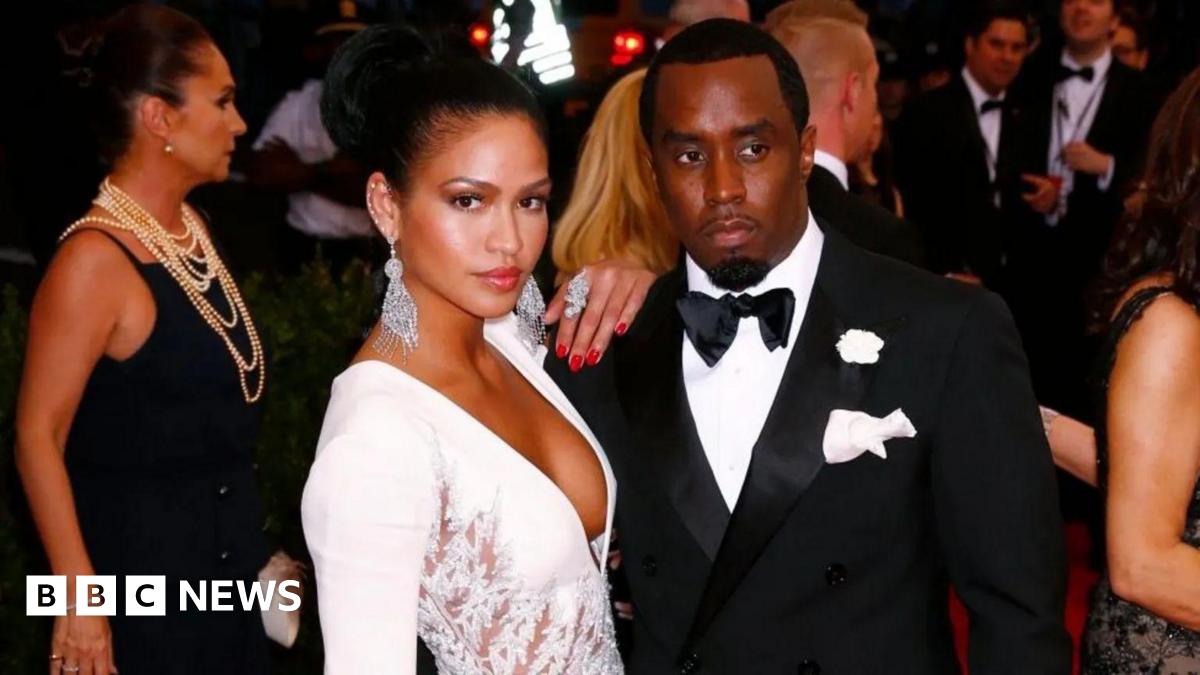

Sean Diddy Combs Trial The Importance Of Cassies Testimony

May 18, 2025

Sean Diddy Combs Trial The Importance Of Cassies Testimony

May 18, 2025 -

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025 -

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025 -

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025