Altman's Warning: Unstable Markets And The Future Of Finance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Altman's Warning: Unstable Markets and the Future of Finance

Sam Altman's recent comments paint a concerning picture of the future of finance, highlighting the instability of current markets and the potential for significant disruption. The CEO of OpenAI, a leading figure in the AI revolution, isn't known for his financial predictions, but his insights, delivered during a recent interview, carry weight given the transformative power of technology on global economics. His warning serves as a crucial wake-up call for investors and policymakers alike.

The current financial landscape, already grappling with inflation, rising interest rates, and geopolitical uncertainty, faces another layer of complexity – the rapid advancement of artificial intelligence. While AI promises to revolutionize numerous sectors, Altman suggests its impact on financial markets remains largely unpredictable and potentially destabilizing.

H2: The AI Factor: A Double-Edged Sword

Altman didn't explicitly predict a market crash, but his concerns revolve around the inherent unpredictability of AI's integration into financial systems. He highlighted the potential for:

-

Algorithmic trading gone wrong: The increasing reliance on AI-driven high-frequency trading (HFT) introduces a new level of risk. A cascading failure in one algorithm could trigger widespread market instability, far exceeding the impact of a single human trader's error. This risk is compounded by the "black box" nature of many AI systems, making it difficult to understand their decision-making processes and identify potential vulnerabilities.

-

Market manipulation: The sophistication of AI could be exploited for malicious purposes, leading to sophisticated market manipulation schemes that are difficult to detect and counteract. This represents a significant challenge for regulatory bodies already struggling to keep pace with rapid technological advancements.

-

Unforeseen consequences: The complex interplay between AI algorithms and human decision-making within financial markets could lead to unforeseen and potentially catastrophic outcomes. The sheer complexity of these systems makes it difficult to predict their behavior with certainty.

H2: Navigating the Uncertain Future: Preparing for the Unknown

Altman's warning isn't a call for panic, but a call for proactive measures. The future of finance hinges on a multifaceted approach:

-

Strengthening regulatory frameworks: Existing regulations may not adequately address the risks posed by AI in finance. Regulatory bodies need to adapt and develop frameworks that account for the unique challenges presented by AI-driven systems. This requires collaboration between governments, regulators, and the tech industry to establish clear guidelines and oversight mechanisms. [Link to relevant regulatory body website, e.g., SEC or FCA].

-

Promoting transparency and explainability: The "black box" problem needs to be addressed. Encouraging the development of more transparent and explainable AI systems is crucial to understand their decision-making processes and mitigate potential risks. This requires investment in research and development of AI algorithms that prioritize interpretability and accountability.

-

Diversifying investment strategies: Reliance on single algorithmic trading strategies should be avoided. Diversification across different investment strategies and asset classes can help mitigate the risk of AI-driven market instability.

H2: Conclusion: A Call for Vigilance and Adaptation

Sam Altman's warning serves as a crucial reminder of the inherent uncertainties associated with the rapid integration of AI into financial systems. While AI promises significant benefits, it also presents considerable risks. By proactively addressing these challenges through enhanced regulation, transparency, and diversified strategies, we can strive to build a more resilient and stable financial future. The future of finance is inextricably linked to the responsible development and deployment of AI. Vigilance and adaptability are no longer optional; they are essential for navigating the complexities ahead. What steps do you think need to be taken to mitigate these risks? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Altman's Warning: Unstable Markets And The Future Of Finance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Doctor Pleads Guilty In Matthew Perry Overdose Death Case

Jul 24, 2025

Doctor Pleads Guilty In Matthew Perry Overdose Death Case

Jul 24, 2025 -

Opelka Vs Cassone Citi Open 2025 Prediction And Betting Odds

Jul 24, 2025

Opelka Vs Cassone Citi Open 2025 Prediction And Betting Odds

Jul 24, 2025 -

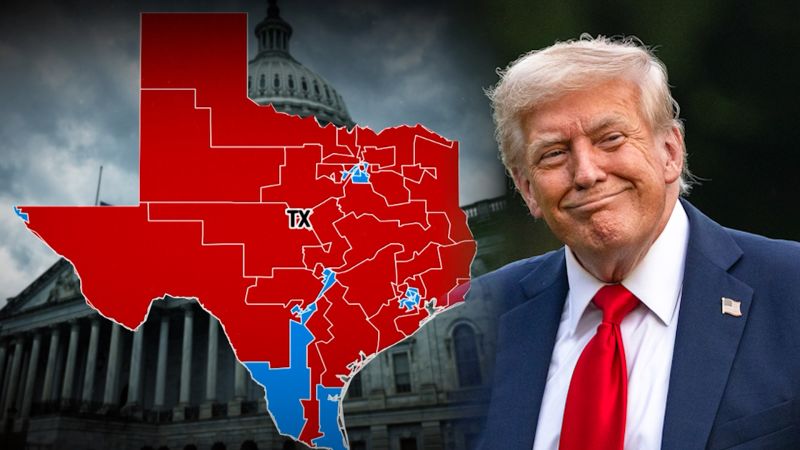

Trumps Texas Maneuver Democratic Official Demands Party Resistance

Jul 24, 2025

Trumps Texas Maneuver Democratic Official Demands Party Resistance

Jul 24, 2025 -

Dolphins Training Camp Setback Key Cornerback Injured

Jul 24, 2025

Dolphins Training Camp Setback Key Cornerback Injured

Jul 24, 2025 -

Open Ais Ceo Predicts Widespread Job Losses From Ai To Federal Reserve

Jul 24, 2025

Open Ais Ceo Predicts Widespread Job Losses From Ai To Federal Reserve

Jul 24, 2025

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win