Alarming UK Statistics: One In Ten Possess No Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alarming UK Statistics: One in Ten Possess No Savings – A Nation on the Brink?

The UK is facing a concerning financial reality: a staggering one in ten adults have absolutely no savings, according to recent data from [Insert reputable source, e.g., the Office for National Statistics, a reputable financial institution]. This alarming statistic highlights a growing vulnerability within the British population, leaving millions potentially one unexpected event away from financial crisis. The implications are far-reaching, impacting not only individual households but also the wider economic stability of the nation.

The Shocking Reality of Zero Savings

This isn't just about a lack of luxury; it's about a fundamental lack of financial security. For those with no savings, unexpected events like job loss, illness, or car repairs can quickly spiral into unmanageable debt. The absence of a financial buffer leaves individuals and families extremely vulnerable, forcing them to rely on high-interest loans or depleting already stretched household budgets. This precarious position can have devastating consequences on mental health and overall well-being.

Who are the Unsaved? Understanding the Demographics

While the statistic impacts all demographics, certain groups are disproportionately affected. Research suggests that younger generations, low-income households, and those in precarious employment are more likely to lack savings. [Insert data points from the source, citing specific percentages where possible]. This points to a systemic issue that requires targeted interventions beyond simply promoting saving habits.

Factors Contributing to the Savings Gap

Several factors contribute to this worrying trend. The rising cost of living, particularly in areas like housing and energy, has left many struggling to make ends meet, let alone put money aside. Stagnant wages, coupled with inflation, further exacerbate the problem. The increasing reliance on credit and the normalization of debt also play a significant role, making saving a seemingly distant possibility.

Addressing the Crisis: Potential Solutions

The government, financial institutions, and individuals all have a role to play in tackling this crisis. Some potential solutions include:

- Improved Financial Literacy Programs: Comprehensive education on budgeting, saving, and investing is crucial, particularly for younger generations entering the workforce. [Link to a relevant government website or educational resource].

- Accessible Savings Schemes: Encouraging saving through initiatives like government-backed savings plans or incentives for low-income earners can make a tangible difference.

- Fairer Wages and Employment Practices: Addressing wage stagnation and promoting secure employment conditions will significantly improve individuals' ability to save.

- Debt Management Support: Providing access to affordable debt counselling and consolidation programs can help those already struggling to manage debt.

The Path Forward: Building a More Secure Future

The fact that one in ten UK adults possess no savings is a wake-up call. It demands immediate attention from policymakers, financial institutions, and individuals alike. By addressing the underlying issues and implementing effective solutions, the UK can move towards a future where financial security is a reality for all, not just a privilege for the few. This requires a collective effort to build a more resilient and equitable financial landscape.

What are your thoughts on this alarming statistic? Share your opinions and experiences in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alarming UK Statistics: One In Ten Possess No Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Willie Nelson Joins Steve Perry For A New Version Of Journeys Classic Faithfully

