Amazon (AMZN) Stock: A Momentum Play?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon (AMZN) Stock: A Momentum Play? Navigating the E-commerce Giant's Future

Amazon (AMZN) stock has seen its share of ups and downs recently. While the undisputed king of e-commerce continues to dominate online retail, questions linger about its future growth trajectory. Is now the time to jump in, capitalizing on potential momentum, or should investors proceed with caution? This in-depth analysis explores the current market sentiment surrounding AMZN and offers insights to help you decide.

The Current Market Landscape for AMZN

Amazon's recent performance has been a mixed bag. While the company continues to report significant revenue, growth rates have slowed compared to the pandemic boom. This slowdown, coupled with broader economic concerns, has led to some investor hesitancy. However, Amazon's diverse business model, encompassing AWS (Amazon Web Services), advertising, and physical retail, offers a degree of resilience that many competitors lack.

Strengths Driving Potential Momentum:

- AWS Dominance: Amazon Web Services remains a powerhouse, consistently demonstrating strong growth and profitability. AWS is a key driver of Amazon's overall financial health and provides a stable foundation even during periods of e-commerce volatility. [Link to relevant AWS news article or financial report]

- Advertising Revenue Growth: Amazon's advertising business is a rapidly expanding segment, leveraging its massive customer base and targeted advertising capabilities. This diversification further strengthens its financial position. [Link to Amazon's investor relations page on advertising revenue]

- Expansion into New Markets: Amazon continues to expand into new markets and explore innovative technologies, including areas like grocery delivery (Whole Foods), healthcare, and autonomous delivery vehicles. These ambitious projects represent significant long-term growth potential.

- Strong Brand Loyalty: Amazon enjoys unparalleled brand recognition and customer loyalty, a significant competitive advantage in the increasingly crowded e-commerce landscape.

Challenges and Risks to Consider:

- Increased Competition: Amazon faces intensifying competition from other e-commerce giants like Walmart and Shopify, as well as the rise of independent online retailers.

- Inflationary Pressures: Rising inflation and supply chain disruptions continue to impact Amazon's operations and profitability margins.

- Labor Costs: The company faces ongoing challenges related to labor costs and employee relations, which could impact its bottom line.

- Regulatory Scrutiny: Amazon faces increasing regulatory scrutiny in various jurisdictions, potentially leading to increased compliance costs and legal challenges.

Is AMZN a Momentum Play? A Balanced Perspective

Whether Amazon stock is currently a "momentum play" depends heavily on individual investment strategies and risk tolerance. While the company faces challenges, its diverse revenue streams, strong brand, and continued innovation suggest a long-term growth outlook. However, near-term volatility is a possibility due to macroeconomic factors and competition.

For Conservative Investors: A gradual approach, perhaps through dollar-cost averaging, might be a prudent strategy. This allows participation in potential upside while mitigating the risk of investing a large sum at a potentially high valuation.

For Growth-Oriented Investors: Amazon's long-term growth potential might justify a more aggressive investment strategy, but careful consideration of potential risks is crucial. Diversification within a broader portfolio remains essential.

Conclusion: Due Diligence is Key

Before making any investment decisions, thorough research and due diligence are paramount. Consult with a qualified financial advisor to assess your risk tolerance and investment goals. While Amazon's future remains bright, understanding both its potential and its challenges is essential for making informed investment choices. Stay informed on market trends and Amazon's financial performance for a more comprehensive understanding.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market carries inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon (AMZN) Stock: A Momentum Play?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

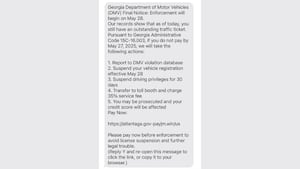

Is That Text About Your Georgia Drivers License A Scam Heres How To Tell

May 28, 2025

Is That Text About Your Georgia Drivers License A Scam Heres How To Tell

May 28, 2025 -

Abortion Arrest Controversy Internal Police Recording Raises Serious Questions

May 28, 2025

Abortion Arrest Controversy Internal Police Recording Raises Serious Questions

May 28, 2025 -

Multiple Homes Damaged Truck Explosion Linked To Propane Leak

May 28, 2025

Multiple Homes Damaged Truck Explosion Linked To Propane Leak

May 28, 2025 -

Controversial Abortion Arrest Leaked Audio Highlights Police Reservations

May 28, 2025

Controversial Abortion Arrest Leaked Audio Highlights Police Reservations

May 28, 2025 -

Controversial Everest Ascent The Risks Of Using Anesthetic Gas

May 28, 2025

Controversial Everest Ascent The Risks Of Using Anesthetic Gas

May 28, 2025

Latest Posts

-

Newark Airport Atc System Upgrades Facing Delays Officials

May 30, 2025

Newark Airport Atc System Upgrades Facing Delays Officials

May 30, 2025 -

Ukraine Races To Deploy Drone Defenses Ahead Of Expected Russian Offensive

May 30, 2025

Ukraine Races To Deploy Drone Defenses Ahead Of Expected Russian Offensive

May 30, 2025 -

Swiss Village Of Blatten Buried Under Glacier Debris

May 30, 2025

Swiss Village Of Blatten Buried Under Glacier Debris

May 30, 2025 -

Police Seek Help Missing Teen Case Reward Announced

May 30, 2025

Police Seek Help Missing Teen Case Reward Announced

May 30, 2025 -

Badenochs Early Missteps A Total Disaster For The Conservatives

May 30, 2025

Badenochs Early Missteps A Total Disaster For The Conservatives

May 30, 2025