Alaska's Fiscal Future: Dunleavy's Rejection Of Tax Bills And Push For Joint Planning

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alaska's Fiscal Future: Dunleavy's Rejection of Tax Bills and Push for Joint Planning

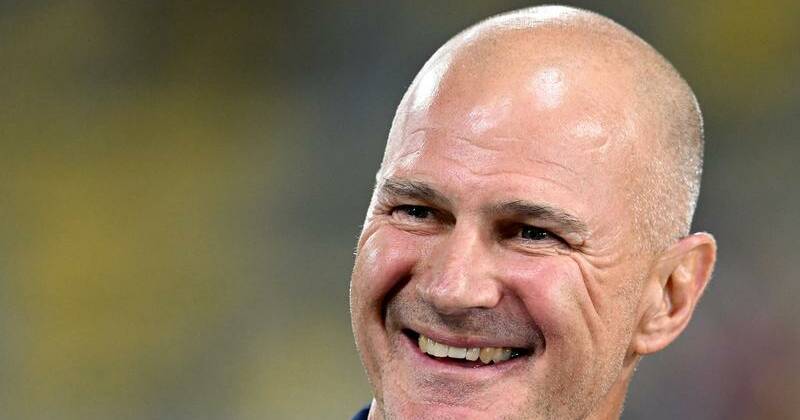

Alaska's fiscal landscape is currently navigating turbulent waters, with Governor Mike Dunleavy's recent actions sparking intense debate. His vetoes of several tax increase bills and his strong push for collaborative budgeting are shaping the state's financial trajectory in significant ways, raising crucial questions about the future of Alaskan resources and services.

Dunleavy's Vetoes: A Stand Against Increased Taxation?

Governor Dunleavy has consistently opposed significant tax increases, viewing them as detrimental to Alaska's economic growth and individual liberties. His vetoes of bills proposing increased taxes on oil and gas production, as well as other revenue-generating measures, underscore his commitment to fiscal conservatism. This stance has, however, drawn criticism from those who argue that increased revenue is necessary to adequately fund essential public services, such as education and healthcare. The Governor maintains that responsible spending, not increased taxation, is the key to solving Alaska's budget woes.

The Argument for Increased Revenue:

Proponents of tax increases argue that Alaska's current revenue streams are insufficient to meet the growing demands placed on the state's budget. They point to the ongoing need for infrastructure improvements, the rising costs of healthcare, and the importance of investing in education as crucial reasons for increasing tax revenue. Furthermore, they highlight the potential for increased taxes to help stabilize the state's Permanent Fund Dividend (PFD), a significant source of income for many Alaskans. The debate centers around finding a balance between responsible spending and maintaining a robust social safety net.

A Push for Joint Planning: A Path Towards Collaboration?

In the face of ongoing fiscal challenges, Governor Dunleavy has emphasized the need for joint planning and collaborative budgeting. This approach involves bringing together stakeholders from various sectors, including legislators, industry leaders, and community representatives, to develop a comprehensive long-term fiscal strategy. The goal is to foster a more collaborative and transparent process, ensuring that budgetary decisions reflect the needs and priorities of all Alaskans. This initiative, however, requires significant buy-in from all parties involved and faces the challenge of bridging the deep partisan divides that currently exist within the state legislature.

The Permanent Fund Dividend (PFD) at the Heart of the Matter:

The PFD, a yearly dividend distributed to Alaska residents from the earnings of the Alaska Permanent Fund, is a central point of contention. The size of the PFD is directly linked to the state's financial health, making it a key factor in the ongoing budgetary debates. Differing opinions on the appropriate level of PFD payments directly influence proposed tax policies and spending priorities. Finding a sustainable model for the PFD that balances the needs of current residents with the long-term health of the Permanent Fund remains a major challenge.

Looking Ahead: Uncertainty and the Need for Consensus:

Alaska's fiscal future remains uncertain. The ongoing debate between fiscal conservatives and those advocating for increased revenue highlights the complex challenges facing the state. The success of Governor Dunleavy's push for joint planning will depend on the willingness of all stakeholders to engage in good-faith negotiations and find common ground. Reaching a consensus on a long-term fiscal strategy that addresses the needs of both current and future generations of Alaskans is crucial for the state's long-term prosperity. The coming months will be critical in determining the direction Alaska takes in navigating these complex financial waters. The outcome will significantly impact the lives of all Alaskans.

Keywords: Alaska, fiscal future, Mike Dunleavy, tax bills, vetoes, joint planning, Permanent Fund Dividend (PFD), budget, revenue, spending, economic growth, Alaska politics, Alaskan economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alaska's Fiscal Future: Dunleavy's Rejection Of Tax Bills And Push For Joint Planning. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Houston Rockets Future Uncertain After Game 7 Defeat Key Takeaways

May 11, 2025

Houston Rockets Future Uncertain After Game 7 Defeat Key Takeaways

May 11, 2025 -

Why This Michigan City Claims A Spot Among Americas Premier College Towns

May 11, 2025

Why This Michigan City Claims A Spot Among Americas Premier College Towns

May 11, 2025 -

The Uks Role In Major Film Productions Case Studies From Barbie To Jurassic Park

May 11, 2025

The Uks Role In Major Film Productions Case Studies From Barbie To Jurassic Park

May 11, 2025 -

Blake Lively And Justin Baldoni Lawsuit Taylor Swifts Testimony Sought

May 11, 2025

Blake Lively And Justin Baldoni Lawsuit Taylor Swifts Testimony Sought

May 11, 2025 -

El Clasico Odiame Mas Y Papachuca Se Disputan La Supremacia

May 11, 2025

El Clasico Odiame Mas Y Papachuca Se Disputan La Supremacia

May 11, 2025

Latest Posts

-

Three Weeks Lost California Mountain Survivors Incredible Story

May 19, 2025

Three Weeks Lost California Mountain Survivors Incredible Story

May 19, 2025 -

A Case For Griffith Park Why Its A Leading City Park In America

May 19, 2025

A Case For Griffith Park Why Its A Leading City Park In America

May 19, 2025 -

Las Griffith Park A Contender For Americas Best Urban Park

May 19, 2025

Las Griffith Park A Contender For Americas Best Urban Park

May 19, 2025 -

Aussie Coaching Clash In Super League Arthur Claims Victory

May 19, 2025

Aussie Coaching Clash In Super League Arthur Claims Victory

May 19, 2025 -

Exclusive Hall Reveals The Tactics Behind His Decisive Try

May 19, 2025

Exclusive Hall Reveals The Tactics Behind His Decisive Try

May 19, 2025