May 18, 2025

Willie Nelson Joins Steve Perry For A New Version Of Journeys Classic Faithfully

May 18, 2025 -

Wes Andersons Cinematic Universe A Study In Underlying Sadness

May 18, 2025

Wes Andersons Cinematic Universe A Study In Underlying Sadness

May 18, 2025 -

Ohtanis Power Display Two Home Runs On Special Bobblehead Night

May 18, 2025

Ohtanis Power Display Two Home Runs On Special Bobblehead Night

May 18, 2025 -

No Savings Uk Regulator Highlights Growing Financial Vulnerability

May 18, 2025

No Savings Uk Regulator Highlights Growing Financial Vulnerability

May 18, 2025 -

Corporate Funding Of State Officials Rome Trip Sparks Debate

May 18, 2025

Corporate Funding Of State Officials Rome Trip Sparks Debate

May 18, 2025

Latest Posts

-

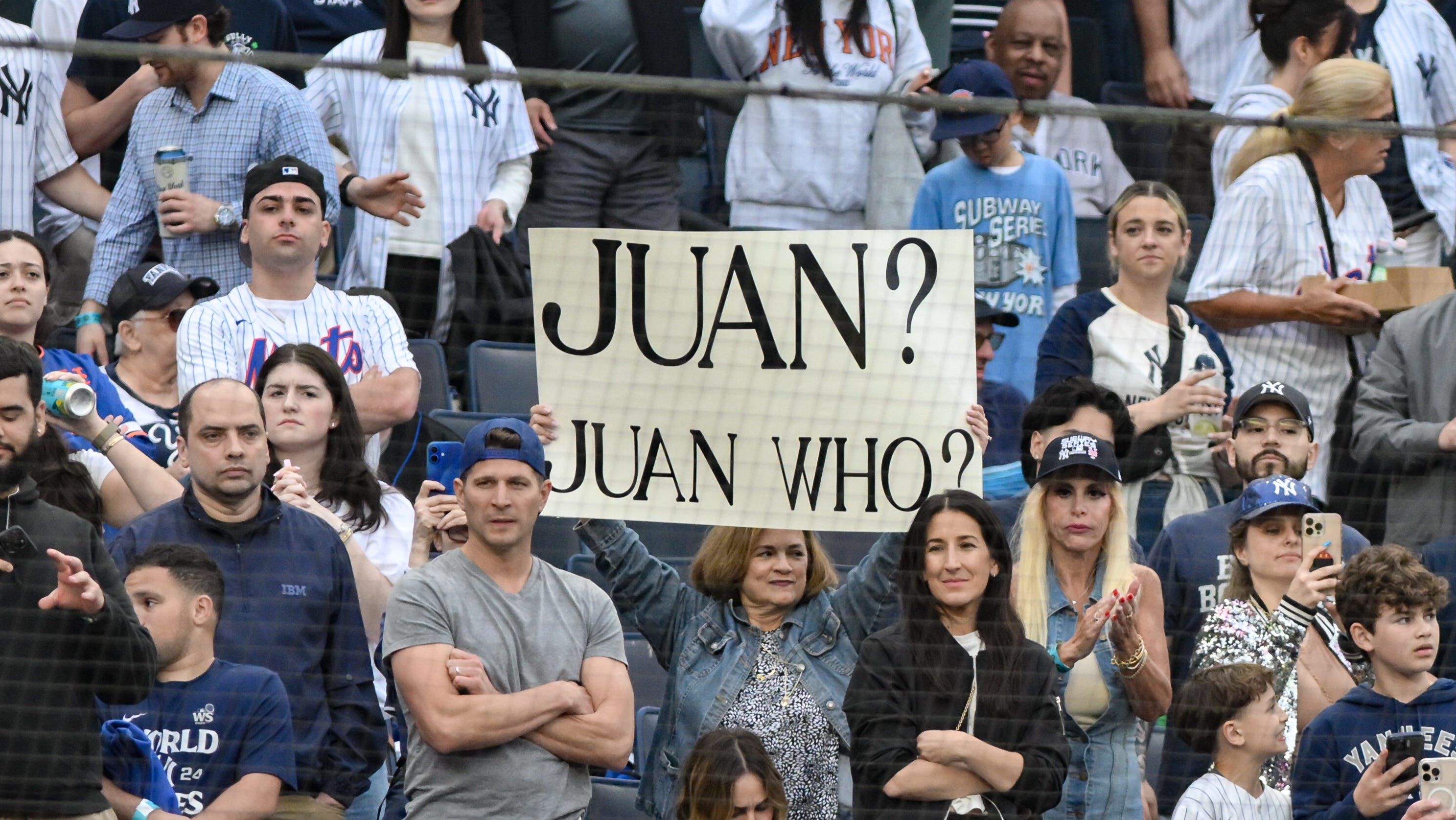

Unforgettable Moments Best Photos From The 2025 Yankees Mets Subway Series

May 18, 2025

Unforgettable Moments Best Photos From The 2025 Yankees Mets Subway Series

May 18, 2025 -

Joe Ryans Dominance Fuels Twins 12 Game Winning Streak

May 18, 2025

Joe Ryans Dominance Fuels Twins 12 Game Winning Streak

May 18, 2025 -

Netflixs Manga Series Bet Fails To Deliver A Thorough Tv Review

May 18, 2025

Netflixs Manga Series Bet Fails To Deliver A Thorough Tv Review

May 18, 2025 -

Jon Chus New Film Potential Cast And Project Details

May 18, 2025

Jon Chus New Film Potential Cast And Project Details

May 18, 2025 -

Diddy Trial How Forensic Psychology Could Influence The Verdict

May 18, 2025

Diddy Trial How Forensic Psychology Could Influence The Verdict

May 18, 2025