Amazon (AMZN) Stock Momentum: A Deep Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon (AMZN) Stock Momentum: A Deep Dive into the E-commerce Giant's Future

Amazon (AMZN) stock has experienced a rollercoaster ride in recent years, leaving investors questioning its future trajectory. While the e-commerce giant remains a dominant force, understanding the current momentum requires a deep dive into its multifaceted business model and the challenges it faces. This analysis will explore key factors influencing AMZN's stock price, providing insights for both seasoned investors and those new to the market.

The Current Market Sentiment:

Recent market performance reveals a mixed bag for AMZN. While the company continues to report substantial revenue, concerns surrounding inflation, rising interest rates, and slowing consumer spending have cast a shadow on its growth prospects. This uncertainty has led to increased volatility in the stock price, making it crucial to analyze the underlying fundamentals.

Key Factors Driving Amazon's Momentum (or Lack Thereof):

-

E-commerce Dominance: Amazon's core e-commerce business remains a powerhouse, but growth rates are slowing compared to the pandemic boom. Increased competition from other online retailers and shifting consumer preferences are contributing factors. The ongoing battle for market share with giants like Walmart (WMT) and Target (TGT) significantly impacts AMZN's performance.

-

AWS Cloud Computing: Amazon Web Services (AWS) continues to be a significant driver of profit, consistently delivering strong growth. Its dominance in the cloud computing sector offers a buffer against fluctuations in the e-commerce market. However, increased competition from Microsoft Azure and Google Cloud Platform (GCP) presents a long-term challenge.

-

Advertising Revenue: Amazon's advertising business is rapidly expanding, becoming a substantial revenue stream. This diversification helps mitigate reliance on e-commerce alone. The growth of targeted advertising and the increasing number of sellers using Amazon's platform contributes to this segment's success.

-

Supply Chain and Logistics: Efficient supply chain management and logistics are vital for Amazon's success. Recent investments in infrastructure and technology aim to optimize delivery times and reduce costs. However, persistent global supply chain disruptions and inflationary pressures remain significant hurdles.

Challenges Facing Amazon:

-

Inflationary Pressures: Rising inflation significantly impacts consumer spending, potentially reducing demand for discretionary purchases. Amazon’s ability to manage costs and maintain profit margins in this environment is crucial.

-

Labor Relations: Amazon's labor practices have faced scrutiny, leading to increased labor costs and potential disruptions. Maintaining a positive employee relationship is essential for operational efficiency and long-term success.

-

Regulatory Scrutiny: Amazon faces ongoing regulatory scrutiny concerning antitrust issues and its market dominance. Potential fines and regulations could significantly impact profitability.

Analyzing Future Momentum:

Predicting future stock momentum is challenging, but several indicators provide insight:

-

Innovation and New Initiatives: Amazon's continuous investment in research and development across various sectors, including artificial intelligence (AI), healthcare, and autonomous vehicles, suggests a long-term growth strategy. The success of these initiatives will greatly influence future performance.

-

Financial Performance: Closely monitoring Amazon's quarterly earnings reports, revenue growth, and profit margins is crucial for gauging its financial health and future potential.

-

Market Trends: Staying informed about broader economic trends, consumer spending patterns, and the competitive landscape will help assess the future outlook for AMZN stock.

Conclusion:

Amazon's stock momentum is a complex interplay of various factors. While challenges exist, its diversified business model, strong brand recognition, and continuous innovation provide a foundation for long-term growth. Investors should thoroughly research and understand these dynamics before making any investment decisions. Consider consulting with a financial advisor for personalized guidance. Staying informed through reputable financial news sources and conducting your own due diligence is essential for navigating the complexities of the AMZN stock market.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon (AMZN) Stock Momentum: A Deep Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Significant Investment Bank Of America Bac In Financial Avengers Holdings

May 27, 2025

Significant Investment Bank Of America Bac In Financial Avengers Holdings

May 27, 2025 -

This Weeks Social Security Payments Maximum 5 108

May 27, 2025

This Weeks Social Security Payments Maximum 5 108

May 27, 2025 -

French Open 2024 Zverev Vs Tien And Mensik Vs Muller Round 1 Predictions

May 27, 2025

French Open 2024 Zverev Vs Tien And Mensik Vs Muller Round 1 Predictions

May 27, 2025 -

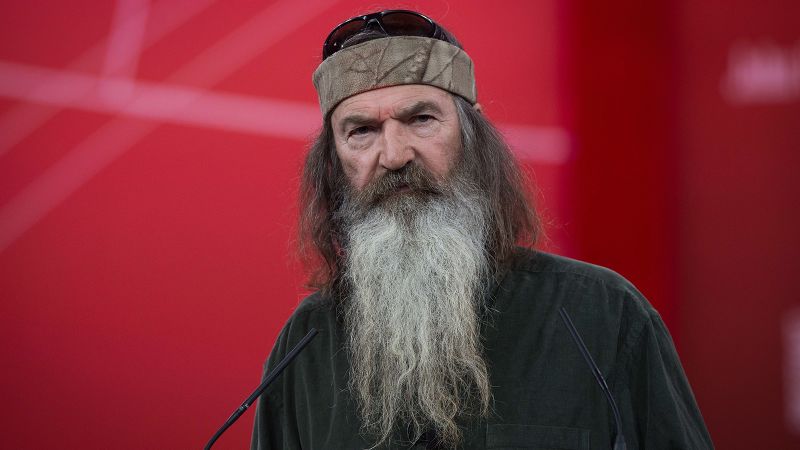

Family Announces Passing Of Phil Robertson Duck Dynasty Star At 79

May 27, 2025

Family Announces Passing Of Phil Robertson Duck Dynasty Star At 79

May 27, 2025 -

Malaysian Government Sources Bruneis Sultan Undergoing Treatment For Fatigue In Kl Hospital

May 27, 2025

Malaysian Government Sources Bruneis Sultan Undergoing Treatment For Fatigue In Kl Hospital

May 27, 2025

Latest Posts

-

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025 -

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025 -

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025 -

Tesco Shoppers Mock Self Checkout Surveillance

May 30, 2025

Tesco Shoppers Mock Self Checkout Surveillance

May 30, 2025 -

In Memoriam George Strait Remembers His Hero Victim Of North Texas House Fire

May 30, 2025

In Memoriam George Strait Remembers His Hero Victim Of North Texas House Fire

May 30, 2025